Microinsurance in Africa: a new insurance model

Some of today's insurers got their start in industrial life insurance in the 19th and 20th century, selling small-premium policies to workers at factory gates. Other insurers started as mutuals, owned by their policyholders; they existed to help their member-owners manage risks and make it through tough times. In this context, microinsurance today is seen essentially as a back-to-basics campaign.

Some of today's insurers got their start in industrial life insurance in the 19th and 20th century, selling small-premium policies to workers at factory gates. Other insurers started as mutuals, owned by their policyholders; they existed to help their member-owners manage risks and make it through tough times. In this context, microinsurance today is seen essentially as a back-to-basics campaign.

Microinsurance covers a wide range of risks: accident, health, death, natural catastrophes and property losses. It may also cover a single or composite risk.

Microinsurance does not refer to the size of the insurer. There are examples of very large companies that offer microinsurance products, including multi-nationals like Allianz, AIG and Zurich.

Microinsurance in Africa: an undeveloped market

In Africa, microinsurance has been available in various forms for a number of years. Cooperative insurers have penetrated the market since 1970. In the 1980s, many community-based health insurance schemes, especially in West Africa, were created. In the mid 1990s, private insurers began to enter the market, offering specialized microinsurance products to low income population. Informal microinsurance has been available for decades in a range of forms, from "tontines" in West Africa or "friend in need" groups in East Africa to burial societies in South Africa.

Microinsurance opportunities

The microinsurance market represents a sizeable opportunity for African insurers. Approximately one billion people live in Africa, of which 60% live below 2 USD per day. Microinsurance targets the working poor which represent a market of approximately 700 million people. The annual income of this group is approximately 500 billion USD (World Bank, 2007). Assuming a potential for insurance expenditure of 5% of GDP (Sigma 2009), the microinsurance market in Africa represents approximately 25 billion USD.

The landscape of microinsurance in Africa

The situation of microinsurance in Africa is falls far short of these figures. A landscaping survey conducted by the International Labour Organization's Microinsurance Innovation Facility in 2009 found that 14.7 million people were covered by microinsurance, representing a premiums volume of around 257 million USD.

The situation of microinsurance in Africa is falls far short of these figures. A landscaping survey conducted by the International Labour Organization's Microinsurance Innovation Facility in 2009 found that 14.7 million people were covered by microinsurance, representing a premiums volume of around 257 million USD.

Southern and Eastern Africa dominate the microinsurance landscape with respectively 8.8 million and 4 million people covered. In the other African areas, only 1.9 million people are covered by an insurance policy.

These figures indicates that only 2.6% of the poor population in Africa is currently using microinsurance products. The gross premiums account for just 1% of the market's estimated potential.

Microinsurance products in Africa

African microinsurers offer a wide variety of products. Life insurance is clearly predominant. With 7 million insured, credit life insurance is the most popular product. It is generally required for the delivery of microcredit or loans.

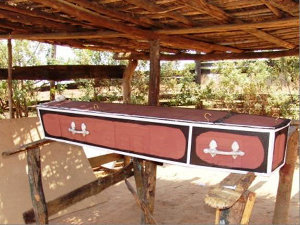

Funeral and personal accident insurance, which cover about 6.2 million insured, also stand among the products that are most commonly underwritten.

Term life policies (4.8 million) are relatively easy to manage and require few investments and are thus popularly offered in many African countries.

Endowment policies (0.8 million people) are less common since their long-term nature requires a more complex management and a higher risk for the policyholder.

Health products cover at least 1.9 million people, out of which 1.3 million enjoy comprehensive packages mostly delivered by health mutuals and few specialized insurers.

Less than 0.3 million Africans access non-agriculture related property insurance. Concerning the agriculture insurance category, the study found that less than 80 000 people have underwritten policies covering livestock, crop and other products.

Finally, these figures clearly demonstrate that there is great potential for microinsurance expansion and growth in Africa.

Microinsurance distribution channels in Africa

For the placement of their products, African insurers use a variety of distribution channels. Community-based organizations, mutuals and microfinance institutions are among the most common distribution channels. However, some insurers still use conventional ways to market their products, but this trend is changing slowly in South Africa and Kenya where there are more experiments with alternative channels such as retailers or mobile phone providers.

For the placement of their products, African insurers use a variety of distribution channels. Community-based organizations, mutuals and microfinance institutions are among the most common distribution channels. However, some insurers still use conventional ways to market their products, but this trend is changing slowly in South Africa and Kenya where there are more experiments with alternative channels such as retailers or mobile phone providers.

Microinsurance pilot programs have shown that all of these institutional models have advantages and disadvantages. Consequently, collaborations between different types of institutions can represent a win-win solution.

- For traditional insurers, microinsurance stands for an enormous undeveloped market and a good mean of diversifying their operations. According to Colette Patience, senior project manager at Old Mutual (South Africa): "The low income market is the next growth point from a commercially sustainable perspective, not from a corporate social responsibility perspective" (see box below).

Old Mutual

Old Mutual is an international long term savings group, established in 1845 in South Africa and operating in 38 countries worldwide. In 2009, he achieved revenues worth 35 billion USD.

Old Mutual provides wealth management, investment products, retirement savings as well as life, disability and health insurance to individuals and groups. Old Mutual's microinsurance project targets the low-income market (monthly income up to 460 USD) both at the level of individuals and communities in rural and periurban environments. Old Mutual is testing the “one stop shop” approach, delivering a full spectrum of financial services to low-income clients. In the rural areas, engagement models leverage pre-existing groups and work with 1000 burial societies, stokvels and funeral parlors. Their target is an outreach of 1 million clients by 2020.

- For community based organisations, microinsurance represents a solution to protect vulnerable citizens.

- For microfinance institutions, microinsurance represents a way to safeguard loan portfolios and diversify the offers of financial products.

Each of these players brings in some value-added to a microinsurance partnership. Traditional insurers have experienced actuaries who are able to introduce risk analysis and evaluation tools. As to the community based organisations, they have earned the trust of customers while micro finance institutions have expertise in financial transactions in order to rationalize the distribution.

Challenges of microinsurance in Africa

For microinsurance to become a profitable business for African insurers, some obstacles have to be overcome. Among the factors hindering the development of this activity, we note:

- the lack of understanding of the insurance by customers

- the very limited financial capacity of the individuals targeted by microinsurance

- the very high administrative costs for insurers

- the lack of information technology relative to microinsurance

- the lack of qualified staff

The viability of microinsurance, therefore, requires:

- the improvement of products in order to provide better offers to low-income populations,

- a reduction of operating costs,

- improving the efficiency of distribution and management methods for the different players,

the introduction of technological solutions that are likely to reduce operating costs and fraud. For instance the use of smartcards for mobile transfers of premiums by UAB in Burkina Faso (see box below) or handheld devises for agents to collect premiums and manage claims information (solution promoted by UAP Insurance Company, Kenya and the International Livestock Research Institute, Kenya).

the introduction of technological solutions that are likely to reduce operating costs and fraud. For instance the use of smartcards for mobile transfers of premiums by UAB in Burkina Faso (see box below) or handheld devises for agents to collect premiums and manage claims information (solution promoted by UAP Insurance Company, Kenya and the International Livestock Research Institute, Kenya).

Union des Assurances du Burkina Vie

Union des Assurances du Burkina Vie (UAB) is a well-established life insurance company (37.79% of the market shares in 2008) that is launching a life microinsurance product on a large scale. The product which targets informal sector entrepreneurs in urban areas, is based on a contractual savings scheme, and includes life and disability guarantees. Clients' contributions are collected every day. Insurance premiums are low, at 100 FCFA (0.2 USD) per month. The benefit is twice the value of the contracted capital with a ceiling of 200 000 FCFA (415 USD) for both life and disability. The use of new technologies, equipping clients with smart cards and collectors with computer terminals, should improve the administration of the product, reduce costs and help UAB expand its nationwide operations, with a target of 200 000 clients for the next three years.

- the emergence of microinsurance as a specific financial service standing at the crossroads of traditional insurance and social protection. This recognition is likely to facilitate cooperation among insurers and social protection entities. In Kenya, for instance, the Cooperative Insurance Company is collaborating with the National Hospital Insurance Fund to extend coverage to workers in the informal economy: the Bima Ya Jami project (see box below).

Bima Ya Jami

Bima Ya Jami (BYJ) is a pilot project that provides a composite microinsurance product covering health, accidental death or disability, and funerals to low-income Kenyans. The project is run by a consortium: the Swedish Cooperative Centre (SCC) is responsible for project management and capacity building, the Cooperative Insurance Company (CIC) is the risk carrier for the accidental death and funeral components, and the National Health Insurance Fund (NHIF) is the risk carrier for the health component. The linkage with the National Health Insurance Fund provides an interesting case for using market-based mechanisms to enable workers in the informal economy to access health services. The project began in September 2008, and the insurer expects to cover 200 000 low-income persons by the end of two years. If the initiative is successful in Kenya, the consortium plans to expand the products offer to other countries in the region.

The future of microinsurance in Africa

Despite the impressive growth of microinsurance in Africa during the last three years, most of the African continent is still regarded as an undeveloped market.

Despite the impressive growth of microinsurance in Africa during the last three years, most of the African continent is still regarded as an undeveloped market.

Being currently confined to some life guarantees, the microinsurance has to extend its operations to include health, agricultural and damage to property risks which account for a minimal fraction of the premiums collected today.

The market is there. In fact, the future of microinsurance depends solely on the insurers and on the solutions that they may adopt to meet the needs of the low-income populations.

It is about a genuine reshape of the current insurance model which is has to integrate:

- a diversification of business providers and an improvement of the current distribution channels,

- a greater awareness — raising program for low-income populations for the sake of a better understanding of microinsurance,

- reinforced capacities to develop, sell and manage better products.

With innovation and creativity provided, the microinsurance sector is set to operate like the standard type of insurance and will simply become a class of business of its own among the traditional African insurance companies.

Nota: This article has been recommended to Atlas Magazine by the International Labour Organization's Microinsurance Innovation Facility (ILO), Geneva, whom we thank.