Qatar Insurance Company

Dotted with an initial capital of 1 500 000 rupees, regarded as a fortune at that time, QIC then underwrote only personal lines risks and those of a few small companies operating at the heart of the ancient city of Doha.

Dotted with an initial capital of 1 500 000 rupees, regarded as a fortune at that time, QIC then underwrote only personal lines risks and those of a few small companies operating at the heart of the ancient city of Doha.

In 2011, the activities of local insurers’ doyen have gone far beyond Qatar’s borders to reach the Middle East where the company has become a major player.

At the close of 2010, QIC is ranking fifth among the Arab countries, in terms of premiums, posting the highest profits in the same area.

From the local small seized insurer to the large group extending its tentacles to the United Arab Emirates, Kuwait and Oman, QIC has perfectly managed to meet country’s great economic boom.

Thanks to its technical know-how, the company has built an important portfolio of oil, marine and aviation risks. Currently, it is the insurer of the largest companies established in a country with huge financial resources. It controls approximately 60% of the premiums written on the Qatari market in 2010.

A sound capitalization, solid technical performances and a stable management will provide QIC with a power base to go international where the sought diversification goes through the geographic expansion of its operations and the development of life, health and takaful business.

|  |

| Ali Mohd. Ghanem Al-Mannai | P.E. Alexander |

| Chief Executive Officer | Chief Operating Officer |

Qatar Insurance in 2010

| Paid up capital | 204 280 340 USD |

| Turnover | 591 774 000 USD |

| Return on Equity | 19.1% |

| Shareholder’s equity | 968 062 378 USD |

| Total assets | 1 989 129 578 USD |

| Technical result | 117 015 000 USD |

| Profit | 171 113 000 USD |

| Net loss ratio | 52.3% |

| Net expenses ratio | 27% |

| Combined ratio | 79.3% |

| Insurance subsidiaries | Qatar, Oman and Kuwait |

| Branches | Dubai and Abu Dhabi |

| Representative office | Malta |

| Number of employees | 300 |

Management

| Chief Executive Officer | Ali Mohd. Ghanem Al-Mannai |

| Chief Operating Officer | P.E. Alexander |

| Chief financial officer | Mohd.Haitham Nahas |

| Human resources manager | Khalifa M. Al Sewaidi |

| Energy insurance manager | Russell Tong |

| Property insurance manager | C.M. Unnikrishman |

| Marine and aviation insurance manager | Sultan Mohamed Ghani |

| Property claims manager | Gnanasekar Sundaram |

| Motor claims manager | Mohd. Aly Ahmed Hejazy |

Main shareholders

| Qatari State | 12% |

| Qatar National Bank | 5% |

| Burooq Trading Co. | 5% |

| Commercial Bank | 2% |

| Other shareholders | 76% |

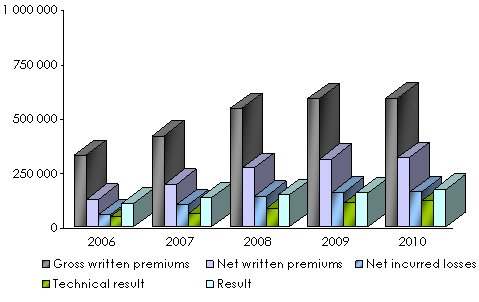

Main technical highlights: 2006-2010

in thousands USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

Gross written premiums | 327 823 | 418 254 | 542 128 | 590 642 | 591 774 |

Written premiums net of reinsurance | 125 607 | 193 780 | 267 843 | 312 072 | 320 486 |

Net earned premiums | 101 951 | 169 911 | 238 432 | 290 047 | 307 247 |

Net incurred losses | 53 715 | 101 332 | 138 007 | 157 292 | 160 748 |

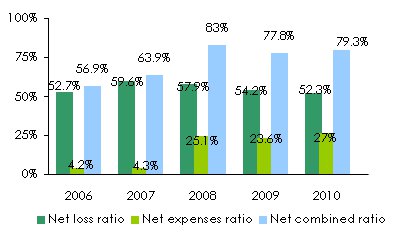

Net loss ratio | 52.7% | 59.6% | 57.9% | 54.2% | 52.3% |

Net expenses ratio | 4.2% | 4.3% | 25.1% | 23.6% | 27% |

Net combined ratio | 56.9% | 63.9% | 83% | 77.8% | 79.3% |

Technical result | 43 974 | 61 283 | 84 282 | 108 473 | 117 015 |

Financial income | 82 648 | 111 541 | 111 534 | 94 592 | 112 118 |

Result | 106 719 | 133 002 | 145 704 | 154 055 | 171 113 |

Evolution of premiums, losses and results

in thousands USD

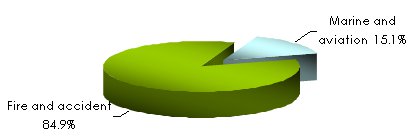

Premiums' evolution per class of business: 2006-2010

in thousands USD| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 % | 2009/10 growth | |

|---|---|---|---|---|---|---|---|

Marine & aviation | 54 951 | 63 339 | 67 775 | 84 471 | 89 104 | 15.1% | 5.5% |

Fire & accident | 272 872 | 354 915 | 474 353 | 506 171 | 502 670 | 84.9% | -0.7% |

Grand total | 327 823 | 418 254 | 542 128 | 590 642 | 591 774 | 100% | 7.8% |

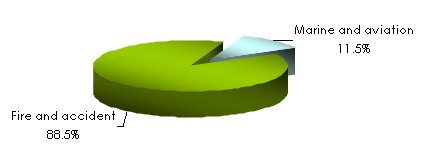

Net losses’ evolution per class of business: 2006-2010

in thousands USD| 2006 | 2007 | 2008 | 2009 | 2010 | 2010 % | 2009/10 growth | |

|---|---|---|---|---|---|---|---|

Marine & aviation | 11 884 | 23 533 | 14 632 | 16 458 | 18 426 | 11.5% | 12% |

Fire & accident | 41 831 | 77 799 | 123 375 | 140 834 | 142 322 | 88.5% | 1.1% |

Grand total | 53 715 | 101 332 | 138 007 | 157 292 | 160 748 | 100% | 2.2% |

Premiums’ breakdown per class of business in 2010

Losses’ breakdown per class of business in 2010

Ratios’evolution: 2006-2010

Exchange rate QAR/USD as at 31/12 | 2006 | 2007 | 2008 | 2009 | 2010 |

0.27489 | 0.27546 | 0.27487 | 0.27475 | 0.27485 |

Contact

| Head office | Qatar Insurance Company SAQ Tamin Street, West Bay, PO Box: 666, Doha, Qatar |

| Phone | (+974) 44 962 222 (+974) 44 962 275 |

| Fax | (+974) 44 831 569 |

| Website |