D&O insurance: Directors and officers liability insurance

D&O insurance: The reasons behind the development

Nowadays, recourse to justice has become more and more common and could affect the private wealth of companies' leaders. It is after acts of mismanagement having triggered the spectacular downfall of companies of international renown (Enron, Lehman Brothers, etc) that the third party liability of company directors and officers gained momentum again. With the economic world getting more and more competitive, companies and shareholders can hardly accept management faults which could lead to considerable losses in terms of funds and image. They are, therefore, seeking compensations, likewise for creditors and liquidators, ...

Nowadays, recourse to justice has become more and more common and could affect the private wealth of companies' leaders. It is after acts of mismanagement having triggered the spectacular downfall of companies of international renown (Enron, Lehman Brothers, etc) that the third party liability of company directors and officers gained momentum again. With the economic world getting more and more competitive, companies and shareholders can hardly accept management faults which could lead to considerable losses in terms of funds and image. They are, therefore, seeking compensations, likewise for creditors and liquidators, ...

This trend comes within the framework of a general "Americanization" of conducts, of the globalization of economies and financial markets. As a result, any top executive or member of the board of directors in a company may be held accountable for the consequences of his bad decisions.

That is how in France almost 2000 companies' directors and officers are, in average, indicted every year by the civil courts and that an additional 2 500 stand before penal courts. Directors and officers liability insurance (D&O) is meeting such concerns.

Beneficiaries of the directors and officers liability insurance

- Persons mentioned in the company's statutes: the so-called eligible leaders, regardless of the size and the legal status of the company: the chairman or vice chairman of a limited company, the manager of a limited company the treasurer, the president of an association, the founder, the member of a board of directors, ...

- People performing management, supervision or administration duties: de facto leaders who are entrusted with management duties within the company under coverage and in interim of the legal representative, employee or not.

D&O insurance: Cover usage

Misconducts that may trigger indictment of leaders are divided into three groups:

- mismanagement

- non-compliance with the statutes

- breaches of the legislative or regulatory framework

Most insurance policies cover the presumed misconducts on the basis of the claims submitted by the plaintiff (claims-made basis), that is, regardless of the real date of the loss. In some cases, the coverage period may be of retroactive effect.

Who is entitled to press charges ?

Any individual or company which claims to have suffered a damage may press charges and make use of the cover. Those who are able to act are:

- owners, investors, creditors (including bond holders), employees, shareholders

- consumers, competitors, associates, the State or state-run institutions

- the company itself

D&O insurance: The different kinds of policies

The insurance contract is underwritten by the company and not by company's directors and officers who are the beneficiaries.

There are three kinds of policies:

The “Side A” insurance policies. They are designed to protect directors and officers and not the companies. They provide officers and directors with an indemnity in the event the company turns out to be unable to pay for damages as provided by law, or due to economic reasons (protection goes beyond what the company is able to offer), or in case of insolvency.

The “Side A” insurance policies. They are designed to protect directors and officers and not the companies. They provide officers and directors with an indemnity in the event the company turns out to be unable to pay for damages as provided by law, or due to economic reasons (protection goes beyond what the company is able to offer), or in case of insolvency.- The "Side B" insurance policies. They are designed to protect companies by reimbursing to them the sums they paid to their directors as indemnities for which they were indicted.

- The “Side C” insurance policies. They are designed to protect companies as entities against their own misconduct. This kind of cover is particularly used in the protection of listed companies against lawsuits that may be lodged against them on the financial markets and which are linked to their listing. This protection is even larger for non-listed companies or non-profit organizations.

D&O insurance: The scope of the cover

The contract is designed to cover the directors' liability against damages caused to third parties due to misconduct committed while performing their duties.

Intentional misconducts are not taken into account. Only two kinds of expenses are covered:

Intentional misconducts are not taken into account. Only two kinds of expenses are covered:

- defense fees: investigation, expertise, legal expenses, …

- indemnification fees: interests and principal amounts due by the insured to the plaintiffs.

D&O insurance: The characteristics of the contract

In general, the insurance contract provides a limit per claim and a limit per year with a low or rather inexistent deductible. Nevertheless, deductibles have been often raised following the financial crisis.

The coverage period is generally of one year. The guarantee is used when during this period, a claim is brought to the attention of the insured. The claim itself may have occurred before the notification is made.

The territorial limit is most often local as is the law of the contract. As far as multinationals are concerned, the cover may be extended to the countries where the company is operating. It is also common for guarantees including risks located in Canada, in the United States and in the rest of the world, to be granted by means of two distinct policies: one containing terms and conditions for Canada and the United States, and the other for those terms applied in the rest of the world.

The territorial limit is most often local as is the law of the contract. As far as multinationals are concerned, the cover may be extended to the countries where the company is operating. It is also common for guarantees including risks located in Canada, in the United States and in the rest of the world, to be granted by means of two distinct policies: one containing terms and conditions for Canada and the United States, and the other for those terms applied in the rest of the world.

The contract pricing depends upon:

- the limits of the guarantee

- the deductible

- the company's activity

- the size of the insured company

- the financial characteristics of the company especially of its balance sheet

- the economic environment

- the persons covered

D&O insurance: The guarantees' exclusions

Most exclusions pertain to classical third party liability policies. Nonetheless, some exclusions are specific to directors and officers liability, especially:

- property damage or bodily injury induced by the company's activity

- intentional misconducts

- fraud

- lawsuits lodged against lack of or total default of insurance

- lawsuits lodged by insurers among themselves

- lawsuits pertaining to assets' embezzlement, illegal or wrongful personal profit or remuneration, misuse of company property

- fines, penalties or taxes payable by directors and resulting from conventional or penal sentences

- legal recourse of shareholders detaining a significant share, of relatives of the concerned director (spouse, ascendants, descendants)

- ERISA (Employee Retirement Income Security Act of 1974 — typical exclusion of the American market). This exclusion impedes any recourse having a link with the American retirement and pension system.

By underwriting a policy offering guarantees that go beyond the standard cover, it is now possible to include in it the exclusions mentioned above.

The directors and officers liability insurance

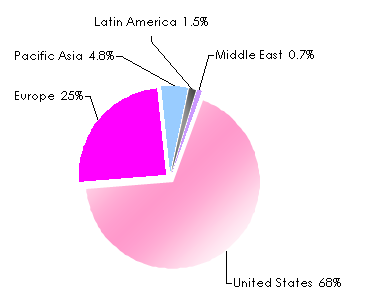

The overall premiums volume of the directors and officers liability insurance is estimated at 10.3 billion USD, split as follows:

Most business underwritten in the Middle East comes from Israel.

The most important European market is Germany which accounts for about 15% of the premiums collected on the continent.

D&O insurance: The market's major players

Some insurers have a worldwide activity that is the case of: AIG, Ace, Liberty, Chubb, XL.

Other players have a limited territorial activity often restricted to local markets: Mapfre (Spain), Nissay Dowa (Japan), Gerling GKA (Germany), VoV (Germany), Banco Vitalicio (Spain).

Loss experience

For the period 2007 to 2009, D&O losses would amount to 5.9 billion dollars. This estimate has been revised upwards on various occasions and is poised to go up even more. Losses relative solely to "Side A" policies may attain 1.5 billion dollars while the volume of premiums generated by this cover can only attain 500 million dollars.

Among the most striking claim in recent years is the Madoff case whose current losses are estimated at 1.8 billion dollars (total exposure being approximately at 50 billion dollars).

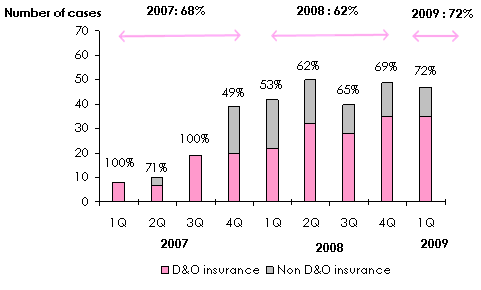

Percentage of lawsuits against directors and officers in the United States.

This percentage is calculated according to the total of lawsuits resulting from the financial crisis.

Source: National Economic Research Associates, Inc

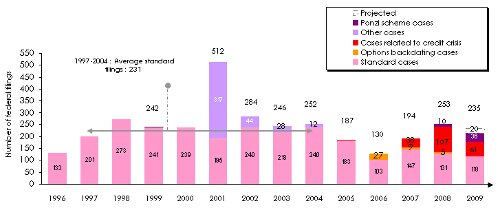

Source: National Economic Research Associates, Inc Number of appeals in the United States per type of case:

January 1, 1996 — November 30, 2009 (Click to enlarge)

(Click to enlarge)The effect of recession on the D&O insurance market

The financial crisis has resulted in heavy losses to shareholders and led to numerous bankruptcies. Recourse against directors and officers remains nonetheless well below the expectations. The supervisory authorities of the main countries have stepped in to introduce more regulations, thus meeting part of the shareholders' expectations.

Following the stiffening of the underwriting terms at the beginning of the subprime crisis, the market has become softer. The capacities currently offered are more substantial, and insurers are expecting a significant increase in the premium volumes. The potential of D&O market remains high, especially in Europe where the penetration rate of this kind of contract remains poor.