The Yemenite insurance market

Insurance market features

- Regulatory authority: Ministry of Industry and Trade. Insurance Supervision Department

- Life and non life premiums (2008):

72 million USD - Insurance density (2008): 3.12 USD

- Penetration rate (2008): 0.27%

Market structure in 2008

- Insurance companies: 12

Identity

- Superficie: 528 000 Km2

- Population (2008): 23 050 000 inhabitants

- GDP (2008): 26.58 billion US

- GDP per capita (2008): 1 153 USD

- GDP growth rate (2008): 3.9%

- Inflation rate (2008): 18.69%

- Main economic sectors: services, agriculture and fishing, oil, mining, manufacture industries

Major cities

(in number of inhabitants)

- Sana'a (capital): 1 510 500

- Aden: 607 900

- Taiiz: 524 200

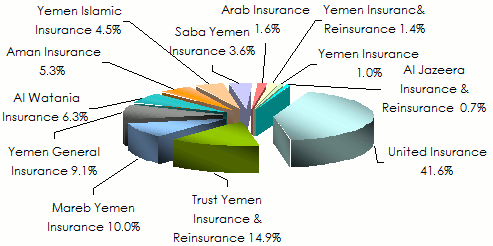

Premiums' growth per company: 2004-2008

in thousands USD| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 shares | |

|---|---|---|---|---|---|---|

United Insurance | 11 738 | 8 579 | 26 316 | 25 982 | 30 109 | 41.6% |

Trust Yemen Insurance & Reinsurance | 4 944 | 5 591 | 7 352 | 7 286 | 10 768 | 14.9% |

Mareb Yemen Insurance | 4 437 | 4 813 | 6 073 | 5 590 | 7 246 | 10.0% |

Yemen General Insurance | 3 891 | 4 172 | 5 443 | 6 884 | 6 567 | 9.1% |

Al Watania Insurance | 3 385 | 4 577 | 5 043 | 5 455 | 4 556 | 6.3% |

Aman Insurance | 1 912 | 2 479 | 3 030 | 3 719 | 3 868 | 5.3% |

Yemen Islamic Insurance | 710 | 1 017 | 1 737 | 2 301 | 3 263 | 4.5% |

Saba Yemen Insurance | 2 006 | 2 260 | 2 420 | 2 370 | 2 609 | 3.6% |

Arab Insurance | 1 581 | 1 749 | 739 | 1 143 | 1 136 | 1.6% |

Yemen Insurance & Reinsurance | 1 295 | 1 126 | 929 | 690 | 987 | 1.4% |

Yemen Insurance | 1 154 | 1 116 | 598 | 642 | 705 | 1.0% |

Al Jazeera Insurance & Reinsurance | - | - | 150 | 310 | 538 | 0.7% |

Total | 37 053 | 47 479 | 59 830 | 62 372 | 72 352 | 100% |

Market share per company in 2008

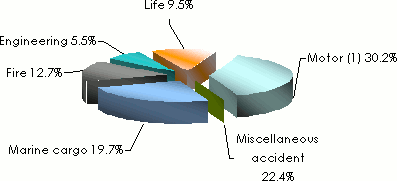

Premiums' growth per class of business: 2004-2008

in thousands USD| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 shares | |

|---|---|---|---|---|---|---|

| Non life | ||||||

Motor1 | 10 813 | 12 772 | 17 785 | 19 013 | 21 895 | 30.2% |

Miscellaneous acc. | 6 457 | 11 886 | 11 648 | 13 613 | 16 204 | 22.4% |

Marine cargo | 8 780 | 10 446 | 13 249 | 13 468 | 14 221 | 19.7% |

Fire | 5 982 | 6 667 | 7 112 | 8 135 | 9 160 | 12.7% |

Engineering | 1 689 | 2 140 | 5 923 | 2 892 | 3 979 | 5.5% |

| Life | ||||||

Life | 3 332 | 3 568 | 4 113 | 5 251 | 6 893 | 9.5% |

Total | 37 053 | 47 479 | 59 830 | 62 372 | 72 352 | 100% |

Market share per class of business in 2008

1 Including workmen's compensation and third party liability

1 Including workmen's compensation and third party liability Loss ratio's evolution per company: 2004-2008

| 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|

United Insurance | 62% | 77% | 75% | 25% | 47% |

Trust Yemen Insurance & Reinsurance | 2% | 14% | 11% | 23% | 15% |

Mareb Yemen Insurance | 104% | 126% | 71% | 81% | 72% |

Yemen General Insurance | 86% | 74% | 75% | 64% | 75% |

Al Watania Insurance | 32% | 47% | 31% | 110% | 87% |

Aman Insurance | 284% | 60% | 59% | 65% | 67% |

Yemen Islamic Insurance | 47% | 36% | 37% | 33% | 37% |

Saba Yemen Insurance | 123% | 66% | 76% | 78% | 66% |

Arab Insurance | 45% | 60% | 141% | 85% | 96% |

Yemen Insurance & Reinsurance | 49% | 51% | 61% | 78% | 55% |

Yemen Insurance | 76% | 93% | 138% | 97% | 90% |

Al Jazeera Insurance & Reinsurance | - | - | - | 17% | 51% |

Average | 72% | 68% | 62% | 52% | 52% |

Loss ratio's evolution per class of business: 2004-2008

| 2004 | 2005 | 2006 | 2007 | 2008 | ||

|---|---|---|---|---|---|---|

| Non life | ||||||

Motor1 | 82% | 94% | 73% | 81% | 79% | |

Miscellaneous acc. | 10% | 7% | 6% | 14% | 14% | |

Marine cargo | 88% | 111% | 134% | 26% | 50% | |

Fire | 98% | 39% | 17% | 20% | 38% | |

Engineering | 77% | 111% | 24% | 129% | 88% | |

| Life | ||||||

Life | 74% | 83% | 81% | 78% | 62% | |

Average | 72% | 68% | 62% | 52% | 52% | |

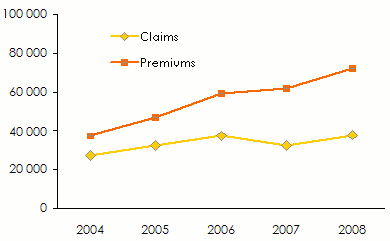

Losses and premiums 'evolution: 2004-2008

in thousands USD

Exchange rate USD/YER as at 31/12 | 2004 | 2005 | 2006 | 2007 | 2008 |

183.4 | 180 | 174.866 | 198.15 | 199.5 |

0

Your rating: None

Mon, 20/05/2013 - 15:22

The online magazine

Live coverage

04/26

04/26

04/26

04/26

04/25

Latest news