Insurance and augmented reality

Actually, users are provided with spectacles on glasses from which additional information related to the immediate environment is relayed. The telephone or tablet may replace the spectacles.

Actually, users are provided with spectacles on glasses from which additional information related to the immediate environment is relayed. The telephone or tablet may replace the spectacles.

In this configuration, the device screen is used as a container where the flow of the camera capturing the immediate environment mingles with augmented reality.

This format, not requiring any specific equipment, enables users to interact with the screen interface the way players interact with a videogame interface.

Read also | Gamification in insurance

The concept of virtual agency fits in particularly well with this format. Indian insurer PNB Metlife has used this principle in its conVRse project. Virtual agency conVRse, available to holders of virtual reality headsets, throws users in a 3D virtual environment reenacting a real agency whereby customers get to visualize contracts, submit their requests and interact with experts.

The concept of virtual agency fits in particularly well with this format. Indian insurer PNB Metlife has used this principle in its conVRse project. Virtual agency conVRse, available to holders of virtual reality headsets, throws users in a 3D virtual environment reenacting a real agency whereby customers get to visualize contracts, submit their requests and interact with experts.

Augmented reality is there to improve the vision of daily environment, and consequently the risks associated with it, a finding that did not go unnoticed by insurers. SightCall communication interface, already used by Allianz and AXA, is a good illustration of its use. This mobile application enables the insurer to communicate effectively with his or her claim handler in case of a failure.

In the event of an incident, the insured may use SightCall to carry out a capture of the risk incurred. That is when the claim handler comes into play within this capture by directly making annotations on the screen.

SightCall, in fine, enables two interlocutors to carry out instantly in situ diagnoses and to come up with joint solutions.

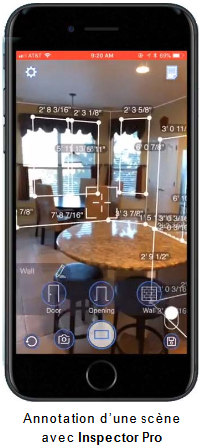

Augmented reality is particularly fit to simplify indemnification applications. Mobile application InspectorPro developed by OnSource company, provides an interesting vision of the job of a claim handler.

Augmented reality is particularly fit to simplify indemnification applications. Mobile application InspectorPro developed by OnSource company, provides an interesting vision of the job of a claim handler.

Under the framework of OnSource, claim handlers are field staff dispatched to customers by the information system in keeping with the pace of indemnification applications. Claim handlers use their mobile phone to capture the measures of the affected item, annotate the scene and forward it to the central system.

Recent technological breakthroughs have reignited the founding concepts of the 2010s. Among the absolute highest pioneers, Allianz’ Haunted House stands out among these emblematic projects. The concept, simple enough to touch wide audience, invites visitors to walk through and observe a house rebuilt into a city, with a tablet in hand. A domestic risk plays out on screen by going over locations spotted along the way.

XL Catlin’s Hololens project stands a continuum of that first initiative related to risk prevention. In this futuristic iteration, augmented reality is no longer designed for the public but for claim managers who are dispatched to handle the clients' high value physical assets.

Another equally notable difference is that augmented reality is directly projected on Hololens spectacles that substitute tablets. This configuration, worthy of a science fiction movie, enables handlers to annotate sensitive risks by means of signs and virtual interactions in space. The threat inherent to each risk is therefore calculated according to the layout of the scene and the consequences of disasters are modeled in the form of films which can be viewed by clients.

Apart from its use on the field, the technology is also useful in the training of claim handlers. In this regard, Allianz is exploring virtual reality (3) in order to set up 3D environments at real scale where staff can be trained.

A headset and video game controllers would plunge learners into a scene while providing them with the means to move and interact. Typical environments (factories,…) with installation risks are submitted to the candidates in order to test their ability to detect threats.

These use cases open up great prospects for augmented and virtual reality. Both technologies are expected to develop in fields as varied as risk management, training, marketing or information.