CASH

Unfortunately, such parentage is too difficult to take shape. CASH had to go solo without taking specific advantage from its prestigious sponsor.

Unfortunately, such parentage is too difficult to take shape. CASH had to go solo without taking specific advantage from its prestigious sponsor.

After a difficult start, the company has finally managed to get established on the Algerian insurance landscape.

|

| Nacer Sais |

| Chairman |

Intent on building up a balanced portfolio, CASH no longer wishes to be the insurer of a few mega risks. Henceforth, it shall target a clientele of small and medium sized enterprises which it endeavors to retain through a distribution network in full development.

It is up to the management team to prove that there is a genuine market of industrial risks willing to go in line with a professional entity that has the capacity to make dreams come true.

CASH Assurances in 2008

Market share | 15% of the Algerian market |

Turnover | 9 957 597 000 DZD (146 775 000 USD) |

Paid up capital | 2 800 000 000 DZD (41 272 000 USD) |

Technical result | 811 202 000 DZD (11 957 000 USD) |

Net result | 512 209 000 DZD (7 550 000 USD) |

Shareholders' equity | 3 703 012 796 DZD (54 582 408 USD) |

Loss ratio | 21.07% |

Number of employees | 204 |

Direct network | 9 direct management offices 7 general agents |

Management

| Chairman | Nacer Sais |

Assistant to the chairman in charge of administration and finance | Mahmoud Bencharif |

Advisor to the chairman in charge of marketing | Omar Akchiche |

Construction insurance manager | Mehdi Chellouche |

Industrial and personal line insurance manager | Sadek Aoudia |

Marine manager | Kamel Rahem |

Reinsurance manager | Abdelghani Rehal |

Shareholders

| SONATRACH | 39% |

| CAAR | 33.3% |

| CCR | 16.7% |

| NAFTAL | 11% |

Main technical highlights 2004-2008

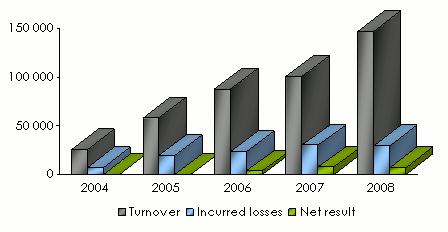

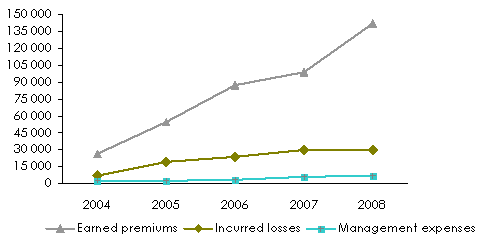

in USD| 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|

Gross written premiums | 25 480 000 | 58 167 000 | 87 838 000 | 101 087 000 | 146 775 000 |

Premiums net of reinsurance | 3 220 000 | 6 142 000 | 7 636 000 | 11 250 000 | 8 854 000 |

Gross earned premiums | 26 167 000 | 54 783 000 | 87 768 000 | 99 260 000 | 141 931 000 |

Gross incurred losses | 6 993 000 | 19 593 000 | 23 737 000 | 30 247 000 | 29 911 000 |

Loss ratio | 26.73% | 35.77% | 27.05% | 30.47% | 21.07% |

Management expenses | 2 763 000 | 3 000 000 | 3 792 000 | 6 177 000 | 7 002 000 |

Technical result | 379 000 | 5 559 000 | 9 307 000 | 12 742 000 | 11 957 000 |

Financial income | 1 242 000 | 1 017 000 | 1 337 000 | 1 777 000 | 2 295 000 |

Net result | 230 000 | 35 000 | 3 667 000 | 7 837 000 | 7 550 000 |

Evolution of premiums, losses and results

in thousands USD in thousands USD

in thousands USD

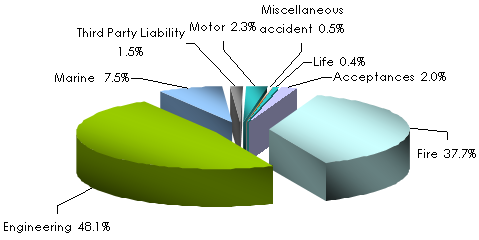

Turnover's evolution per class of business 2004-2008

in thousands USD| 2004 | 2005 | 2006 | 2007 | 2008 | Shares | 2007-2008 growth | |

|---|---|---|---|---|---|---|---|

Fire | 15 052 | 42 922 | 56 050 | 40 218 | 55 293 | 37.7% | 37.5% |

Engineering | 4 687 | 7 564 | 20 509 | 37 043 | 70 536 | 48.1% | 90.4% |

Marine | 4 793 | 5 644 | 5 373 | 16 950 | 11 095 | 7.5% | -34.5% |

Third Party Liability | 308 | 576 | 853 | 2 145 | 2 245 | 1.5% | 4.7% |

Motor | 537 | 1 033 | 1 838 | 3 099 | 3 337 | 2.3% | 7.7% |

Miscellaneous accident | 85 | 351 | 560 | 735 | 777 | 0.5% | 5.8% |

Life | 18 | 43 | 154 | 456 | 575 | 0.4% | 26.0% |

Acceptances | - | 34 | 2 501 | 441 | 2 917 | 2.0% | 561.5% |

Grand total | 25 480 | 58 167 | 87 838 | 101 087 | 146 775 | 100.0% | 45.2% |

Breakdown per class of business in 2008

Exchange rate DZD/USD as at 31/12 | 2004 | 2005 | 2006 | 2007 | 2008 |

0.01437 | 0.01374 | 0.01452 | 0.01556 | 0.01474 |

Contact

| Head office | 54, Avenue des Frères Bouadou Bir Mourad Rais - 16300 Algiers |

| Phone | (+213) 21 54 15 35 |

| Fax | (+213) 21 54 13 29 |

| Website | |

info [at] cash-assur [dot] com |

0

Your rating: None

Mon, 20/05/2013 - 14:42

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news