Al Dhafra Insurance

Present on the market since 1979, Al Dhafra Insurance is a state-owned company operating in life and non life insurance. In a highly competitive market, the company has reported in 2010 a turnover of 77 million USD, that is an increase of 19.3% in comparison with 2009.

Present on the market since 1979, Al Dhafra Insurance is a state-owned company operating in life and non life insurance. In a highly competitive market, the company has reported in 2010 a turnover of 77 million USD, that is an increase of 19.3% in comparison with 2009.

|

| Kamal Sartawi |

| General manager |

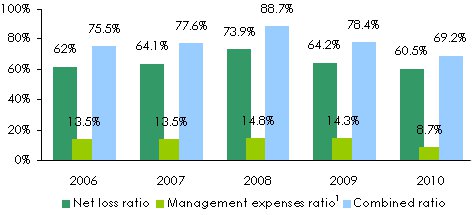

During the 2006-2010 period, Al Dhafra has displayed excellent technical indicators. The 62% loss ratio in 2006 was only 60.5% in 2010. The 69.2% combined ratio in 2010 is the lowest rate posted over the last five years. This meticulous technical management enables Al Dhafra to report a return on equity of 17.7% in, up by 0.9 point compared to 2009.

After the opening of the market to foreign companies in 2005, Al Dhafra, along with other Emirati insurers, had to struggle to maintain and develop its positions. Today, a new challenge is looming ahead. The company must not only increase its capital to 100 million AED (27 million USD) to be in compliance with local legislation, but must also seek additional sources of income to be able to continue to remunerate its shareholders easily.

Al Dhafra Insurance in 2010

| Capital | 20 415 750 USD |

| Turnover | 76 967 091 USD |

| Shareholder’s equity | 82 207 385 USD |

| Total assets | 211 924 020 USD |

| Net result | 14 554 735 USD |

| ROE | 17.7% |

| Loss ratio | 60.5% |

| Combined ratio | 69.2% |

| Distribution network | 9 new agencies opened in the UAE between 2008 and 2009, among which 5 in 2009 |

Management

| Chairman | Mohammed Bin Sultan Al Dhaheri |

| General manager | Kamal Sartawi |

| Deputy general manager, finance | Ajith Kumar |

| Deputy general manager, technical | Talha Ul Islam |

| Deputy general manager, business administration | Joseph Chubatte |

| Senior manager, Motor department | Nasser Arar |

| Senior manager, Fire department | Ali Hussain |

| Senior manager, Engineering department | Nabeel Nasser |

| Senior manager, internal audit | Abdul Rahman Jadalah |

Main Shareholders

| Ghobash Trading & Investment Co. | 20.10% |

| Masaa Co. | 5.83% |

| Saeed A. Al Mazraoui | 5.54% |

| Nawaf G. A. Al Merri | 5.16% |

| Mohammad S. Al Dhahiri | 5.04% |

Main technical highlights: 2006-2010

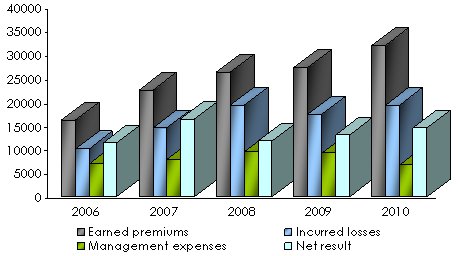

in USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

Gross written premiums | 51 152 165 | 57 807 709 | 64 075 739 | 64 517 884 | 76 967 091 |

Written premiums* | 20 278 108 | 25 565 866 | 29 170 666 | 27 276 554 | 36 891 095 |

Net earned premiums | 16 196 190 | 22 583 655 | 26 283 765 | 27 291 780 | 32 038 566 |

Incurred losses* | 10 049 613 | 14 479 714 | 19 413 964 | 17 513 635 | 19 382 160 |

Net loss ratio | 62% | 64.1% | 73.9% | 64.2% | 60.5% |

Management fees | 6 901 270 | 7 813 085 | 9 514 283 | 9 194 557 | 6 725 013 |

Net result | 11 428 876 | 16 384 704 | 11 798 794 | 13 122 306 | 14 554 735 |

Evolution of premiums, losses, management expenses and results

in thousands USD

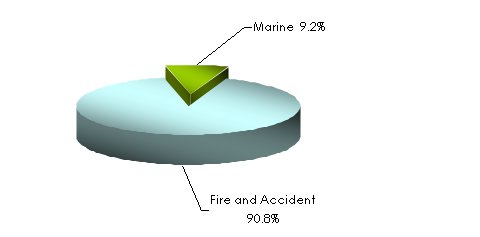

Turnover’s evolution per class of business: 2006-2010

in USD| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 shares | 09-10 growth | |

|---|---|---|---|---|---|---|---|

Fire & Accident | 46 443 960 | 52 601 268 | 59 183 177 | 59 567 361 | 69 901 574 | 90.8% | 17.3% |

Marine | 4 708 205 | 5 206 441 | 4 892 562 | 4 950 522 | 7 065 517 | 9.2% | 42.7% |

Total | 51 152 165 | 57 807 709 | 64 075 739 | 64 517 884 | 76 967 091 | 100% | 19.3% |

Breakdown per class of business in 2010

Evolution of ratios: 2006-2010

1 Management expenses on gross written premiums

1 Management expenses on gross written premiums Exchange rate AED/USD as at 31/12 | 2006 | 2007 | 2008 | 2009 | 2010 |

0.27219 | 0.27217 | 0.27212 | 0.2722 | 0.27221 |

Contact

| Head office | Bldg - Zayed 2nd Street P.O. Box 319, Abu Dhabi, United Arab Emirates |

| Phone | (+971) 2 672 1444 |

| Fax | (+971) 2 672 9833 (+971) 2 677 1813 |

aldhafra [at] emirates [dot] net [dot] ae | |

| Website |