Arab Orient Insurance Company

With the exception of an establishment in Oman, Arab Orient has not ventured in an all-round regional development. It focused on the Emirates where it has a network of high-quality branches.

With the exception of an establishment in Oman, Arab Orient has not ventured in an all-round regional development. It focused on the Emirates where it has a network of high-quality branches.

|

| Omer Hassan Elamin |

| Senior Managing Director |

Despite an unfavorable economic environment marked by the international crisis and the fierce competition involving tens of local and foreign insurers, Arab Orient has managed to maintain sound fundamentals. During the last five years, the turnover has regularly grown while the loss ratio has always been below 65% and overhead expenses below 14%. Thanks to such performance, the company has posted the market’s highest profits in recent years.

Arab Orient Insurance in 2011

| Share capital | 102 112 000 USD |

| Paid up capital | 81 690 000 USD |

| Turnover | 344 518 000 USD |

| Shareholder's equity | 277 563 000 USD |

| Total assets | 649 000 000 USD |

| Net technical result | 31 333 000 USD |

| Profit | 55 613 000 USD |

| Net loss ratio | 47.5% |

| Loading rate | 13.3% |

| Combined ratio | 60.8% |

| Number of branches | 11 among which one in Oman |

| Number of employees | 356 |

Management

| Senior Managing Director | Omer Hassan Elamin |

| GM, Technical | Rohana Alagiyage |

| GM, Business Development | Syed Mohamed Asim |

| AGM, Sales & Marketing | Fadi Awni Al Ahamdi |

| AGM, Medical | Wissam Khalifeh |

| AGM, Life & bancassurance | Xavier Arputharaj |

| AGM, Finance | Mohamed Husain Suleman |

| AGM, Claims | Natarajan Ramesh |

| AGM, Reinsurance | Nadia Saleh |

| AGM, Human Resources & Administration | Gilbert Espiritu |

Main shareholders

| Al Futtaim development Services | 90% |

| Al Futtaim Private Co. | 5% |

| Al Futtaim Group. | 5% |

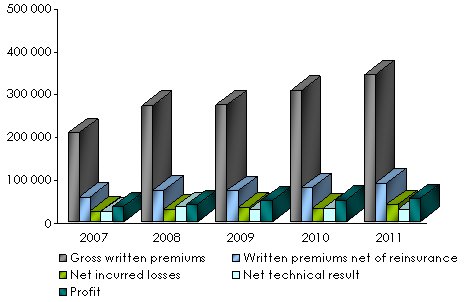

Main technical highlights: 2007-2011

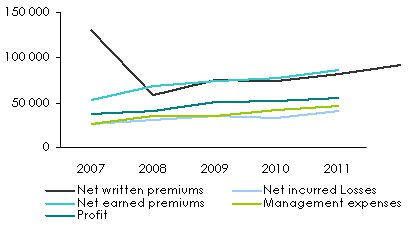

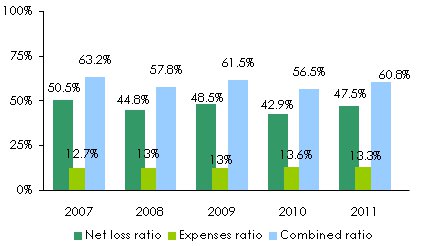

in thousands USD| 2007 | 2008 | 2009 | 2010 | 2011 | |

|---|---|---|---|---|---|

Gross written premiums | 208 657 | 272 208 | 272 723 | 307 098 | 344 518 |

Written premiums net of reinsurance | 58 098 | 74 763 | 73 732 | 81 124 | 91 354 |

Net earned premiums | 52 845 | 67 902 | 73 826 | 77 746 | 86 507 |

Net incurred losses | 26 688 | 30 427 | 35 796 | 33 336 | 41 066 |

Net loss ratio | 50.5% | 44.8% | 48.5% | 42.9% | 47.5% |

Management expenses | 26 560 | 35 270 | 35 382 | 41 896 | 45 798 |

- Commissions | 15 542 | 20 349 | 17 121 | 19 506 | 21 998 |

- Overhead expenses | 11 018 | 14 921 | 18 261 | 22 390 | 23 800 |

Expenses ratio | 12.7% | 13% | 13% | 13.6% | 13.3% |

Net technical result | 24 672 | 36 887 | 30 094 | 33 635 | 31 333 |

Financial income | 8 870 | 8 899 | 12 071 | 11 074 | 11 490 |

Profit | 37 044 | 40 843 | 50 637 | 52 187 | 55 613 |

Evolution of premiums, losses, management expenses and results 2007-2011

Evolution of ratios: 2007-2011

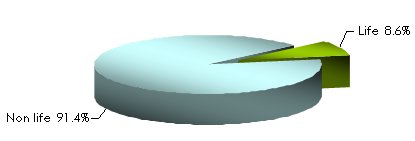

Breakdown of life and non life premiums

in thousands USD| 2009 | 2010 | 2011 | 2011 portfolio breakdown | 2010/11 evolution | |

|---|---|---|---|---|---|

Non life | 66 943 | 70 095 | 79 094 | 91.4% | 12.8% |

Life | 6 883 | 7 651 | 7 413 | 8.6% | -3.1% |

Total | 73 826 | 77 746 | 86 507 | 100% | 11.3% |

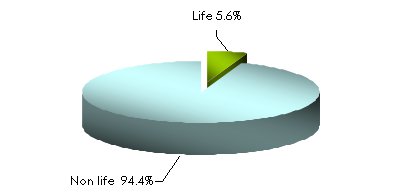

Breakdown of life and non life losses

in thousands USD| 2009 | 2010 | 2011 | 2011 portfolio breakdown | 2010/11 evolution | |

|---|---|---|---|---|---|

Non life | 33 297 | 31 213 | 38 754 | 94.4% | 24.2% |

Life | 2 499 | 2 122 | 2 311 | 5.6% | 8.9% |

Total | 35 796 | 33 336 | 41 066 | 100% | 23.2% |

Exchange rate AED/USD as at 31/12 | 2007 | 2008 | 2009 | 2010 | 2011 |

0.27217 | 0.27212 | 0.2722 | 0.27221 | 0.2723 |

Contact

| Head office | P.O Box 27966, Orient Building, Al Badia Business Park, Dubai, United Arab Emirates |

| Phone | (+971) 4 253 1300 |

| Fax | (+971) 4 253 1500 |

| Website |

0

Your rating: None

Tue, 21/05/2013 - 12:08

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news