French insurance market from 2010 to 2020

In addition to its omnipresence in the social fabric, French insurance has always been there, playing the role of an economic and financial stabilizer.

In addition to its omnipresence in the social fabric, French insurance has always been there, playing the role of an economic and financial stabilizer.

Endowed with a sound model and with the ability to absorb large-scale shocks such as natural disasters, financial crises and epidemics, this activity has become an indispensable asset to cushion against everyday hazards.

Finally, as a pillar of the economy, the insurance sector is an important source of market financing.

Read also | French insurance market structure

French insurance market: key indicators 2010-2020

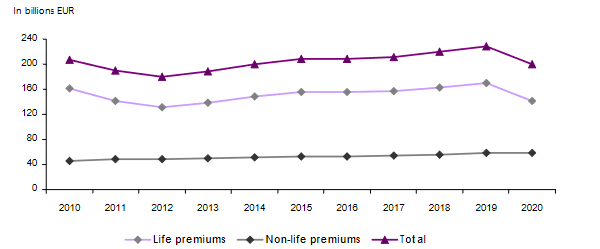

As a result of the pandemic, the total life and non-life turnover of 200.7 billion EUR (246.5 billion USD) in 2020 has clearly gone down compared to 2019 (-12%). The health crisis has set the French market back more than 10 years of premium growth, bringing it down to a level lower than that of 2010 when it accounted for 206.6 billion EUR (273.8 billion USD).

Like other mature markets, French insurance is overwhelmingly based on the life business. With 141.5 billion EUR (173.8 billion USD) of premiums in 2020, the latter accounts for nearly two thirds of the premium income, that is, 70.5% of the market share, compared to only 59.2 billion EUR for the non-life class of business.

In 2020, France followed the global trend, marked by a decline in the volume of life premiums against a growth in the collection of non-life premiums. This relative decline in life insurance is confirmed over the 2010-2020 period, when the market share of life insurance had fallen from 78% to 70.5%, while non-life insurance went from 22% to 29.5%.

The density and the penetration rate have also pursued this downward trend.

It is equally worth noting that due to consolidation operations, the number of companies established on the market has also been declining from 1129 to 696 operators.

French insurance market: evolution 2010-2020 of the main indicators in billion EUR

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Life premiums | 161.1 | 141.6 | 132 | 138.3 | 149.1 | 156.3 | 155.4 | 157.1 | 163.4 | 169.4 | 141.5 |

Non-life premiums | 45.5 | 48.4 | 48.7 | 50.2 | 51.2 | 52.4 | 53.3 | 54.6 | 56.2 | 58.6 | 59.2 |

Total premiums | 206.6 | 190 | 180.7 | 188.5 | 200.3 | 208.7 | 208.7 | 211.7 | 219.6 | 228 | 200.7 |

Total worldwide premiums | 3607.3 | 3943.5 | 3918.8 | 3776.5 | 4476.0 | 4887.7 | 5209.6 | 4832.7 | 5371.5 | 5618.4 | NA |

International market share | 5.70% | 4.80% | 4.60% | 5% | 4.50% | 4.30% | 4% | 4.40% | 4.10% | 4.10% | NA |

Density (in EUR) | 3 177 | 2 908 | 2 752 | 2 856 | 3 021 | 3 136 | 3 128 | 3 166 | 3 280 | 3 400 | 2 985 |

Penetration rate | 10% | 9% | 8.50% | 8.90% | 9.30% | 9.60% | 9.50% | 9.40% | 9.60% | 9.80% | 8.70% |

Number of companies | 1129 | 1074 | 1018 | 974 | 909 | 826 | 774 | 741 | 713 | 696 | NA |

NA: Not available

Sources : The French Insurance Federation (FFA) and the Prudential Supervision and Resolution Authority (ACPR)

Evolution 2010-2020 of life, non-life and total premiums

French insurance market: evolution 2010-2020 of the main indicators in billion USD

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Life premiums | 213.5 | 183.3 | 174.4 | 190.4 | 181.2 | 170.8 | 163.7 | 188.2 | 186.9 | 189.7 | 173.8 |

Non-life premiums | 60.3 | 62.7 | 64.4 | 69.1 | 62.2 | 57.2 | 56.2 | 65.4 | 64.3 | 65.6 | 72.7 |

Total premiums | 273.8 | 246 | 238.8 | 259.5 | 243.4 | 228 | 219.9 | 253.6 | 251.2 | 255.3 | 246.5 |

Total worldwide premiums | 4780.7 | 5106.9 | 5179.9 | 5199.4 | 5441.1 | 5340.8 | 5489.5 | 5789.8 | 6149 | 6292.6 | NA |

International market share | 5.70% | 4.80% | 4.60% | 5% | 4.50% | 4.30% | 4% | 4.40% | 4.10% | 4.10% | NA |

European market share | 16.95% | 15.11% | 15.51% | 16.02% | 14.36% | 15.29% | 15.18% | 17.15% | 15.67% | 15.92% | NA |

NA : Not available

French insurance market: evolution of life and non-life premiums (2010-2020)

In 2020, premiums, all classes of business included, had amounted to 200.7 billion EUR (246.5 billion USD), that is, a decrease of 11.9% compared to 2019. Over the period 2010-2020, the decline was reported at 2.8%.

Life premium income reached 141.5 billion EUR (173.8 billion USD) in 2020, going down by 16.4% in one year and by 12.1% over ten years. The market share of this segment had gone from nearly 78% in 2010 to 70.5% in 2020.

With 59.2 billion EUR (72.7 billion USD) of premiums, the non-life activity continues to progress, increasing by 30% over the last ten years. Its market share has, consequently, risen from 22% in 2010 to 29.5% in 2020.

In billions EUR

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Life premiums | 161.1 | 141.6 | 132 | 138.3 | 149.1 | 156.3 | 155.4 | 157.1 | 163.4 | 169.4 | 141.5 |

% Life premiums | 78.00% | 74.50% | 73.00% | 73.40% | 74.40% | 74.90% | 74.50% | 74.20% | 74.40% | 74.30% | 70.50% |

Non-life premiums | 45.5 | 48.4 | 48.7 | 50.2 | 51.2 | 52.4 | 53.3 | 54.6 | 56.2 | 58.6 | 59.2 |

% Non-life premiums | 22.00% | 25.50% | 27.00% | 26.60% | 25.60% | 25.10% | 25.50% | 25.80% | 25.60% | 25.70% | 29.50% |

Total premiums | 206.6 | 190 | 180.7 | 188.5 | 200.3 | 208.7 | 208.7 | 211.7 | 219.6 | 228 | 200.7 |

In billions USD

| 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

Life premiums | 213.5 | 183.3 | 174.4 | 190.4 | 181.2 | 170.8 | 163.7 | 188.2 | 186.9 | 189.7 | 173.8 |

% Life premiums | 78.00% | 74.50% | 73.00% | 73.40% | 74.40% | 74.90% | 74.50% | 74.20% | 74.40% | 74.30% | 70.50% |

Non-life premiums | 60.3 | 62.7 | 64.4 | 69.1 | 62.2 | 57.2 | 56.2 | 65.4 | 64.3 | 65.6 | 72.7 |

% Non-life premiums | 22.00% | 25.50% | 27.00% | 26.60% | 25.60% | 25.10% | 25.50% | 25.80% | 25.60% | 25.70% | 29.50% |

Total premiums | 273.8 | 246 | 238.8 | 259.5 | 243.4 | 228 | 219.9 | 253.6 | 251.2 | 255.3 | 246.5 |

French insurance market: density and penetration rate

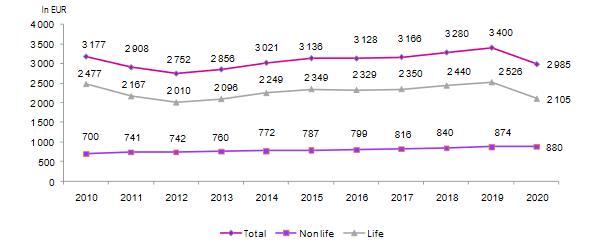

Insurance density

The table below shows the evolution of per-capita insurance consumption during the period 2010-2020.

From an average expenditure of 3 177 EUR (4 210 USD) per French person in 2010, this amount dropped to 2 985 EUR (3 667 USD) ten years later, a slowdown in life collection being at the origin of this downward trend.

The life insurance density went from 2 477 EUR (3 283 USD) in 2010 to 2 105 EUR (2 586 USD) in 2020 while in non-life it went up by 25.7%, standing at 880 EUR (1 081 USD) in 2020, compared to 700 EUR (927 USD) ten years earlier.

The insurance density in France is higher than the world average which amounted to 818 USD in 2019. However, this indicator remains below the amounts found in countries such as the United States (7495 USD), Hong Kong (9 706 USD), Switzerland (6 835 USD), Denmark (6 384 USD) and Ireland (5 920 USD).

Evolution of the insurance density in France: 2010-2020

| Total | Non-life | Life | ||||

|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | |

| 2020 | 2 985 | 3 667 | 880 | 1 081 | 2 105 | 2 586 |

| 2019 | 3 400 | 3 808 | 874 | 978 | 2 526 | 2 830 |

| 2018 | 3 280 | 3 751 | 840 | 960 | 2 440 | 2 791 |

| 2017 | 3 166 | 3 793 | 816 | 978 | 2 350 | 2 815 |

| 2016 | 3 128 | 3 296 | 799 | 842 | 2 329 | 2 454 |

| 2015 | 3 136 | 3 426 | 787 | 860 | 2 349 | 2 566 |

| 2014 | 3 021 | 3 671 | 772 | 938 | 2 249 | 2 733 |

| 2013 | 2 856 | 3 932 | 760 | 1 047 | 2 096 | 2 885 |

| 2012 | 2 752 | 3 637 | 742 | 981 | 2 010 | 2 656 |

| 2011 | 2 908 | 3 765 | 741 | 960 | 2 167 | 2 805 |

| 2010 | 3 177 | 4 210 | 700 | 927 | 2 477 | 3 283 |

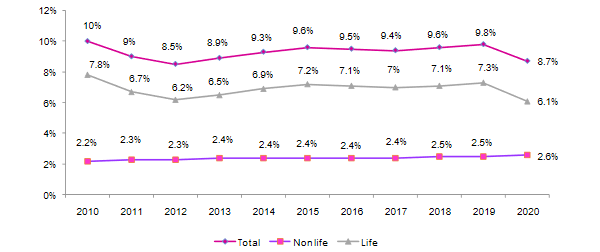

Penetration rate

The penetration rate, measuring the contribution of the insurance sector to the national economy, has followed the same trend as the insurance density.

Over a period of ten years, the entire market, life and non-life combined, reported a decline in the penetration rate. From 10% in 2010, this rate fell to 8.7% ten years later. Life insurance decreased by 1.7 points in ten years, while the non-life class of business' penetration rate improved slightly, from 2.2% in 2010 to 2.6% in 2020.

At the global level and according to 2019 data, the insurance penetration rate in France was higher than the global average of 7.23%.

Evolution of the insurance penetration rate in France: 2010-2020

| Total | Non-life | Life | ||||

|---|---|---|---|---|---|---|

| EUR | USD | EUR | USD | EUR | USD | |

| 2020 | 8.70% | 9.80% | 2.60% | 2.90% | 6.10% | 6.90% |

| 2019 | 9.80% | 9.40% | 2.50% | 2.40% | 7.30% | 7.00% |

| 2018 | 9.60% | 9.00% | 2.50% | 2.30% | 7.10% | 6.70% |

| 2017 | 9.40% | 9.80% | 2.40% | 2.50% | 7.00% | 7.30% |

| 2016 | 9.50% | 8.90% | 2.40% | 2.30% | 7.10% | 6.60% |

| 2015 | 9.60% | 9.40% | 2.40% | 2.30% | 7.20% | 7.00% |

| 2014 | 9.30% | 8.50% | 2.40% | 2.20% | 6.90% | 6.40% |

| 2013 | 8.90% | 9.20% | 2.40% | 2.50% | 6.50% | 6.80% |

| 2012 | 8.50% | 8.90% | 2.30% | 2.40% | 6.20% | 6.50% |

| 2011 | 9.00% | 8.60% | 2.30% | 2.20% | 6.70% | 6.40% |

| 2010 | 10.00% | 10.40% | 2.20% | 2.30% | 7.80% | 8.10% |

French insurance market in figures

The French insurance market accounts for:

- 200.7 billion EUR (246.5 billion USD) in premiums in 2020

- 695 licensed insurance organizations (2019 figures)

- 53 200 institutions operating in insurance (1)

- 255 000 staff members as of 12/31/2019 (2)

- 38 million life insurance policies (3)

- 2.5 million insured businesses (3)

- 55 million insured vehicles (cars, motorcycles, ...) (3)

- 355 000 insured farms (3)

- 43 million insured homes (3)

(1) Source: REE-Insee. Establishments by 12/31/2018

(2) Source: Sequoia-Acoss. Employees of insurance companies, intermediaries and insurance experts by 12/31/2019.

(3) Source: FFA 2020

Exchange rate as at 31/12/2020 : 1 EUR = 1.22824 USD ; 31/12/2019 : 1 EUR = 1.11986 USD : 31/12/2018 : 1 EUR = 1.14379 USD ; 31/12/2017 : 1 EUR = 1.19786 USD : 31/12/2016 : 1 EUR = 1.05356 USD ; 31/12/2015 : 1 EUR = 1.09254 USD : 31/12/2014 : 1 EUR = 1.21548 USD ; 31/12/2013 : 1 EUR = 1.3766 USD : 31/12/2012 : 1 EUR = 1.32148 USD : 31/12/2011 : 1 EUR = 1.29485 USD ; 31/12/2010 : 1 EUR = 1.32515 USD

Read also | History of French insurance