Kuwait Insurance Company

|  |

Kuwait Insurance Company in 2021

|

| Share capital | 63 985 466 USD |

| Turnover | 154 663 546 USD |

| Assets | 653 517 316 USD |

| Shareholder’s equity | 388 206 204 USD |

| Net result | 37 694 750 USD |

| Net non-life loss ratio | 28.65% |

| Net non-life management expenses ratio | 58.7% |

| Net non-life combined ratio | 87.35% |

Management

| Ali Morad Behbehani | Chairman of the Board of Directors |

| Sami Sharif | Chief Executive Officer |

| Ossama Reda El Bizri | Chief Financial Officer |

| Meshari AlNusf | Director, Investment |

| Yasser Kayessi | Director, Reinsurance |

| Alsayed Ashour | Director, Legal |

| Ibrahim Sharawi | Senior Manager, Business Development |

Shareholding

| Shareholders | Parts |

| Mohammad Saleh and Reza Yousuf Behbehani | 9.91% |

| Heirs of Mohammed Saleh Yousef Behbehani | 5.18% |

| The Kuwaiti Social Security Fund | 5.15% |

| Bibi Hussain Abdul Karim Marafie | 5.05% |

| Others | 74.71% |

Kuwait Insurance Company: main technical highlights

In thousands USD| Highlights | 2017 | 2018 | 2019 | 2020 | 2021 |

|---|---|---|---|---|---|

| Gross written premiums | 124 878 | 119 306 | 123 546 | 124 671 | 154 664 |

| Gross non-life written premiums | 102 602 | 95 196 | 96 984 | 97 307 | 121 043 |

| Gross life written premiums | 22 276 | 24 110 | 26 562 | 27 364 | 33 621 |

| Net written premiums | 63 883 | 56 117 | 54 735 | 53 165 | 65 275 |

| Net non-life written premiums | 47 446 | 39 622 | 37 818 | 37 335 | 43 831 |

| Net earned premiums | 64 361 | 59 095 | 55 556 | 53 249 | 62 710 |

| Net non-life earned premiums | 47 923 | 42 600 | 38 639 | 37 420 | 41 266 |

| Net non-life incurred losses | 25 506 | 19 977 | 21 024 | 14 555 | 11 822 |

| Non-life management expenses | 19 733 | 18 836 | 17 754 | 20 295 | 25 727 |

| Net non-life loss ratio (1) | 53.22% | 46.90% | 54.41% | 38.90% | 28.65% |

| Net non-life management expenses ratio (2) | 41.59% | 47.54% | 46.95% | 54.36% | 58.70% |

| Net non-life combined ratio (3) | 94.81% | 94.44% | 101.36% | 93.26% | 87.35% |

| Net result | 26 751 | 29 419 | 31 382 | 34 477 | 37 695 |

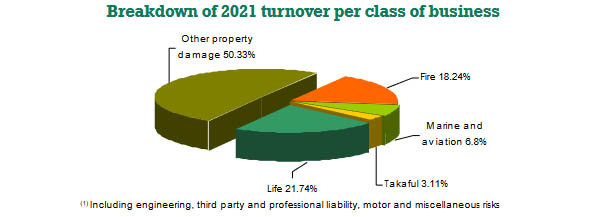

Kuwait Insurance Company: turnover breakdown per class of business

In thousands USD| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Other property damage (1) | 70 757 | 65 934 | 61 141 | 62 202 | 77 838 |

| Fire | 22 769 | 20 174 | 23 881 | 23 508 | 28 215 |

| Marine and aviation | 8 333 | 8 161 | 10 691 | 10 223 | 10 171 |

| Takaful | 742 | 928 | 1 270 | 1 374 | 4 819 |

| Total non-life | 102 602 | 95 196 | 96 984 | 97 309 | 121 043 |

| Life | 22 276 | 24 110 | 26 562 | 27 364 | 33 621 |

| Grand total | 124 878 | 119 306 | 123 546 | 124 671 | 154 664 |

Kuwait Insurance Company: net written premiums per class of business

In thousands USD| 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 evolution (1) | |

|---|---|---|---|---|---|---|

| Other property damage (2) | 43 254 | 36 181 | 33 152 | 34 260 | 37 190 | 7.79% |

| Fire | 2 212 | 1 629 | 2 332 | 874 | 2 964 | 236.63% |

| Marine and aviation | 1 410 | 1 267 | 1 581 | 1 351 | 882 | -35.15% |

| Takaful | 570 | 545 | 753 | 850 | 2 795 | 226.59% |

| Total non-life | 47 446 | 39 622 | 37 818 | 37 335 | 43 831 | 16.57% |

| Life | 16 437 | 16 495 | 16 917 | 15 829 | 21 444 | 34.52% |

| Grand total | 63 883 | 56 117 | 54 735 | 53 164 | 65 275 | 21.92% |

Kuwait Insurance Company: net earned premiums per class of business

In thousands USD| 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 evolution (1) | |

|---|---|---|---|---|---|---|

| Other property damage (2) | 43 235 | 38 889 | 34 409 | 33 755 | 36 115 | 6.24% |

| Fire | 2 704 | 1 856 | 2 053 | 1 453 | 2 130 | 45.60% |

| Marine and aviation | 1 496 | 1 300 | 1 504 | 1 407 | 1 002 | -29.28% |

| Takaful | 489 | 555 | 673 | 806 | 2 019 | 148.82% |

| Total non-life | 47 923 | 42 600 | 38 639 | 37 420 | 41 266 | 9.51% |

| Life | 16 437 | 16 495 | 16 917 | 15 829 | 21 444 | 34.52% |

| Grand total | 64 361 | 59 095 | 55 556 | 53 249 | 62 710 | 16.94% |

Kuwait Insurance Company: incurred losses per non-life class of business

In thousands USD| 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 evolution (1) | |

|---|---|---|---|---|---|---|

| Other property damage (2) | 25 229 | 19 424 | 20 217 | 13 663 | 10 697 | -22.26% |

| Fire | -248 | 35 | 623 | 466 | 253 | -46.04% |

| Marine and aviation | 251 | 190 | 75 | 238 | 16 | -93.31% |

| Takaful | 274 | 328 | 109 | 187 | 856 | 354.13% |

| Total non-life | 25 506 | 19 977 | 21 024 | 14 555 | 11 822 | -19.35% |

Kuwait Insurance Company: net management expenses per non-life class of business

In thousands USD| 2017 | 2018 | 2019 | 2020 | 2021 | 2020-2021 evolution (1) | |

|---|---|---|---|---|---|---|

| Other property damage (2) | 14 617 | 13 803 | 12 592 | 14 553 | 18 223 | 24.34% |

| Fire | 2 564 | 2 454 | 2 535 | 2 697 | 3 426 | 26.14% |

| Marine and aviation | 2 159 | 2 244 | 2 220 | 2 605 | 2 601 | -0.86% |

| Takaful | 393 | 336 | 407 | 440 | 1 476 | 233.15% |

| Total non-life | 19 733 | 18 836 | 17 754 | 20 295 | 25 727 | 25.87% |

Kuwait Insurance Company: net loss ratio per non-life class of business

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Other property damage | 58.35% | 49.95% | 58.76% | 40.48% | 29.62% |

| Fire | -9.18% | 1.90% | 30.37% | 32.06% | 11.88% |

| Marine and aviation | 16.77% | 14.64% | 4.96% | 16.95% | 1.60% |

| Takaful | 56.08% | 59.10% | 16.17% | 23.22% | 42.38% |

| Total non-life | 53.22% | 46.90% | 54.41% | 38.90% | 28.65% |

Kuwait Insurance Company: management expenses ratio per non-life class of business

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Other property damage | 33.79% | 38.15% | 37.98% | 42.48% | 49% |

| Fire | 115.93% | 150.64% | 108.71% | 308.46% | 115.59% |

| Marine and aviation | 153.09% | 177.16% | 140.39% | 192.85% | 294.86% |

| Takaful | 68.89% | 61.58% | 54.00% | 51.79% | 52.83% |

| Total non-life | 41.59% | 47.54% | 46.95% | 54.36% | 58.70% |

Kuwait Insurance Company: combined ratio per non-life class of business

| 2017 | 2018 | 2019 | 2020 | 2021 | |

|---|---|---|---|---|---|

| Other property damage | 92.14% | 88.10% | 96.74% | 82.96% | 78.62% |

| Fire | 106.75% | 152.54% | 139.08% | 340.52% | 127.47% |

| Marine and aviation | 169.86% | 191.80% | 145.35% | 209.80% | 296.46% |

| Takaful | 124.97% | 120.68% | 70.17% | 75.01% | 95.21% |

| Total non-life | 94.81% | 94.44% | 101.36% | 93.26% | 87.35% |

(1) Evolution in local currency

(2) Including engineering, third party and professional liability, motor and miscellaneous risks

Exchange rate as at 31/12/2021 : 1 KWD = 3.29754 USD ; 31/12/2020 : 1 KWD = 3.27438 USD ; 31/12/2019 : 1 KWD = 3.28983 USD; at 31/12/2018 : 1 KWD = 3.27956 USD; at 31/12/2017 : 1 KWD = 3.30268 USD

0

Your rating: None

Wed, 15/02/2023 - 11:05

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news