Jordan Insurance Company (JIC)

As of 1958, that is, seven years after its creation, the company has expanded its activities in Kuwait and the United Arab Emirates.

As of 1958, that is, seven years after its creation, the company has expanded its activities in Kuwait and the United Arab Emirates.

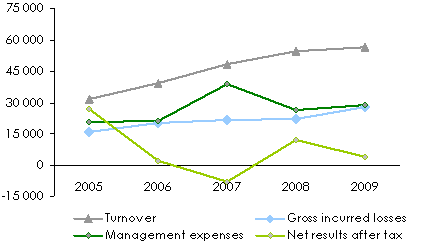

Today, in a very tight market where twenty-eight companies are operating, JIC has managed to double its turnover over the past five years and to triple its share capital in a decade. With nearly 57 000 000 USD of premiums in 2009, JIC stands, along with Arab Orient and Middle East Insurance, as one of the market 's leading insurers.

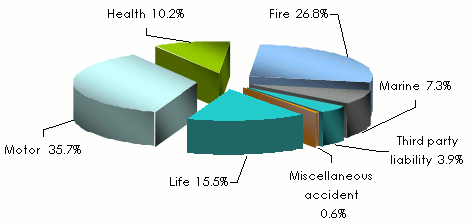

The company which underwrites life and non life business has managed to build a stable portfolio dominated by motor, fire and life insurance.

|

| Imad Abdel Khaleq |

| General manager |

Despite a very difficult 2007 and a slowing growth in 2009, JIC has succeeded in maintaining the confidence of its traditional reinsurers which are Munich Re, SCOR, CCR, Allianz and Mapfre.

The company 's performance and reputation have even prompted Munich Re to establish a strategic partnership with JIC by acquiring 10% of its capital.

Jordan Insurance Company in 2009

| Paid up capital | 42 611 100 USD |

| Turnover | 56 598 951 USD |

| Shareholder's equity | 68 377 741 USD |

| Total assets | 101 601 746 USD |

| Technical result | 6 593 122 USD |

| Net result after tax | 4 270 114 USD |

| Loss ratio | 59.2% |

| Combined ratio | 110.32% |

| Number of branches | 4 (Dubai, Sharjah, Abu Dhabi and Kuwait) |

| Number of employees | 221 |

Management

| General manager | Imad Abdel Khaleq |

| Deputy general manager | Mustapha Darhbour |

| Deputy general manager, technical operations | Jawad Janeb |

| Deputy general manager, life and medical department | Mazen Nimri |

| Deputy general manager, marketing and production | Omar Abuhassan |

| Deputy general manager, marine department | Najeeb Anani |

| Financial department manager | Eyad Belbeasi |

Main shareholders

| Othman M. Bdeir | 19.03% |

| Munich Re | 10.00% |

| Al Maseera Investment Co. | 6.65% |

| Mithkal Shawkat & Sami Asfour Co. | 6.29% |

| Other shareholders | 58.03% |

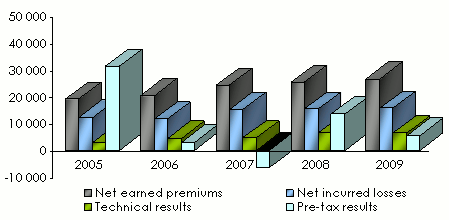

Main technical highlights: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|---|

Gross written premiums | 31 762 490 | 39 072 227 | 48 202 740 | 54 671 104 | 56 598 951 |

Written premiums* | 19 444 899 | 21 500 600 | 26 157 856 | 25 525 845 | 26 700 406 |

Net earned premiums | 19 049 962 | 20 413 726 | 24 198 381 | 25 305 787 | 26 684 390 |

Gross incurred losses | 15 934 831 | 20 075 768 | 21 901 929 | 22 136 762 | 27 906 208 |

Net incurred losses* | 12 168 974 | 11 696 927 | 15 257 396 | 15 268 189 | 15 798 278 |

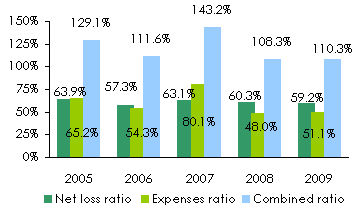

Net loss ratio | 63.9% | 57.3% | 63.1% | 60.3% | 59.2% |

Management expenses | 20 714 102 | 21 216 519 | 38 634 227 | 26 262 334 | 28 931 224 |

Technical results | 3 049 801 | 4 433 303 | 4 722 699 | 6 522 839 | 6 593 122 |

Pre-tax results | 31 225 424 | 2 901 249 | - 6 473 901 | 13 592 078 | 5 567 304 |

Net results after tax | 27 038 579 | 2 085 338 | - 7 688 387 | 12 065 245 | 4 270 114 |

Evolution of premiums, losses and results

in thousands USD in thousands USD

in thousands USD

Turnover 's evolution per class of business: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 shares | 08/09 growth | ||

|---|---|---|---|---|---|---|---|---|

| Non life | ||||||||

Motor | 15 319 100 | 17 255 137 | 21 054 886 | 19 353 596 | 20 197 394 | 35.7% | 4.4% | |

Health | 2 632 460 | 2 870 060 | 3 644 479 | 4 647 666 | 5 786 184 | 10.2% | 24.5% | |

Fire | 7 181 357 | 10 419 384 | 11 536 142 | 15 454 494 | 15 192 493 | 26.8% | -1.7% | |

Marine | 2 796 155 | 3 822 262 | 4 497 100 | 5 285 626 | 4 143 340 | 7.3% | -21.6% | |

TPL | 685 164 | 1 188 300 | 2 246 413 | 2 249 940 | 2 211 160 | 3.9% | -1.7% | |

Misc. acc. | 578 335 | 338 890 | 354 987 | 346 194 | 335 219 | 0.6% | -3.2% | |

Total non life | 29 192 571 | 35 894 033 | 43 334 007 | 47 337 516 | 47 865 790 | 84.5% | 1.1% | |

| Life | ||||||||

Life | 2 569 919 | 3 178 194 | 4 868 733 | 7 333 588 | 8 733 161 | 15.5% | 19.1% | |

Grand total | 31 762 490 | 39 072 227 | 48 202 740 | 54 671 104 | 56 598 951 | 100% | 3.5% | |

Breakdown per class of business 2009

Ratios' evolution: 2005-2009

Exchange rate JOD/USD as at 31/12 | 2005 | 2006 | 2007 | 2008 | 2009 |

1.42146 | 1.42045 | 1.42389 | 1.42615 | 1.42037 |

Contact

| Head office | 3rd circle - Amman P.O. Box 279 Amman 11118, Jordan |

| Phone | (+962) 6 4634161 |

| Fax | (+962) 6 4637905 |

allinsure [at] jicjo [dot] com | |

| Website |