Increase in the number of natural disasters claims

In its latest annual review on natural catastrophes, Swiss Re states that climate change is a systemic risk for the entire world. Unlike the Covid-19 crisis, it has no expiry date.

In its latest annual review on natural catastrophes, Swiss Re states that climate change is a systemic risk for the entire world. Unlike the Covid-19 crisis, it has no expiry date.

2020 toll

The year 2020 ended with a natural catastrophe bill of 89 billion USD, up by 41% compared to 2019. Moreover, 71% of the events that occurred were secondary perils. In the future, an accumulation of NAT CAT and secondary perils claims could raise the bill to 300 billion USD, the Swiss reinsurer warns.

2021 toll

The year 2021 does not suggest a better outcome than 2020. The first half of the current year, which did not witness any major event, has already reported 40 billion USD of insured losses due to natural disasters. This toll is up by 14% compared to the first half of 2020 and by 21% in comparison with the ten-year 2011-2020 average.

In the second half of the year, several catastrophic events have compounded the amount of the first semester's losses. From the beginning of the summer, severe storms, torrential rains, floods, fires and heat waves occurred in several regions of the world, particularly around the Mediterranean basin, in the United States, Canada and Russia.

In Northern Europe, mainly in Germany and Belgium, the July floods have caused insured losses estimated at 16 billion USD. In addition to this amount, 30 billion USD of insured losses were generated at the end of August-beginning of September by hurricane Ida in the United States.

With the increase of the loss experience described above, a rate increase in 2022 seems inevitable, at least for the affected areas.

In Europe, the loss experience in the second half of 2021 should lead to a catch-up in reinsurance premiums. Consequently, after six years of rate stability, the European continent is poised to sustain a significant rate increase in 2022.

Read also | List of natural disasters in 2021

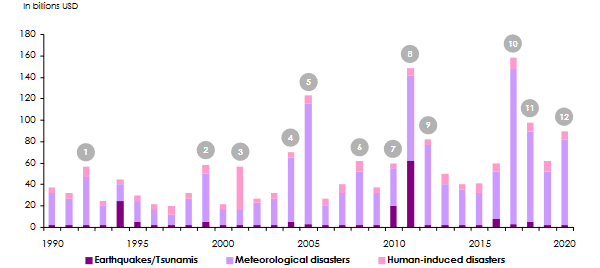

The largest natural disasters in terms of insured losses: 1990-2020

- 1992: Hurricane Andrew (United States)

- 1999: Winter storm Lothar (Western Europe)

- 2001: 11/9 attacks (United States)

- 2004: Hurricanes Ivan, Charley and Frances (United States and the Caribbean)

- 2005: Hurricanes Katrina, Rita and Wilma (United States, Mexico and the Caribbean)

- 2008: Hurricanes Ike and Gustav (United States, Canada, Haiti, Cuba, ...)

- 2010: Earthquakes (Chile and New Zealand)

- 2011: Earthquakes (Japan and New Zealand) and floods (Thailand)

- 2012: Hurricane Sandy (United States, Jamaica, Cuba, Haiti, Bahamas, …)

- 2017: Hurricane Harvey, Irma and Maria (United States, the Caribbean, Cuba)

- 2018: Forest fires (United States) and Typhoon Jebi (Japan)

- 2020: Hurricane Laura (United States) and forest fires (United States)

Source: Swiss Re