Marine insurance market on a downward cycle

|

The 2015 Tianjin catastrophe could have been a significant turning point for the market. After that event, all the professionals were hoping to see a substantial increase of the contributions. However, most ship owners have renewed their insurance policies downwards or based on the same terms as the previous year. The renewal of marine insurance treaties on January 1, 2016 has been, once again, marked by a decrease in the tariffs comprised between 5 and 20% in comparison with 2015.

This downward cycle is largely accounted for by the overcapacity of the insurance market and by the entry of new players who have contributed to maintaining the tariffs at historically low levels.

Finally, the economic slowdown sustained by emerging countries, particularly China, risks once again to delay the increase of rates.

Marine insurance: market at a halt

According to figures posted by IUMI, the total amount of marine premiums for the merchant fleet, alone, has been decreasing since 2012. It amounted to 32.6 billion USD in 2014, in decrease by 3.2% in comparison with 2013 and by 4.9% compared to 2012. The market has been stagnant for the past three years despite exponential increases in the number of ships, in tonnage and in the amount of insured sums.

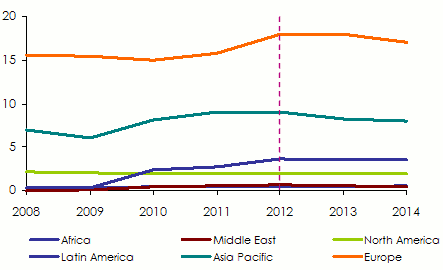

Evolution of the global marine insurance premiums: 2008-2014

In billions USD Source: International Union of Marine Insurance (IUMI)

Source: International Union of Marine Insurance (IUMI)As featured in the graph below, the premium decrease noted since 2012 has not been slowed by either the exponential increase of the volume of carried goods or by the continued increase in the number of ships.

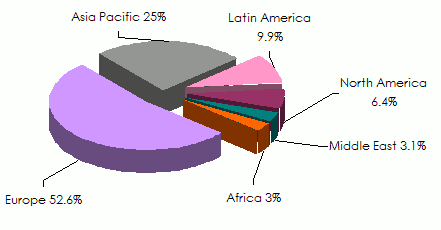

Premiums per region in 2014

In 2014, Europe, alone, accounts for more than half of the collections (52.6%). During the same year, the Asia-Pacific, Latin America and North American regions respectively detained 25%, 9.8% and 6.4% of market shares. Middle East and Africa are lagging behind with 3.1% and 3% of total premiums.

Source: International Union of Marine Insurance (IUMI)

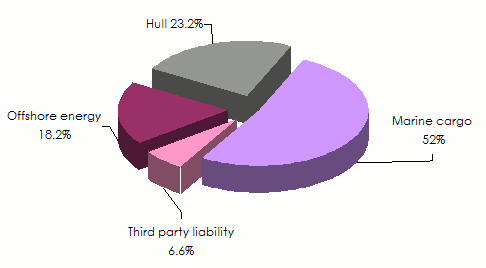

Source: International Union of Marine Insurance (IUMI)Premiums per class of business in 2014

The premiums collected in marine cargo insurance generated by the merchant fleet amounted to 16.95 billion USD in 2014, a decline of 7.1% in comparison with 2013. Europe accounts for 43% of this amount. The Asia-Pacific region ranks second with 28.9% in underwritten premiums.

The ship hull insurance totaled 7.6 billion USD of premiums in 2014. This class of business has sustained the 19 th consecutive decline, with a 5.8% decrease of revenues in comparison with 2013.

The energy and third party liability markets accounted for 5.7 and 2.35 billion USD respectively.

Source: International Union of Marine Insurance (IUMI)

Source: International Union of Marine Insurance (IUMI)Marine Insurance: Loss experience

The level of security of marine transport has been constantly improving since the beginning of the 20 th century. Loss experience has notably decreased despite the increase in the traffic and in the marine fleet. The market has consequently shifted in a century from 1 affected vessel out of 100 in 1912 to 1 out of 984 in 2012(1).

Still based on Allianz report “Safety and shipping review 2015”(2), the downward trend of the claims has been confirmed. Only 75 total losses were reported worldwide in 2014, which makes it the safest year of the last decade. The number of reported claims in 2014 (127) has dwindled down by 32% compared to the previous year, a level also lower than the average value of the last ten years.

Even though the decrease in ship losses is an encouraging sign, the increase in the insured values and the upsurge of major catastrophes, such as those of Costa Concordia in 2012, Sandy in 2012 and Tianjin in 2015, have raised big questions as to the future of the market.

(1) Atlas Magazine «Safety and maritime transport»(2) Source: agcs.allianz.com/assets/PDFs/Reports/Shipping-Review-2015.pdf

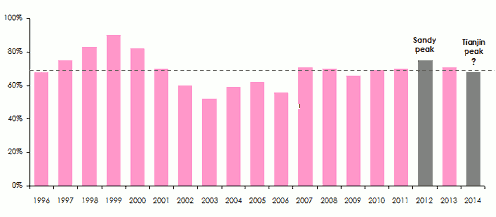

Marine insurance: evolution of the loss ratio

Following the occurrence of hurricane Sandy in 2012, the loss ratio of marine cargo insurance has largely surpassed 70%. Though the years 2013 and 2014 were hardly impacted, they reported a slight decrease in loss experience, compared to 2012. According to IUMI, the performances reported in 2014, the year deemed to be a mild one in terms of marine catastrophes, have been affected by the Tianjin catastrophe.

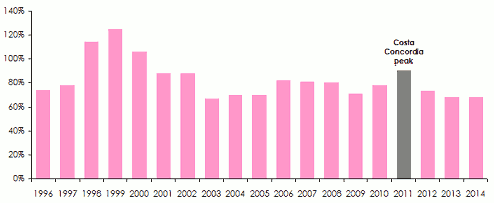

Marine cargo insurance: loss ratios for the period 1996-2014

Since 2007, the marine cargo loss ratio has exceeded 70% (except in 2009).

Source: Union Internationale d’Assurance Maritime (IUMI)

Source: Union Internationale d’Assurance Maritime (IUMI) Marine hull insurance: loss ratios for the period 1996-2014

Source : Union Internationale d’Assurance Maritime (IUMI)

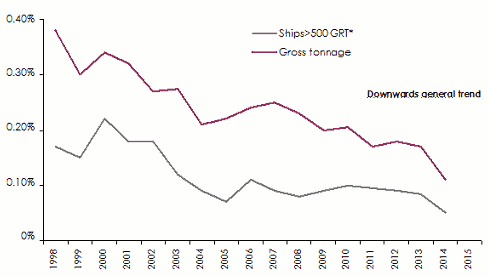

Source : Union Internationale d’Assurance Maritime (IUMI)Loss experience frequency: 1998-2015

Source : Union Internationale d’Assurance Maritime (IUMI)

Source : Union Internationale d’Assurance Maritime (IUMI)The low loss experience reported by the market of marine transport since 1998 has made it possible to absorb some large-scale events like the grounding of Costa Concordia in Italy, which so far, stands as the most costly sinking in history. Allianz Global Corporate & Specialty(1) has advanced the amount of 2 billion USD of losses to be borne by insurers. The cost pertaining to the withdrawal of the wreckage has largely surpassed the value of the hull.

Another marking event of the recent years, is hurricane Sandy which devastated the East coast of the United States in October 2012 causing considerable damage, part of which was borne by marine insurers. The latter disbursed an amount comprised between 2.5 and 3.5 billion USD(2), thus devouring all of the 2012 premiums of the American market.

Apart from these two catastrophes, the Japanese container ship “MOL Comfort”, with a capacity of 8110 TEU, which broke in two in the Indian Ocean in June 2013, is another particularly important total loss. So far, the indemnification of hull and cargo losses is close to 500 million USD.

* GRT = Gross registered tonnage(1) Source: Allianz Global Corporate & Speciality, Safety and shipping review 2015

(2)May 2013 report, Zurich Global Corporate in North America ,

aimu.org/aimupapers/CBMUPresentationonSANDYbySeanDaltonslides.pdf

Marine insurance, an under-exploited potential

Seaway is by far the most used means of transportation for the conveyance of goods; 90% of global trade is carried out via this means. According to Swiss Re Economics Research & Consulting, international trade will continue to grow faster than global GDP during the next ten years. Insurers should normally be taking advantage of this situation.

Reality, however, may be otherwise because marine transport is generating little profits for insurers. Global demand of insurance remains inconsistent with the ongoing intensification of global trade. Hence, the enormous gap between premiums and the persistence of significant future lost earnings for insurers.

Regulation of marine insurance

Despite the international aspect of marine transport, the business is suffering from the lack of harmonization of legislations between countries, with laws, clauses, insurance policies and practices differing from one region to another.

Marine insurance harbors intermodal transport operations as well as non-transport activities. Marine insurance schemes comprise four main kinds of coverage:

- Hull insurance policy is designed to compensate losses and material damage sustained by insured vessels.

- Cargo insurance covers damage caused to goods carried by seaways. Damage sustained during complementary or preliminary itineraries (by land, railway or river) including the stages of loading, unloading, trans-shipping and transit is also covered.

- Third party liability and contractual insurance for ship owners, marine and inland waterway carrier and for marine charterer. Such policies are oftentimes delivered by P & I Clubs (2).

- Offshore energy insurance for risks such as damage and liability associated with exploitation operations, construction, sea drilling and production of energy (oil and gas).

(2) Atlas Magazine «Shipowners' responsibility: the P&I Clubs»