Allianz, a success story

Active in non-life insurance, accident, life and health but also in asset management and banking, the company has experienced a turbulent background during its 133-year history. Emerging from bankruptcy in its darkest hours, it is nowadays one of the largest insurers in the world reporting a premiums volume of approximately 152.7 billion EUR (163 billion USD) in 2022.

Active in non-life insurance, accident, life and health but also in asset management and banking, the company has experienced a turbulent background during its 133-year history. Emerging from bankruptcy in its darkest hours, it is nowadays one of the largest insurers in the world reporting a premiums volume of approximately 152.7 billion EUR (163 billion USD) in 2022.

Read also | Allianz: 2022 results

The beginning of Allianz: 1890-1919

In the last decades of the nineteenth century, Germany was emerging from recession and entering the second phase of its industrial revolution. Economic activity was expanding. Carl Thieme, head of Munich Re, and Wilhelm Finck, a private banker, then foresaw the need for the establishment of an insurance company in order to support this growth.

On February 5, 1890, both men registered the new company, which they baptized Allianz Versicherungs-Aktien-Gesellschaft, in the Trade Registry at Berlin’s Municipal Court. Associated to eight figures in the economic and political life, they injected a start-up capital of 4 million marks.

Allianz, first, sold marine and accident policies in Germany. In 1893, the company went international by opening an office in London which distributed marine insurance coverage for the benefit of German clients seeking to protect themselves against claims they were exposed to abroad.

In 1904, and after several years of co-leadership with Carl Thieme, Paul Von Naher took control as the sole head of the company expanding the company’s portfolio outside Germany. The new insurer was present in the United States in the early twentieth century and had to withstand the terrible earthquake of 1906 in San Francisco . On the eve of World War I, Allianz was also present in the Netherlands, Italy, Belgium, France, the Scandinavian countries and Baltic States. Nearly 20% of its turnover was posted outside Germany, mainly in Great Britain.

It was not until 1905 that the company offered fire insurance. In 1913, Allianz was the largest marine insurer in the country. This class of business accounted for 45% of its collected premiums. Even if the insurer had diversified its offer, it was then nowher e near proposing an exhaustive list of products. In 1900, it became the first insurer to obtain a license to distribute corporate policies. In 1911, the first machinery breakdown policies were put on the market, a monopoly it had held until 1924. But the First World War greatly affected the company. The premiums collected fell by 20% as of 1915. Out of the 800 staff members counted in 1914, 92 lost their lives due to fighting while business continued to shrink throughout the conflict.

It was not until 1905 that the company offered fire insurance. In 1913, Allianz was the largest marine insurer in the country. This class of business accounted for 45% of its collected premiums. Even if the insurer had diversified its offer, it was then nowher e near proposing an exhaustive list of products. In 1900, it became the first insurer to obtain a license to distribute corporate policies. In 1911, the first machinery breakdown policies were put on the market, a monopoly it had held until 1924. But the First World War greatly affected the company. The premiums collected fell by 20% as of 1915. Out of the 800 staff members counted in 1914, 92 lost their lives due to fighting while business continued to shrink throughout the conflict.

As of 1918, Allianz bounced back. Motor insurance was the new product which it marketed through Kraft Versicherungs-AG company, a joint venture established with Munich Re and Kaiserlicher Automobilclub. With the growth of road traffic in the 1920's, the company became Germany’s largest motor insurer.

Allianz: the boom of the 1920s

The financial strategy of Paul Von Naher paid off between the end of the war and the mid 1920. Foreseeing the consequences of the conflict, he maintained a substantial reserve in foreign currency. Kurt Schmitt, who succeeded him upon his death in 1921, would use the financial reserves allowing the Berlin insurer to become Germany’s market leader in terms of turnover. It did not take long before he concluded agreements with life insurance companies.

As they did not last, he decided in 1922 to launch Allianz Lebensversicherungsbank AG which became the largest life insurer in Europe in a five year’s time, helped by the period of hyper inflation affecting the country and which forced many companies to close or merge in order to survive. Allianz seized the opportunity to increase its network by merging particularly with Deutsche Lebensversicherungs Arminia in 1923.

Premises in Munich Premises in Munich |

At the time of rapid currency depreciation, the company's strategy was crucial. After each acquisition, Hans Heb (deputy manager), who joined the group in 1918, endeavored to rationalize the new structure as much as possible. To combat costs and increase productivity, he introduced a new organization in all German subsidiaries and installed new working equipment. He parted from the multi-company agents focusing exclusively on those working for Allianz and trained by the Group.

Heb also outlined social measures and financial incentives for employees. Despite the period of depression, Allianz kept its business running and significantly increased the number of its employees.

As of 1923, the company endeavored to increase its premiums volume. It proceeded to a major increase in its capacities.

|

In 1927, Allianz merged with Stuttgarter Verein Versicherung-AG, the number one accident and third party liability insurer, a move then characterized as the largest merger. Two years later, the group came to the rescue of the entire insurance industry by deciding to honor the commitments of Frankfurter Allgemeine Versicherungs-AG, Germany’s second insurer which went bankrupt following a massive financial scandal.

Allianz during the pre and post-war years

Upon the arrival of Adolf Hitler to power in 1933, the whole economy had to contribute for the secret purpose to prepare for the war. As of 1935, insurers were forced to subscribe to State bonds. In 1942, these investments accounted for two-thirds of the group’s investments. At the end of the war, Hans Heb was appointed at the head of the company.

World War II, reduced Allianz to ashes. The headquarters in Berlin and the majority of its real estates were destroyed, and the partition of Germany resulted in the loss of some of its teams. State bonds were devalued and the company was technically bankrupt. All subsidiaries outside Germany were lost.

On May 22, 1945 Allianz received a temporary authorization allowing it to operate again. The growing difficulties pertaining to organization and resulting from the creation of East Germany, forced the company to move Allianz non-Life headquarters to Munich and that of Allianz life to Stuttgart.

In the East, the whole economy suffered a profound change. All private insurers were immediately nationalized.

The reconstruction of Allianz

At the end of 1948, Heb gave up the presidency of the board. He was succeeded by Hans Goudefroy whose mission was to preserve the capital of Allianz and strengthen its stability.

Allianz Treptowers, Berlin Allianz Treptowers, Berlin |

Hans Goudefroy primarily focuses redeployment efforts on the local market, especially in personal lines insurance. The agents’ network was growing larger. The company became again the market leader in Germany in the mid 1950s. Towards the end of the decade, the group tried to expand somewhat in Europe. Allianz acquired stakes in its former Italian and Austrian subsidiaries. In 1959 an office was opened in Paris.

The turnover reached one billion DM in 1962. It was motor insurance that was behind this expansion as it accounted for over 50% of the portfolio at the end of the 1960s.

Change of course

With the arrival of Wolfgang Schieren at the head of the company in 1971, Allianz followed a new direction: staff hiring have been slowed as a drastic cost-cutting program ensued whereas the underwriting of industrial risks was privileged.

Finally, W. Schieren accelerated the internationalization of the group, and the move soon paid off as Allianz became the world leader in engineering insurance in a few years. In 1972, 120 million DEM (37 million USD) of premiums were reported outside Germany. As of 1973, Allianz was among the ten largest insurers in the world.

During the first phase of expansion abroad, Allianz set up its own subsidiaries. Allianz International Insurance Co. began operations in London in 1975 and was later followed by Spain, the Netherlands and Austria. In 1977, Allianz completed the first stage of its development abroad by entering the American market.

Allianz: the years 1980–1990

On the eve of his retirement, Schieren, who anticipated the collapse of barriers between banks and insurance companies, took a stake in Dresdner Bank in October 1981.

To be present in new markets, Allianz acquired stakes in insurance companies in Argentina, Greece and Spain. The acquisition of British Cornhill Insurance Co. in 1986 opened the doors of South-East Asia and enhanced its presence in the United Kingdom.

The premiums collected, which reached 4 billion DM in 1970 (1.2 billion USD) rose to 31.8 billion DEM (20 billion USD) in 1987. Over 40% of this volume was generated outside Germany. This uncontrolled growth had to be accompanied by a restructuring process. The insurance industry was entrusted in 1985 to Allianz Versicherungs-AG, which then had financial arrangements with Allianz AG Holding which would become Allianz SE in 2006.

In 1990, Allianz took over the entire personal lines insurance portfolio of Deutsche Versicherungs-AG, the former state-owned company of East Germany . It also invested in the whole of Eastern Europe including Hungary, Russia, Czech Republic, Romania, Slovakia and Poland. Today, Allianz is represented in ten Eastern European countries through 25 companies.

In 1991, another major operation was performed: the American insurer Fireman's Insurance Co. was purchased for 1.1 billion USD. Allianz, therefore, quadrupled its turnover on the American soil. The same year a license to operate in Japan was granted.

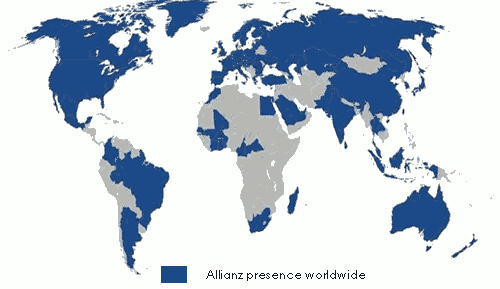

Allianz presence worldwide

In 1992, Allianz suffered its first operating deficit in 20 years (-1.78 billion DEM that is -1.1 billion USD) which was not wiped out before 1995.

The acquisition strategy has continued, Allianz bought in 1994 Swiss Re’s direct insurance business in Switzerland, then Lloyd Adriatico in Italy becoming, thus, the second largest insurer of the peninsula.

The late 1990s was a period of significant expansion in Asia. The company sets foot in life insurance in China in 1998 by establishing a joint venture with the local operator Dazhong (its first operation in this country dates back to1917). Allianz entered South Korea in 1999.

In 1997, a key acquisition, the largest in the history of the group, was made in France with the acquisition of Assurances Générales de France (AGF) for 22 billion EUR (25 billion USD). AGF was then represented in Europe, South America and Asia. That move would extend Allianz participation in Dresdner Bank in which AGF was shareholder.

Allianz: the challenges of the 2000s

|

In an effort to make the company more attractive to investors, Allianz joined the New York Stock Exchange at the end of the year 2000.

Despite the size gained by the group, the 2001 attacks in New York strongly affected Allianz. The compensation costs of the twin towers amounted to 1.3 billion USD at Allianz Global Risks while the about financial markets downturn had an even greater impact. The value of the company collapsed and its stock price was halved.

In 2003, Allianz launched into microinsurance through the Indian company Bajaj Allianz which owns 1.6 million customers.

In 2006, Allianz Versicherungs-AG changed its legal status and became a European company with the name Allianz SE. This status allowed it to practice in all the member States of the Union in a legal form reducing administrative costs.

In order to offer coverage tailored to the needs of the population, Allianz Africa embarked, in 2008, on microinsurance in Western Africa . This experience began with the Cameroonian subsidiary, and then spread to Côte d’Ivoire and Senegal. The group also plans to develop this niche in Mali and Burkina Faso. Allianz now covers more than 100 000 micro-insured in partnership with many micro-finance institutions.

In 2011, the company operates in 70 countries worldwide and employs 151 000 people (almost a third of whom in Germany, 8% in France, 4% in the United States). At the end of 2010, the group posted a turnover of 106.45 billion EUR (141 billion USD), all activities together, and reported an operating profit of 8.24 billion EUR (10.9 billion USD). Shareholders' equity totaled 44.5 billion EUR (59 billion USD) which earned it an AA rating from Standard and Poor's.

Allianz Group in 2010

Allianz Group is:

- the first non life insurer worldwide

- a turnover of 106.5 billion EUR (141 billion USD)

- total managed assets of 1 518 billion EUR (2 011 billion USD)

- 91.4 billion EUR (121 billion USD) of indemnities paid to policyholders

- 400 000 sales points

- 151 000 employees

- 76 million customers

- a presence in 70 countries

Financial soundness rating as at 31.12.2010

| Agencies | Rating | Outlooks |

|---|---|---|

Standard & Poor’s | AA | Stable |

Moody’s | Aa3 | Stable |

A.M. best | A+ | Stable |

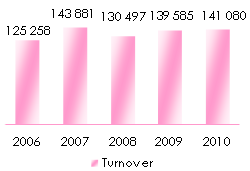

Main technical highlights of the group: 2006-2010

in millions USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

Global turnover of the group | 125 258 | 143 881 | 130 497 | 139 585 | 141 080 |

| - Property / Casualty - Life/health - Other operations 1 | 57 661 62 609 4 988 | 65 231 72 710 5 940 | 61 164 64 305 5 028 | 60 949 72 774 5 862 | 58 174 75 672 7 234 |

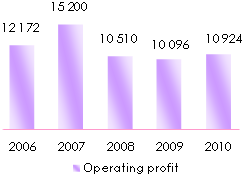

Operating profit | 12 172 | 15 200 | 10 510 | 10 096 | 10 924 |

Shareholder’s equity | 65 551 | 70 333 | 47 536 | 57 488 | 58 964 |

Solvency margin | 190% | 157% | 157% | 164% | 173% |

Non life combined ratio | 92.9% | 93.6% | 95.4% | 97.4% | 97.2% |

Exchange rate EUR/USD as at 31/12 | 2006 | 2007 | 2008 | 2009 | 2010 |

1.32027 | 1.47285 | 1.40974 | 1.43333 | 1.32530 |

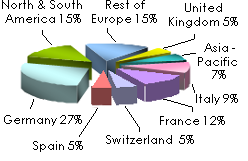

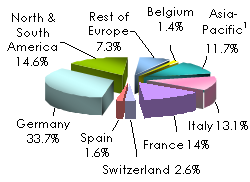

| Breakdown in % of the 2010 non life turnover per geographic zone | Breakdown in % of the 2010 life turnover per geographic zone |

|  |

1 Including the rest of the world

| Evolution of the turnover 2006-2010 | Evolution of the operating profit 2006-2010 |

|---|---|

in millions USD | in millions USD |

Allianz Africa

Allianz Africa is, in 2010

- a turnover of 116 million EUR (153 million USD)

- 261 million EUR (346 million USD) of managed assets

- 15 subsidiaries in 10 countries

- 450 employees

Present on the African continent for nearly a century through the network of the French insurer AGF which it has bought out, Allianz Africa stands among the top five Pan African insurers, excluding South Africa. The group has 15 subsidiaries in West Africa and Central Africa and operates in ten countries: Benin, Burkina Faso, Cameroon, Central African Republic, Côte d’Ivoire, Ghana, Madagascar, Mali, Senegal and Togo.