Natural catastrophes insurance

Two types of catastrophes are listed:

- Natural catastrophes related to major climatic, seismic or astronomic events: floods, land slides, earthquakes, tsunamis, hurricanes, storms, avalanches, volcanic eruptions, forest fires, droughts, heat waves.

- Technological catastrophes related to human activities: accidents in industrial exploitation or production, transportation of individuals, military catastrophes.

Definition

A catastrophe is a brutal happening which generally leads to large-scale destruction and loss of lives. This event is characterized by its occurrence probability, the intensity of its demonstration and the magnitude of damages.

All direct human or material damages having resulted mainly from the abnormal intensity of a natural agent, are regarded as natural catastrophes.

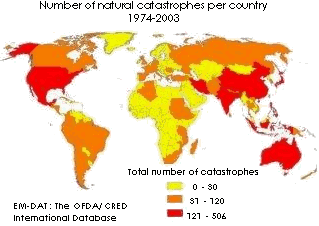

Men's unequal vulnerability to natural catastrophes

Hurricane Mitch, October 1998 Hurricane Mitch, October 1998 |

The impact of a natural catastrophe can be devastating for an emerging country. In October 1998, for instance, hurricane Mitch destroyed 78% of GDP in the Honduras.

In the industrialized countries, however, efficient prevention and early warning systems make it possible to lessen the scale of damage considerably.

Such disparity was once again plainly reported when Tsunami lashed the Indian Ocean on October 26, 2004. On that occasion, the toll of dead was considerably heavy while the damages supported by the insurers were relatively low.

An increasing loss experience

While the incidence of climatic disorders on the upsurge in natural happenings still remains hard to assess for the insurance industry, the cause behind the increase of damages is tightly linked to the concentration and growth of insured values in the industrialized countries.

In 2004, the amount paid by insurers for the series of 13 cyclones in the USA and the Caribbean and for the ten typhoons that lashed Japan amounted to 46 billion USD.

Natural catastrophes risk

- It is the combined product of a hazard and a vulnerability.

- The hazards stands for a potential threat of a natural phenomenon that will have a certain intensity on a specific territory, in a given time.

- Vulnerability pertains to the importance of predictable consequences due to the hazard in all fields: men, goods, territories.

Insurance companies on the frontline of natural catastrophes

Hurricane Ike, September 2008 Hurricane Ike, September 2008 |

The rising losses resulting from natural disasters have turned the spotlights on insurance companies. Confirmed since the 1980s, the trend towards a growing rise of disasters claims constitutes a serious threat for the future of numerous economies and a risk of bankruptcy for the insurance business.

- In the 1950s, 200 events related to climatic changes were listed. This figure had grown to more than 1600 in the 1990s.

- The losses of insurance companies have increased rising from 9.2 billion USD per year in the 1950s to 23 billion USD per year, in average, in the course of the period between 1987 and 2004.

- Between 1985 and 1999, 14% of the world's disasters that had affected USA accounted for 58% of the world's overall losses suffered by the insurance business.

- Mortality resulting from natural catastrophes has risen by 60% between 1980 and 2000.

- Since 1990, natural catastrophes have claimed the lives of 60 000 people each year, according to the International Red Cross.

- Between 1994 and 2004 natural catastrophes have killed 478 100 people and accounted for 690 billion USD in economic losses, according to some

estimates, without taking into account the toll of the December-26-2004 tsunami.

estimates, without taking into account the toll of the December-26-2004 tsunami.

Natural catastrophes: an unbearable burden for insurers

Faced with this global scale hazard, the governments of all the countries are now bound to take into consideration the Risk/Insurance equation. The emergence of new risks and the compelling requirement of security for individuals tending to the zero-risk concept in rich countries have radically modified the demand for insurance.

Furthermore, the burden of disaster rate linked to natural catastrphes has become hardly bearable for the insurance business alone which is calling upon the public authorities to undertake a more active role.

Natural catastrophes peaks

- 1992: Andrew, the hurricane the cyclone that affected Florida, cost insurance companies 17 billion USD.

- 1997: El Ninõ claimed the lives of 13 000 people and damages worth 30 billion USD.

- 1998: a record high in 150 years as far as global warming is concerned, and a dark year with the grim toll of 50 000 dead and 90 billion USD in assessed damages.

- 1999: in France, the Lothar and Martin storms cost insurers over 8.5 billion USD.

- 2004: a record high in losses with 300 000 casualties and material damages amounting to 123 billion USD, excluding the tsunami toll.

- The tsunami alone, on December 26, 2004 which affected 12 neighbouring Indian Ocean countries, claimed the lives of 300 000 people.

Alarmist forecasts

A hurricane lashing the American city Miami would cost 50 billion USD in compensations, and would lead to the bankruptcy of more than a third of American insurance companies.

A rise in the level of La Seine, identical to that of 1910 in Paris, would affect approximately one million people, 170 000 firms, and would cause 37 billion USD in damages.

A major earthquake in Tokyo, a 35 million people megalopolis, would claim the lives of 11 000 people, leave 43 000 injured and 2.4 to 3.3 million homeless. As to material damages, they are estimated at 1 060 billion USD.

The alternative: the necessary solidarity between public authorities/insurers/insured

Resulting from prospective studies, the rise of risks and uncertainties require, in the first place, the mobilization of all forces in order to meet the challenge both at the national and international levels.

Resulting from prospective studies, the rise of risks and uncertainties require, in the first place, the mobilization of all forces in order to meet the challenge both at the national and international levels.

While on the international level, awareness of the risks of natural catastrophes linked to climatic disorders has accelerated the process of negotiation for the prevention and reduction of phenomena contributing to global warming, mobilization at the national level requires:

- Public authorities wise, consolidating the role of the State in its endeavour for prevention, supervision, support and guidance. In practice, a move must be made to adopt legislations and regulations pertaining to the prevention and management of natural catastrophes, setting up early warning networks, crisis simulation, evacuation plan, the creation of solidarity-based compensation funds promoting and disseminating risk culture among individuals as well as communities.

- Insurance wise, a better knowledge of the phenomena by means of measurement and modeling tools, the diversification of the offer with products tailored to specific needs, educational activities for the benefit of the insured, the creation of sufficient financial capacities.

- Insured wise, responsible behaviour based on solidarity when it comes to environment and security issues, the acquisition of a risk culture through a futuristic perspective that can only enhance a consideration for potential hazards.

International conferences and agreements

- June 3-14, 1992:First Earth Summit, Rio de Janeiro, Brazil. Adoption of Agenda 21 with a list of 2 500 recommendations for action during the 21st century.

- May 23-27, 1994:The United Nations World Conference on natural disaster reduction, Yokohama (Japan). Adoption of «an action plan for a safer world» and «the Yokohama Strategy: directives for the prevention of natural catastrophes, disaster preparedness and the alleviation of their effects».

- 1996:The Launching of the European project DIPECHO (Disaster Preparedness ECHO), program for disaster preparedness designed to minimize risks.

- June 23-17, 1997:The second Earth Summit, New York. Updating of Agenda 21 adopted at the 1992 Rio Conference.

- December 1-12, 1997:The third UNO conference on climate, Kyoto (Japan). Adoption of a protocol to the convention on climate, the so-called Kyoto Protocol on the reduction of green house gas emissions.

- November 2-14, 1998:The fourth UNO conference on climate, Buenos Aires (Argentina)

- July 5-9, 1999:Closing of the international decade on the prevention of natural catastrophes (1989-1999), Geneva (Switzerland). Adoption of an international strategy for the reduction of natural disasters, endowed with a permanent secretariat and relying on national committees.

- August 26- September 4, 2002:World summit on sustainable development, Johannesburg (South Africa). The world summit ratifies the concept of sustainable development.

- December 6-17, 2004:The Tenth United Nation's conference on climate changes, Buenos Aires (Argentina)

- January 7, 2005:The European project for a coordination body to face disasters.

- January 8, 2005:The Tempere Convention (Finland). Entry into force of the Tempere Convention on the mobilization of telecommunications resources for the alleviation of disasters effects and for rescue operations in case of disasters.

- January 18-22, 2005:The international conference on the prevention of natural catastrophes, Kobé (Japan). The creation of an international early warning system for the whole of natural catastrophes.

- February 16, 2005:Entry into effect of the Kyoto Protocol predicting the reduction green house gas emissions and the struggle against global warming.