Political risks, what a coverage?

Political risks coverage

The globalization of trade has aroused the need for an environment that is more suitable for the thriving of trade relations between national firms and economic players outside their boundaries.

The September eleven, 2001 events have strengthened “risk phobia” sentiment towards political risks. Before then, attacks, terrorism and sabotage risks (ATS) had been entrusted to insurers and reinsurers without ambiguity. Since the occurrence of the World Trade Centre, the market has been through a serious capacity crisis. Insurers and reinsurers, alone, are no longer able to manage the coverage of these big risks. They are in urgent need to be backed by governmental authorities.

Political risk comprises two aspects:

- ATS risk which concerns any firm operating on a market whose political scene is characterized by Instability.

- Political risk which concerns companies that perform activities on foreign markets (high-risk countries).

A.T.S risks

ATS risks guarantee generally covers the loss or damage to property caused by acts, riots or public disorder targeting to topple or to bring about government or local authorities changes. Equally covered are damages to insured property caused by the intervention of legal authorities trying to cope with the already-mentioned acts.

ATS risks guarantee generally covers the loss or damage to property caused by acts, riots or public disorder targeting to topple or to bring about government or local authorities changes. Equally covered are damages to insured property caused by the intervention of legal authorities trying to cope with the already-mentioned acts.

Country risks

Political risks guarantee on export covers hazards of political or administrative nature that cause damage to the interests of importing or exporting companies or those that are investing on foreign markets. Insurers seeking to adapt their products to the market needs, have integrated this scheme in their strategies.

Political risks coverage : A.T.S. risks insurability

The September 11, 2001 events have unravelled the shortcomings of the insurance system. Indeed, insurers had no idea about the scale of the damage that could be caused by such events. The scale of the damage inflicted upon the World Trade Centre has scared insurers away from political and ATS risks, especially in the absence of support from a government or an insurance pool.

In U.S.A, the government voted a decree in November 2002, designating the State as the ultimate competent insurer. In return, insurers are due to offer guarantees against terrorism to companies, with the premium level being set by the State. In case of a big attack, insurers will have to refund a 10% part of the disaster caused, and the state will pay the difference.

Political risks coverage: Exporting political insurance contracts

The emergence of new growing risks on the international scene has given rise to a mixture of apprehension and dislike for contemporary corporate risks, which incited these firms to further protect their interests through political insurance contracts on export.

Companies will have to come to grips with three types of risks:

- Commercial risk (non-payment by the importer),

- Fluctuation risk (if the payment is made in foreign currency),

- Political risk (risk inherent to the situation of importing country).

The major guarantees offered in the field of insurance on export are:

- The unilateral breach of contract by the public purchaser.

- The breach of contract signed with a private purchaser for political or administrative reasons.

- The non transfer or inconvertibility of currency, which hampers good international trade proceedings.

- The withdrawal or non-renewal of license, which prevents good import and export proceedings.

- The non-respect of arbitration verdict.

- The embargo, seizure or confiscation of merchandise.

- Violent acts for political reasons resulting in damages to insured property.

Political risks impact on credit insurance

The fact that credit reinsurers are often the same ones to underwrite damage guarantees has triggered a capacity crisis and mounting pressure on premium rates. The slowdown of economic activities worldwide has weakened the importing business. The insurers had their “disaster/premium ratios deteriorate as these importers were no longer able to honour their commitments in due time. This resulted in an important increase in premium rates. COFACE, for instance, has decided to raise its rates by 10 to 20% in 2002.

Some markets have been trying to make up for this inconvenience by proposing alternative solutions. In Africa, some companies have committed to offering necessary guarantees, hence, the creation of the African Insurance Company or the Agency for Trade Insurance in Africa.

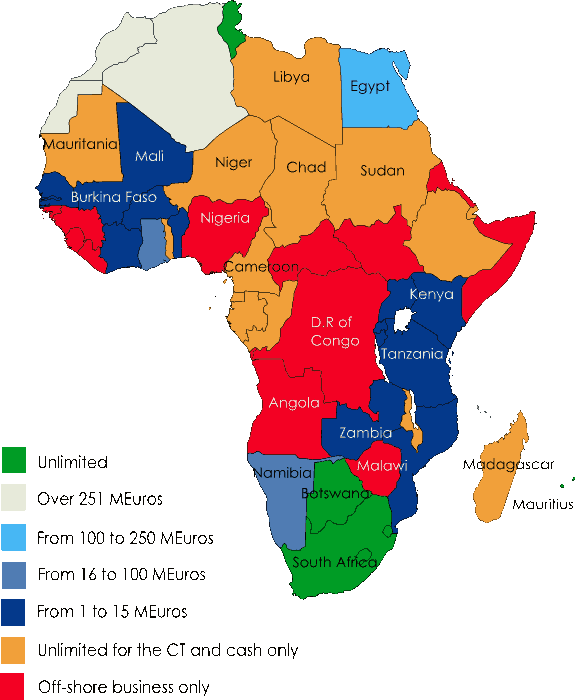

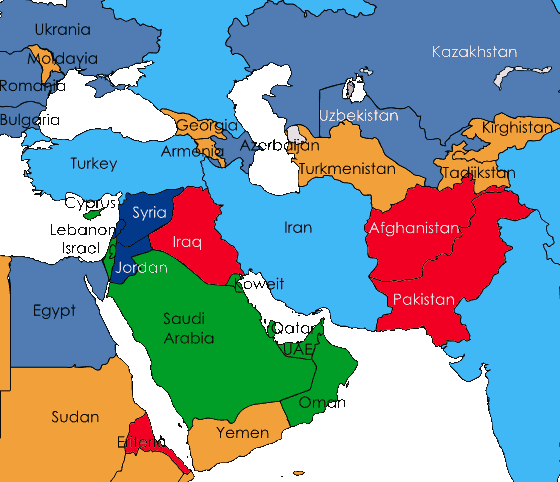

Country's Risk Maps according to Coface (France)

| Africa | Middle East |

|  |

The political risks insurance market

It is a market dominated by specialized public insurance and reinsurance bodies mainly. It is wrapped around the following five poles:

- A local insurer, generally with public capital.

- London and the Lloyd's.

- The United States with recently-set up private companies.

- Continental Europe, with few private insurers.

- The Bermuda, where private companies have recently started to operate.

It is worth noting that some classical insurers underwrite political risks to meet the needs of their big clients. The most active are: AIG, Chubb, Coface (Unistrat), Exporters, Liberty Mutual, Lloyd's, Sovereign Risk, Zurich Assurances.