APA Insurance

Dotted with a technical know-how and benefiting from significant partnerships, APA Insurance has revolutionized the insurance supply in Kenya.

Dotted with a technical know-how and benefiting from significant partnerships, APA Insurance has revolutionized the insurance supply in Kenya.

In five years the company has managed to double its turnover which amounted to 50 million USD in 2009. Kenindia, UAP and ICEA, three traditional non-life insurers, are left lagging behind. Only Jubilee seems able to stand to the expansion of APA Insurance.

In search of niches, the company has progressively focused its activities towards microinsurance which stands as an important driver of insurance development in Africa.

The company's shareholders' equity, among the highest in the local market, provides a flexible financial base to APA to underwrite throughout the Kenyan territory and elsewhere with the opening in January 2009 of a subsidiary in Uganda.

|  |

| John P.N. Simba | Ashok K.M. Shah |

| Chairman | Chief Executive Officer |

APA Insurance in 2009

Rank | 2nd non life insurer in Kenya |

Capital | 6 315 000 USD |

Turnover | 46 628 268 USD |

Shareholder's equity | 16 924 768 USD |

Total assets | 70 161 961 USD |

Net result | 2 210 250 USD |

ROE | 13.1% |

Net loss ratio | 68.7% |

Combined ratio | 96.5% |

Number of offices | 11 throughout the Kenyan territory |

Number of subsidiaries | 1 (in Uganda) |

Management

Chief Executive Officer | Ashok K.M. Shah |

Chief Finance Officer | John Mburu Kigochi |

Chief Operating Officer | Suresh Kumar |

Director of operations | Parul Khimasia |

Head of new channels | Fridah Mburu |

Head of legal departement | Elisabeth Koskei |

Head of claims | Charles Stachwell |

Head of underwriting | Ben Ndegwa |

Head of internal audit | Kenneth Ndura |

Head of corporate communications | Gladys Nashipae |

Head of human resources | Stephen Bosire |

Head of business development | Joseph Muraguri |

Projects manager | Rashid Mohammed |

Main shareholders

| Apollo Insurance Company | 60.03% |

| PA Securities Limited | 39.97% |

Main technical highlights: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|---|

Gross written premiums | 20 669 989 | 28 720 363 | 36 817 731 | 35 734 546 | 46 628 268 |

Written premiums net of reinsurance | 18 400 787 | 24 366 342 | 30 747 445 | 30 022 808 | 40 216 724 |

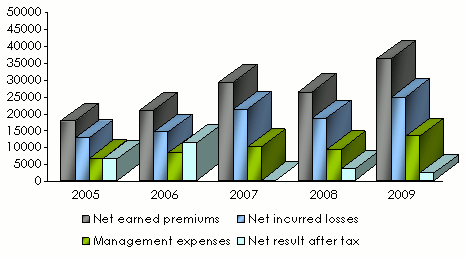

Net earned premiums | 17 374 628 | 20 571 022 | 28 726 815 | 25 997 359 | 35 796 742 |

Net incurred losses | 12 372 636 | 14 124 196 | 20 843 121 | 18 260 205 | 24 594 551 |

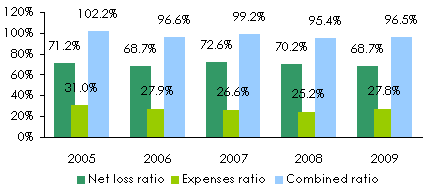

Net loss ratio | 71.2% | 68.7% | 72.6% | 70.2% | 68.7% |

Management expenses | 6 411 373 | 8 000 736 | 9 807 294 | 9 022 449 | 12 985 055 |

Net result after tax | 6 322 379 | 10 896 571 | -56 127 | 3 352 599 | 2 210 250 |

Evolution of premiums, losses, management expenses and results

in thousands USD

The turnover's evolution per class of business: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 shares | 08/09 growth | |

|---|---|---|---|---|---|---|---|

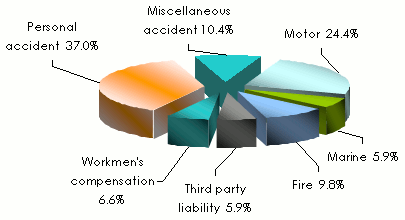

Motor | 5 535 777 | 6 659 639 | 8 496 265 | 7 542 137 | 11 386 463 | 24.4% | 51% |

Marine | 1 481 955 | 1 997 181 | 3 655 513 | 2 155 114 | 2 743 211 | 5.9% | 27.3% |

Fire | 2 138 768 | 3 103 443 | 3 097 209 | 3 960 237 | 4 579 044 | 9.8% | 15.6% |

Third party liability | 306 169 | 1 256 841 | 2 742 471 | 2 844 136 | 2 744 853 | 5.9% | -3.5% |

Workmen's compensation | 768 616 | 1 014 585 | 1 622 347 | 1 866 967 | 3 064 935 | 6.6% | 64.2% |

Personal accident | 8 259 485 | 11 750 381 | 13 688 723 | 13 047 410 | 17 259 122 | 37% | 32.3% |

Miscellaneous accident | 2 179 219 | 2 938 293 | 3 515 203 | 4 318 545 | 4 850 640 | 10.4% | 12.3% |

Total | 20 669 989 | 28 720 363 | 36 817 731 | 35 734 546 | 46 628 268 | 100% | 30.5% |

Breakdown per class of business in 2009

Ratios' evolution: 2005-2009

Echange rate KES/USD as at 31/12 | 2005 | 2006 | 2007 | 2008 | 2009 |

0.01374 | 0.0143 | 0.01563 | 0.0119 | 0.01263 |

Contact

Head office | Apollo Centre, Vale Close, Ring Road Parklands, Westlands, P.O. Box 30065 - 00100 GPO, Nairobi, Kenya |

Phone | (+254) 20 286 2000 |

Fax | (+254) 20 286 2200 |

Email | info [at] apainsurance [dot] org |

Website |