Insurance aggregators

The online search is very often the first step before underwriting a motor, life, health, home insurance policy, ... This tool is about to replace traditional insurance intermediaries.

The online search is very often the first step before underwriting a motor, life, health, home insurance policy, ... This tool is about to replace traditional insurance intermediaries.

Free deals, ease of use, speed of results, diversity of offers, savings are the key elements behind the success of online insurance quotes.

Insurance aggregator: Definition

Insurance aggregators are websites that collect quotes from several insurers and compare the rates and services offered. Quotes are established online that is to say immediately issued or communicated to the customer after a certain time.

In general, the comparator uses the information provided by internet users to define their needs and select the most appropriate proposals to their profiles. It can, therefore, rely on its own database to display a price and proceed to sell online. It can also guide internet users to the website of the insurer concerned to finalize the sale.

Historical background

It all started with QuoteSmith. Launched in 1996 in the United States, the first insurance aggregator is more than 18 years old. From the very first months of activity, the success of QuoteSmith was great.

Other operators followed in the footsteps of the American company, triggering the Big Bang on the web. The sites are multiplying and giants like Confused.com in the United Kingdom, Assurland.com in France, Check24.de in Germany, kanetix.ca in Canada or Australia Iselect.com have emerged.

The first decade of the 21st century was marked by an exponential growth in insurance quotes websites.

Evolution of the concept of insurance aggregator

The first insurance aggregators were focused only on the premium. The goal is simple: to provide the user with the most competitive rates. The offer generally plays out in the form of a table where different quotes, ranked from cheapest to most expensive, are aligned.

The first insurance aggregators were focused only on the premium. The goal is simple: to provide the user with the most competitive rates. The offer generally plays out in the form of a table where different quotes, ranked from cheapest to most expensive, are aligned.

Over the years, the designers of the first commercial websites have realized that insurance is a complex product. The coverage proposed is not based on price only. The latter is based on the extent and amount of the guarantee, taking into account deductibles, exclusions, ...

Based on this finding, a new project takes shape, marketing services resume the concept. The market is thus segmented. Products are customized to meet customers’ needs. Offers are no longer based just on prices; they also refer to the guarantees and to the benefits offered.

Today, insurance quotes are adapting to the trends. They are not only limited to presenting prices, guarantees and the amounts offered, but they are also designed to include the degree of customer satisfaction.

Everything is focused to attract the prospect. Comparators have become interactive, with users communicating not only with the machine but also with other users. Insurance aggregators shift from the status of a passive consumer to that of a contact that interacts within a customer community with which he enters into a dialogue, gives his opinion, rates the products and shares experience.

Products developed by the insurance aggregators

Online insurance quotes target personal line risks, the class of business about which they are in direct competition with general agents and brokers. All classes of insurance are concerned:

- motor,

- homeowner’s,,

- pension and retirement,

- credit,

- health,

- life,

- third party liability,

- etc.

Premium savings?

Saving money and getting the best price is the promise conveyed by insurance aggregators. They are supposed to trigger competition for the benefit of users. Unfortunately, nothing is that simple.

The gap between pledges and achievements is often wide. In fact, online comparators are physically unable to keep their promise and to present to prospects the lowest price.

The first difficulty, the technical requirements make it impossible to compare, on a single platform, all existing insurance products which sometimes amount to hundreds or even thousands.

The second obstacle pertains to the complexity of the insurance contracts. The products offered by the companies are becoming more sophisticated with many formulas to be tailor-made. They are often short cycled, with computer programmers required to integrate many variables and update their algorithms and databases repeatedly.

The third pitfall, insurance aggregators actually deal with only a limited number of companies: those that are keen on cooperating with them. Major insurers often abstain from forging partnerships with online comparators.

They believe that insurance quotes are designed to attract only people interested in "low cost" schemes, while they aim to market products with a maximum of guarantees, thus expensive. In fact, there is a conflict of interest between online comparators and large insurance companies.

They believe that insurance quotes are designed to attract only people interested in "low cost" schemes, while they aim to market products with a maximum of guarantees, thus expensive. In fact, there is a conflict of interest between online comparators and large insurance companies.

Ultimately, it is on a very limited scope that a potential customer may end up choosing the most convenient alternative and thus making "relative savings". It is, nonetheless, uncertain for potential customers to benefit from the lowest prices on the market.

Remuneration of insurance aggregators

The services provided by insurance aggregators are free of charge for internet users. Comparators negotiate their remuneration with partner insurers.

Four main payment methods are commonly used:

- introducing customer to the partner insurer in return for a commission whether the sale materializes or not,

- remuneration upon the conclusion of an insurance contract whereby the commission may account for up to 40% of the annual premium,

- advertisement: the best positioned comparators on search engines (Google, Bing, etc.) highlight the logos of partners to contribute to their promotion,

- sales of leads: insurance companies that buy the leads containing contact information for potential customers are required to contact those clients and make sales proposals.

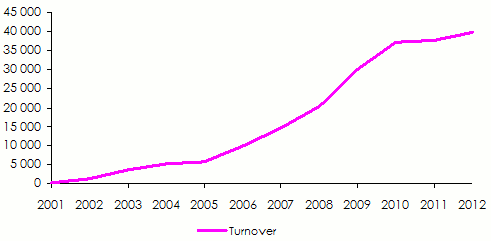

Assurland.com uses the first payment method as its main business model. Its turnover in 2012 amounted to about 40 million USD.

Example: Turnover of the first comparator in France: Assurland.com

in thousands USD

Insurance aggregators: autonomy and dependence

A large number of insurance aggregators is owned by independent companies. It remains nevertheless common for some sites to be funded by one or more insurance companies.

The presence of an insurance partner in the capital of a comparator may cast doubts about the reliability of the results, especially if the insurer is the majority shareholder. However, experts say it is commercially risky for the comparator to favor one of its shareholders. If that happens, then the loss of credibility may cause business failure.

The presence of an insurance partner in the capital of a comparator may cast doubts about the reliability of the results, especially if the insurer is the majority shareholder. However, experts say it is commercially risky for the comparator to favor one of its shareholders. If that happens, then the loss of credibility may cause business failure.

The example of the French market leader of insurance quotes, Assurland, clearly illustrates this fact. The presence since 2005 of Covea, a large group of mutual insurance, in the shareholding does not in any way hinder the development of the comparator. Other insurers prefer to remain discreet about their involvement in this activity.

A regulation overtaken by events

The legal framework governing the business of insurance aggregators is struggling to adapt to the extremely rapid market developments. In principle, intermediation activity, that is to say the presentation of a coverage to individuals, is governed by or what stands as the insurance code.

It is up to each country to define the position and role of the comparators, clarify their status, obligations, and the regulations applicable to them. The websites are not only subject to insurance regulation but also to that pertaining to the protection of privacy.

To reconcile these two requirements and safeguard, in particular, data privacy, control agencies have been set up and tasked with monitoring insurance aggregators, collecting advice from internet users and setting the limits not to be exceeded. Published reports are the basis for drafting new laws.

It is worth noting as well that some consortia of online quotes websites have developed their own charter. The latter generally includes non-legislated standards provisions. Improving transparency and credibility of research stands as the first objective of these consortia.

Benefits of insurance aggregators

Benefits for the users

Users are, in principle, the primary beneficiaries of online insurance quotes. They take advantage of services totally free of charge and realize savings in time and money.

Having the ability to compare products from several insurers, internet users deepen their insurance culture, acquiring the ability to choose not only the cheapest products but also those that best fit their needs.

Be it known that in the United States 20.2 million online quotes are performed annually just with regard to the motor insurance.

Advantages for insurers

The insurance partners of online comparison sites also benefit from a number of advantages. The presence of an insurer on the site of a famous or well-positioned comparator on the canvas allows it to gain visibility and notoriety. It is a means to boost the sales of the company.

The insurance partners of online comparison sites also benefit from a number of advantages. The presence of an insurer on the site of a famous or well-positioned comparator on the canvas allows it to gain visibility and notoriety. It is a means to boost the sales of the company.

In 2009, 50% of motor insurance policies underwritten in the United Kingdom materialized after a client-insurer networking was established through an online comparator. This rate rose to 65% in 2012. Assurland.com has, since 2010, reported nearly 48 million visits per year. In 2004, this site accounted only for 2 million queries.

Insurance aggregators, also, allow partner insurers to better develop their insurance products. This presence on the site gives them the opportunity to conduct studies on trends and behaviors of Internet users. The lessons learned from these studies allow them to innovate and differentiate themselves from competitors.

Disadvantages of Insurance aggregators

Online insurance aggregators have certain drawbacks which hamper their development:

- non-availability of agency and/or physical person to contact in case of conflict. In 2014, only 8% of new business reported in France was underwritten by online insurance quotes, compared to 12% in Spain and 70% in the United Kingdom,

- doubts about the objectivity and reliability of the comparators,

- inability to gather all insurers’ contracts on a single platform,

- lack of transparency as to the destination and use of the data disclosed,

- complexity of online application process. Some citizens believe that the insurance aggregators are too technical and require insurance knowledge.

The future of Insurance aggregators

Despite some shortcomings, the record of insurance aggregators remains rather positive. After fifteen years of practice, the number of visits has been constantly growing. The sites deliver enormous amounts of online quotes and contracts. This boom is driven by online shoppers, a category aged less than 40, used to making purchases online: airline tickets, hotel reservations, banking, etc. The future of online quotes is poised to be prosperous.

In developed countries where insurance comparators are positively perceived by the public, the business of agents and insurance brokers has gone down sharply. The comparators are continually gaining market share from traditional distribution networks, threatening to supplant the latter in the coming years.

According to the German federation of insurance agents and brokers (BVK), more than 8% of traditional insurance brokers will disappear in 2015 and the phenomenon is set to increase in the coming years. The federation says the decline of these intermediaries is accounted for by fierce competition from online insurance aggregators and stifling regulations.

However, despite the good results reported so far, online comparison sites are still not unanimously approved of. They remain on a fragile success, with room for improvement noted on large scale. To ensure their survival, insurance aggregators are required to adopt, among others, the following measures:

- To give up the method of remuneration based on the sale of leads listings. This method usually leads to harassment of Internet users by insurers. Annoyed by this practice, many customers decide not to come back to comparators

Example of good practice: In the United Kingdom, the payment of online comparators’ fees is most often carried out after a customer is put in contact with the insurer. Users are never bothered by sales agents and a climate of confidence reigns on this business. Today, online comparators underwrite 70% of new motor business in England. - Introduce a dynamic mode of comparison whereby users are able to introduce their own comparison parameters and reclassify by a simple click the proposals according to the criteria selected: price, covers, deductibles, additional services, ...

- Improve the way information is presented. Current estimates often use complex terminology and as a consequence, users find it difficult to understand the jargon of insurers. This situation leads to a poor assessment of the proposed covers and a user dissatisfaction.

- Provide advice to users. This dimension is of paramount importance to strengthen the position of the comparators. The latter are therefore called upon to fulfill the same obligations as brokers and insurance agents in terms of advice and assistance to customers.

- • Be more present on the social networks. Facebook, Twitter, Google+, ... are necessary steps for any online business as they provide better visibility with consumers.

According to Experian, the expert in global information and customer relationship management, social networking is draining 7.7% of visits to e-commerce sites. Consequently, the conquest of this part of the web could contribute to the prosperity of online insurance aggregators.