Jordan International Insurance Company (JIIC)

By December 31, 2016 , JIIC posted 25.7 million USD in share capital for 35.1 million USD in shareholders’ equities and 56 million USD in assets.

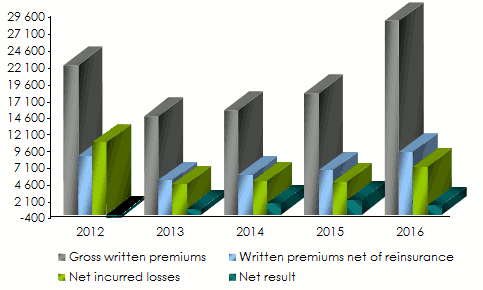

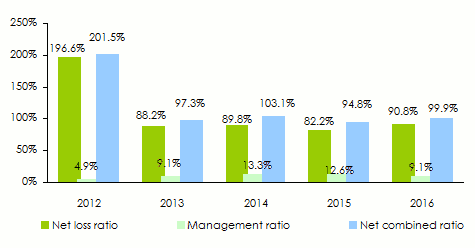

In 2012, the company chose the strategic approach to withdraw from the motor business due to the huge losses sustained by this segment, an option that paid off eventually. The company’s portfolio has gradually gathered momentum with a net loss ratio that shifted from 196.6% in 2012 to 90.8% by December 31, 2016.

In a tight market where 24 companies are operating, JIIC reported 28.9 million USD in turnover by December 31, 2016, that is, 3.5% of the overall premiums written in the same year. It is considered as mid table company. Twenty years on after its establishment, the Jordanian insurer is specialized in health business with 69.2% of underwritten premiums, followed by fire with 16.3% and marine insurance with 6.5%.

Since 2012, the loss-making year by reference, the net result reported substantial recovery with a 12% peak of written premiums in 2015. This indicator shrank in 2016, displaying a rate of 5%.

JIIC started its third decade by tapping into new technologies. Providing better service to customers has become a strategic objective. This qualitative approach coupled with the steadily good results in recent years enabled the company to obtain a B+ rating with stable outlook from A.M. Best.

|  |

| Mazen Darwazeh | Faris Gammoh |

| Chairman of the board of directors | General manager |

JIIC in 2016

| Share capital | 25 707 110 USD |

| Turnover | 28 911 200 USD |

| Assets | 55 972 230 USD |

| Shareholder’s equity | 35 057 730 USD |

| Net result | 1 434 670 USD |

| Net non life loss ratio | 90.8% |

| Non life expenses ratio | 9.1% |

| Net non life combined ratio | 99.9% |

Shareholding

| United Group for Management & Consulting | 12.224% |

| Sami Ebrahim Qamoua | 6.612% |

| Social Security Corporation | 6.417% |

| Qais Fouad | 5.967% |

| Mazen Samih Taleb Darwazah | 5.51% |

| Other shareholders | 63.27% |

Management

| Chairman of the board of directors | Mazen Darwazeh |

| General manager | Faris Gammoh |

| Deputy general manager | Mahmoud Matarneh |

| Senior vice president, health | Lina Jeroshi |

| Vice president, health | Dara Habaybeh |

| Vice president, life | Ghadeer Bosheh |

| Vice president, marine | Suzan Kurdahji |

| Senior vice president, retail & SMEs | Ahmad Khasawneh |

JIIC: main technical highlights (2012-2016)

In USD

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

Gross written premiums | 22 301 349 | 14 758 126 | 15 618 752 | 18 161 367 | 28 911 205 |

Written premiums net of reinsurance | 8 774 565 | 5 165 184 | 5 942 440 | 6 662 475 | 9 353 458 |

Gross non life written premiums | 21 527 343 | 14 083 187 | 14 897 958 | 16 966 345 | 27 486 439 |

Net earned premiums | 10 869 510 | 5 603 496 | 5 780 110 | 6 264 125 | 7 992 573 |

Net non life earned premiums | 6 093 034 | 4 984 782 | 5 546 634 | 5 889 887 | 7 617 649 |

Net incurred losses | 10 793 445 | 4 545 817 | 5 090 034 | 4 964 962 | 7 133 591 |

Net non life incurred losses | 11 980 723 | 4 397 885 | 4 980 639 | 4 842 257 | 6 920 079 |

Management expenses | 1 140 653 | 1 537 961 | 1 527 941 | 1 420 090 | 1 563 927 |

Non life management expenses | 1 047 769 | 1 284 371 | 1 982 517 | 2 135 702 | 2 499 016 |

Net non life loss ratio | 196.6% | 88.2% | 89.8% | 82.2% | 90.8% |

Non life management expenses(2) | 4.9% | 9.1% | 13.3% | 12.6% | 9.1% |

Net non life combined ratio | 201.5% | 97.3% | 103.1% | 94.8% | 99.9% |

Net result | -412 232 | 940 650 | 1 704 834 | 2 268 514 | 1 434 678 |

(2) Expenses ratio = management expenses / gross written premiums

JIIC: evolution of premiums, losses and results (2012-2016)

In thousands USD

JIIC: evolution of net non life technical ratios (2012-2016)

JIIC: breakdown of turnover per class of business (2012-2016)

In USD

| 2012 | 2013 | 2014 | 2015 | 2016 | 2016 shares | |

|---|---|---|---|---|---|---|

Motor(1) | 2 699 140 | 131 499 | 2 810 | - | - | - |

Marine | 2 233 402 | 1 349 371 | 1 327 939 | 1 541 706 | 1 881 131 | 6.5% |

Aviation | 160 331 | 1 527 908 | 1 548 044 | 132 346 | 119 086 | 0.4% |

Fire and others | 6 535 124 | 3 132 852 | 2 052 464 | 4 823 810 | 4 713 601 | 16.3% |

General third party liability | 141 627 | 108 886 | 451 599 | 385 157 | 646 427 | 2.3% |

Personal accident | 2 802 | 184 | - | 1 759 | 111 267 | 0.4% |

Health | 9 754 917 | 7 832 487 | 9 515 102 | 10 081 567 | 20 014 927 | 69.2% |

Total non life | 21 527 343 | 14 083 187 | 14 897 958 | 16 966 345 | 27 486 439 | 95.1% |

Life | 774 006 | 674 939 | 720 794 | 1 195 022 | 1 424 766 | 4.9% |

Grand Total | 22 301 349 | 14 758 126 | 15 618 752 | 18 161 367 | 28 911 205 | 100% |

JIIC: net incurred losses per non life class of business(2012-2016)

In USD

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

Motor(1) | 6 252 624 | 887 419 | -164 254 | -99 523 | -136 443 |

Marine | 108 153 | 175 004 | 83 531 | 122 374 | 144 776 |

Aviation | - | - | - | - | 114 710 |

Fire and others | 96 209 | -115 574 | 34 144 | -27 871 | 26 513 |

Third party liability | 25 243 | 58 055 | 2 426 | -5 646 | 8 569 |

Personal accident | 4 325 | 386 | 3 432 | -98 | - |

Health | 5 494 169 | 3 392 595 | 5 021 359 | 4 853 022 | 6 761 954 |

Total | 11 980 723 | 4 397 885 | 4 980 639 | 4 842 257 | 6 920 079 |

JIIC: net loss ratios per non life class of business (2012-2016)

In USD

| 2012 | 2013 | 2014 | 2015 | 2016 | |

|---|---|---|---|---|---|

Motor(1) | 192.4% | 147.7% | -731.7% | - | - |

Marine | 40.3% | 74.7% | 63.7% | 51.9% | 59.4% |

Aviation | - | - | - | - | 11487.8% |

Fire and others | 109.4% | -155.0% | 36.8% | -23.8% | 16.7% |

Third party liability | 52.1% | 147.0% | 13.6% | -21.6% | 12.0% |

Personal accident | 84.9% | 174.4% | 48460.0% | -83.1% | 0.0% |

Health | 225.8% | 84.1% | 95.1% | 88.1% | 94.9% |

Total | 196.6% | 88.2% | 89.8% | 82.2% | 90.8% |

Source: JIIC's balance sheets

Exchange rate JOD/USD as at 31/12 | 2012 | 2013 | 2014 | 2015 | 2016 |

1.412430 | 1.417600 | 1.416470 | 1.415150 | 1.41637 |

JIIC

| Head office | First circle - Jabal Amman - PO Box 3253 Amman 11181 Jordan |

| Phone | (+962) 6 592 8206 |

| Fax | (+962) 6 592 8232 |

| Website |