Reinsurance treaties' renewal in 2021

With the appearance of the coronavirus, they have additional arguments to convince cedants of the merits of rate increase in their favor.

With the appearance of the coronavirus, they have additional arguments to convince cedants of the merits of rate increase in their favor.

Even before the health crisis, headwinds began to have an impact on the industry, with the list of factors affecting reinsurers' finances only getting longer and longer. Back then, the concerns were numerous:

- uncertain development of natural catastrophe reserves,

- increasing cost of claims,

- unfavorable evolution of the legislative, judicial, social and economic framework.

Moreover, nothing seems to be getting low interest rates off the ground for several years. The Covid-19 outbreak has exacerbated this situation while the reinsurance supply remains vigorous.

This apparently catastrophic situation conceals, however, factors which counterbalance these disastrous effects. After some hesitation, the market players quickly adapted to the virtual work environment. They are developing efficient risk transfer platforms in a sector connected to new technologies.

It is therefore in an unusual environment that treaty negotiations will take place on 1 January 2021, with just one unknown factor dominating this renewal: what impact will the health storm and economic difficulties have on reinsurers? Here is an overview of the main trends and expectations of the reinsurance world.

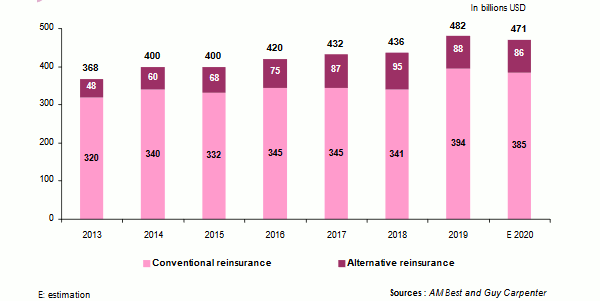

Reinsurance market’s capital

Since 2013/2014, the capital allocated to the market by traditional reinsurers has increased significantly. Estimated at 320 billion USD in 2013, it skyrocketed in 2019 reaching 394 billion USD. This increase is particularly noticeable between 2018 and 2019 with a 15% increase in traditional capital.

However, the strong growth in capacity is taking place in a market where many stakeholders who underwrite business beyond the break-even point are struggling to make profits. However, the financial market downturn at the end of 2018 and throughout 2019 has improved the investment prospects of reinsurers impacted by the multiple financial crises.

The estimated reinsurance capital for 2020 is down by nearly 2.3% at 385 million USD. The latter was already down by nearly 2% as at June 30 of the current year. Between 2016 and 2018, a series of natural disasters eroded the reinsurance capital. The adequacy between capital and risk regressed after each major event without, however, affecting the profession's solvency ratios, which remain very comfortable.

Reinsurance capacity

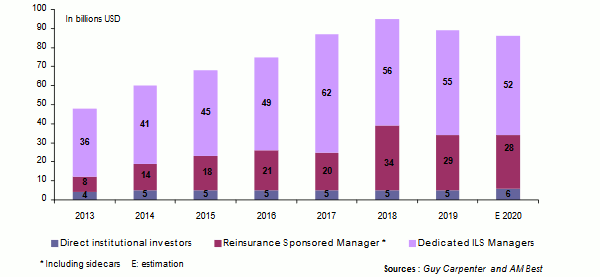

Alternative reinsurance’s capital

Estimates show a regression of alternative capital (from 88 billion USD in 2018 to 86 billion USD in 2019) similar to that of traditional capital, even if on 30 June 2020 the observed decline is more significant.

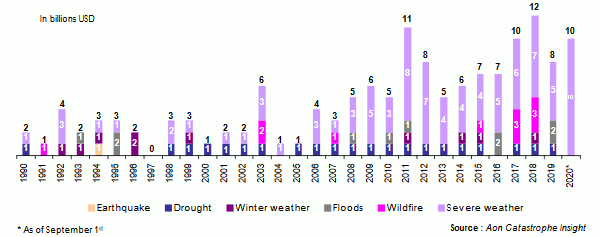

This decline in alternative capacity is accounted for by the loss of certain assets backed by reinsurance commitments following the occurrence of the so-called secondary natural catastrophe claims: severe storms, bush fires, floods, etc.

The year 2020 has witnessed an upsurge in terms of frequency for this category of events whose severity is often moderate, particularly in the United States. The United States alone sustained ten of these disasters by 31 August 2020. This increasing trend can be observed in several regions of the world.

Evolution of insured losses caused by secondary risks: 1990-2020

Alternative reinsurance market’s capacity