Assurances Réassurances Omnibranches (ARO)

The insurer’s shareholding basis is a reflection of the history of the company owned by the state at 73.35% and by staff members who control 16.83% of the capital.

The insurer’s shareholding basis is a reflection of the history of the company owned by the state at 73.35% and by staff members who control 16.83% of the capital.

Despite the long socio-political crisis sustained by the country, ARO is a safe value and a company endowed with a notoriety that goes far beyond the Indian Ocean. The company’s professionalism is well recognized and appreciated all over Africa.

The implementation of the 2011-2020 Business Plan has allowed the company to draw up a coherent development framework that should lead ultimately to the separation of life and non life operations and to the overhaul of the group’s IT system. As for now, ARO continues to dominate the Malagasy market with 55% of market share. The 2013 performance was outstanding with a loss ratio of 41.7%, a combined ratio of 69.9% and a solvency margin of about 13 times higher than the minimum regulatory.

|  |

| Herintsalama Rajaonarivelo | Patrick Andriambahiny |

| Chairman | Chief executive officer |

ARO in 2013

| Share capital | 3 160 193 USD |

| Turnover | 37 751 000 USD |

| Assets | 192 151 225 USD |

| Shareholder’s equity | 80 878 980 USD |

| Net result | 3 690 000 USD |

| Loss ratio | 41.7% |

| Management expenses ratio | 28.2% |

| Combined ratio | 69.9% |

| Distribution network | 19 direct agencies, 5 general agents, 24 sub-agencies |

| Number of employees | 382 |

Management

| Chairman of the board | Herintsalama Rajaonarivelo |

| Chief executive officer | Patrick Andriambahiny |

| Development and projects Manager | Julien Andrianarisaona |

| Financial & HR Manager | Andry Rabaonarison |

| Technical Manager | Zafiarisoa Rakouth |

| Marketing Manager | Sylvie Ranoroharivelo |

| Inspector Manager | Mamy Ramiandrasoa |

| Life Department | Mahenina Ranaivo |

| Reinsurance Department | Johary Andrianarivelo |

Shareholding

| State | 73.35% |

| Companies | 9.62% |

| Staff | 16.83% |

| Others | 0.19% |

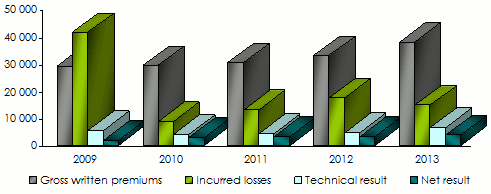

Main technical highlights: 2009-2013

in thousands USD| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Gross written premiums | 28 880 | 29 205 | 30 300 | 32 818 | 37 751 |

Direct written premiums | 27 048 | 27 565 | 28 660 | 30 929 | 35 787 |

Net earned premiums | 28 052 | 26 394 | 28 286 | 31 119 | 34 967 |

Net incurred losses | 41 205 | 8 670 | 12 832 | 17 398 | 14 584 |

Management expenses (1) | 10 657 | 9 786 | 10 965 | 10 247 | 10 658 |

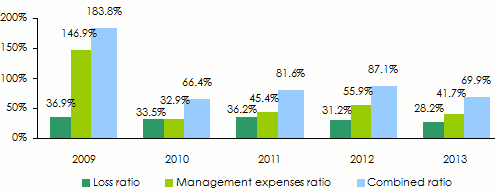

Management expenses ratio (2) | 36.9% | 33.5% | 36.2% | 31.2% | 28.2% |

Net loss ratio | 146.9% | 32.9% | 45.4% | 55.9% | 41.7% |

Combined ratio | 183.8% | 66.4% | 81.6% | 87.1% | 69.9% |

Technical result | 5 193 | 3 797 | 4 269 | 4 712 | 6 465 |

Net result | 1 564 | 2 633 | 3 002 | 3 275 | 3 690 |

2 Management expenses ratio = management expenses / gross written premiums

Evolution of premiums, losses and results

in thousands USD

Evolution of ratios 2009-2013

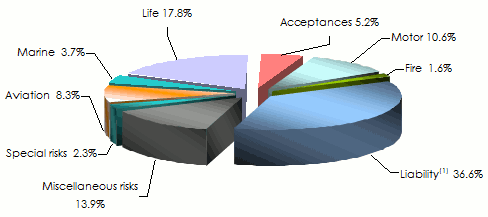

Gross written premiums per class of business: 2009-2013

in thousands USD| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 shares | 2012/2013 evolution | |

|---|---|---|---|---|---|---|---|

Motor | 5 240 | 4 633 | 4 613 | 3 723 | 4 018 | 10.6% | 7.9% |

Fire | 1 028 | 952 | 1 048 | 526 | 605 | 1.6% | 15% |

Liability (1) | 4 696 | 4 906 | 4 647 | 7 502 | 13 834 | 36.6% | 84.4% |

Miscellaneous risks | 4 680 | 4 639 | 4 682 | 4 527 | 5 236 | 13.9% | 15.7% |

Miscellaneous risks | 3 157 | 4 475 | 4 152 | 4 026 | 861 | 2.3% | -78.6% |

Aviation | 2 411 | 2 051 | 2 409 | 3 474 | 3 138 | 8.3% | -9.7% |

Marine | 1 154 | 1 042 | 1 819 | 1 224 | 1 392 | 3.7% | 13.8% |

Total non life | 22 366 | 22 698 | 23 370 | 25 002 | 29 084 | 77% | 16.3% |

Total life | 4 682 | 4 867 | 5 290 | 5 927 | 6 703 | 17.8% | 13.1% |

Direct business | 27 048 | 27 565 | 28 660 | 30 929 | 35 787 | 94.8% | 15.7% |

Acceptances | 1 832 | 1 640 | 1 640 | 1 889 | 1 964 | 5.2% | 4% |

Grand total | 28 880 | 29 205 | 30 300 | 32 818 | 37 751 | 100% | 15% |

Breakdown of gross written premiums per class of business in 2013

1 includes all classes of compulsory insurance

1 includes all classes of compulsory insuranceIncurred losses per class of business: 2009-2013

in thousands USD| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Motor | 1 446 | -136 | 2 326 | 3 450 | 1 783 |

Fire | 2 946 | -1 179 | 9 | 357 | 980 |

Liability (1) | 2 124 | 2 941 | 2 692 | 1 615 | 1 982 |

Miscellaneous risks | 26 077 | -1 492 | -1 077 | 1 785 | 4 403 |

Miscellaneous risks | 993 | 21 | 32 | 54 | -5 |

Aviation | 414 | 1 396 | -1 011 | 31 | 44 |

Marine | 1 052 | -78 | 1 277 | 90 | -859 |

Total non life | 35 053 | 1 473 | 4 248 | 7 382 | 8 328 |

Life | 6 152 | 7 197 | 8 584 | 10 016 | 6 256 |

Grand total | 41 205 | 8 670 | 12 832 | 17 398 | 14 584 |

Loss ratio per class of business: 2009-2013

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Motor | 26.4% | -2.8% | 52.8% | 82.8% | 45.2% |

Fire | 288.7% | -129.7% | 0.9% | 46.7% | 163.5% |

Liability (1) | 46.9% | 62.0% | 58.6% | 19.1% | 15.4% |

Miscellaneous risks | 619.6% | -32.6% | -23.2% | 40.6% | 90.7% |

Miscellaneous risks | 21.3% | 0.6% | 0.7% | 1.6% | -0.4% |

Aviation | 17.3% | 64.5% | -45.0% | 1.0% | 1.3% |

Marine | 90.1% | -7.8% | 76.4% | 8.6% | -52.5% |

Total non life | 149.5% | 6.8% | 18.5% | 29.3% | 29.5% |

Life | 133.8% | 149.5% | 159.6% | 168.3% | 92.7% |

Grand total | 146.9% | 32.9% | 45.4% | 55.9% | 41.7% |

Exchange rate MGA/TND as at 31/12 | 2009 | 2010 | 2011 | 2012 | 2013 |

0.0005189 | 0.0004765 | 0.26669 | 0.26698 | 0.26666 |

Assurances Réassurances Omnibranches (ARO)

| Headquarters | Antsahavola Antananarivo - Madagascar PO Box 42 |

| Tel | +261 20 22 201 54 |

| Fax | +261 20 22 344 64 |

antsahavola [at] aro [dot] mg (antsahavola [at] aro [dot] mg ) | |

| Website |