Emirates Insurance Company

With a turnover of 171 000 000 USD in 2010, the company ranks eighth in a market which counts thirty insurers.

With a turnover of 171 000 000 USD in 2010, the company ranks eighth in a market which counts thirty insurers.

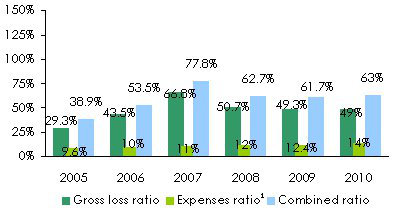

Unrestrained competition which reigns in the United Arab Emirates and in the entire region has not kept Emirates from achieving outstanding results. For the 2005-2010 period, the average underwriting results amounted to 11% of the written premiums while the net income reached 27% of the same written premiums. The average loss ratio (2005-2010) is below 50% and the combined ratio sky-rocketed at 77.8% in 2007 to later settle around 62%.

The icing on the cake, Emirates benefits from handsome reinsurance commissions. The only inconvenience is the return on investments which remains rather low. In fact the company is undergoing the fallout of the financial crisis that has strained the region since 2008.

Despite uncertainties regarding local stock markets and return on investments, long-term perspectives remain quite robust. Emirates is dotted with substantial funds which, in a very fragmented market, is likely to help it consolidate its position when the bell of mergers tolls.

|  |

| Abdullah Muhammed Al Mazrui | Jason Light |

| Chairman of the board | CEO |

Emirates Insurance en 2010

| Share capital | 36 748 350 USD |

| Turnover | 171 438 000 USD |

| Shareholder’s equity | 214 707 800 USD |

| Total assets | 426 144 950 USD |

| Net result | 29 416 000 USD |

| Loss ratio | 49% |

| Loading rate | 14% |

| Combined ratio | 63% |

| Number of branches | 5 |

| Number of employees | 160 |

Management

| Chairman of the board | Abdullah Muhammed Al Mazrui |

| Chief Executive Officer | Jason Light |

| Deputy Chief Executive Officer | Thomas Varghese |

| Chief Operating Officer | Mutaz Dabbagh |

| Chief Financial Officer | Aart Lehmkuhl |

| Chief Marketing Officer | Suresh George |

| Underwriting manager | Andrew Woodward |

| Head of information technology | Shah Ata Ahmed |

Main shareholders

| Abu Dhabi Cooperative Society | 15.35% |

| Al Mazrui Holdings | 14.82% |

| Abu Dhabi Investment Council | 11.81% |

| Other shareholders | 58.02% |

Main technical highlights: 2005-2010

in thousands USD| 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|---|

Gross written premiums | 85 739 | 93 361 | 133 091 | 180 415 | 175 066 | 171 438 |

Gross earned premiums | 83 016 | 84 674 | 122 648 | 158 180 | 175 884 | 171 034 |

Earned premiums* | 22 424 | 23 357 | 31 666 | 51 816 | 58 293 | 60 389 |

Reinsurance premiums ceded | 60 592 | 61 316 | 90 982 | 106 364 | 117 591 | 110 645 |

Gross incurred losses | 24 297 | 36 791 | 81 884 | 80 229 | 86 723 | 83 740 |

Loss ratio | 29.3% | 43.5% | 66.8% | 50.7% | 49.3% | 49% |

Management expenses1 | 8 269 | 9 365 | 14 528 | 21 535 | 21 723 | 23 778 |

Technical result | 9 669 | 6 467 | 12 572 | 13 759 | 14 978 | 16 365 |

Net investment income | 78 258 | 16 796 | 25 620 | 19 625 | 4 196 | 15 748 |

Net result | 86 876 | 22 618 | 36 948 | 30 849 | 17 275 | 29 416 |

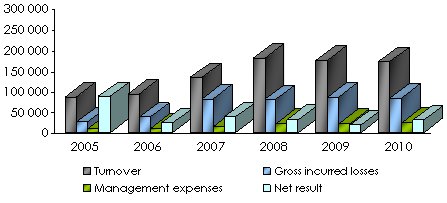

Evolution of premiums, losses, management expenses and results

in thousands USD

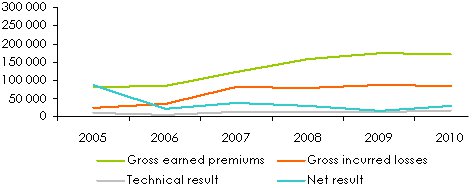

Turnover’s evolution per class of business: 2005-2010

in thousands USD| 2005 | 2006 | 2007 | 2008 | 20091 | 20101 | 2010 shares | 2009/10 growth | |

|---|---|---|---|---|---|---|---|---|

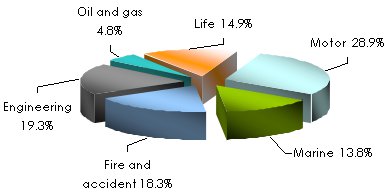

| Non life | ||||||||

Motor | - | 22 602 | 33 773 | 48 438 | 49 365 | 53 958 | 28.9% | 9.3% |

Marine | 9 757 | 11 313 | 14 969 | 22 314 | 24 025 | 25 795 | 13.8% | 7.4% |

Fire and accident | 75 982 | 53 077 | 43 547 | 47 077 | 37 186 | 34 128 | 18.3% | -8.2% |

Engineering | - | - | 26 673 | 32 654 | 34 847 | 36 159 | 19.3% | 3.8% |

Oil and gas | - | - | - | - | 8 865 | 8 980 | 4.8% | 1.3% |

Total non life | 85 739 | 86 992 | 118 962 | 150 483 | 154 288 | 159 019 | 85.1% | 3.1% |

| Life | ||||||||

Total life | - | 6 260 | 14 153 | 29 917 | 37 036 | 27 885 | 14.9% | -24.7% |

Grand total | 85 739 | 93 252 | 133 115 | 180 400 | 191 324 | 186 904 | 100% | -2.3% |

Breakdown per class of business in 2010

Ratios’ evolution: 2005-2010

1Management expenses on gross written premiums

1Management expenses on gross written premiums Exchange rate AED/USD as at 31/12 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 |

0.27233 | 0.27219 | 0.27217 | 0.27212 | 0.2722 | 0.27221 |

Contact

| Head office | Tourist Club Area - PO Box. 3856 Abu Dhabi - United Arab Emirates |

| Phone | (+971) 2 6440 400 |

| Fax | (+971) 2 6445 227 |

info [at] eminsco [dot] com | |

| Website |