Results and combined ratio of the major reinsurers: 2013-2017 period

The profit of the top twenty reinsurers is set at 2 379 million USD, down by 88.69% in comparison with the previous year. The most significant loss has been reported by the American reinsurer Berkshire Hathaway at -460.5%.

The profit of the top twenty reinsurers is set at 2 379 million USD, down by 88.69% in comparison with the previous year. The most significant loss has been reported by the American reinsurer Berkshire Hathaway at -460.5%.

Only three reinsurers managed to report growing results. They are Reinsurance Group of America (+159.9%), China Re (+8.9%) and General Insurance Corporation of India (+10.8%).

Related article:

Net results of the major reinsurers: 2013-2017

| Company | 2013 | 2014 | 2015 | 2016 | 2017 | Evolution (%) | |

|---|---|---|---|---|---|---|---|

| 2016/2017 | 2013/2017 | ||||||

Munich Reinsurance | 4589 | 3 854 | 4 597 | 2 718 | 470 | -82.71 | -89.76 |

Swiss Re | 4 444 | 3 500 | 3 411 | 3 558 | 331 | -90.70 | -92.55 |

Berkshire Hathaway | 1577 | 883 | 553 | 1 012 | -3 648 | -460.47 | -331.33 |

Hannover Rück | 1 233 | 3 500 | 1 327 | 1 234 | 1 148 | -6.97 | -6.89 |

SCOR | 756 | 619 | 702 | 639 | 341 | -46.64 | -54.89 |

Lloyd's | 5 285 | 4 910 | 3 164 | 2 593 | -2 700 | -204.13 | -151.09 |

Reinsurance Group of America | 419 | 684 | 502 | 701 | 1 822 | +159.91 | +334.84 |

China Re | 556 | 580 | 1 183 | 753 | 820 | +8.90 | +47.48 |

Great West Lifeco | 1971 | 2 192 | 1 992 | 1 961 | 1 712 | -12.70 | -13.14 |

Korean Re | 112 | 111 | 159 | 133 | 117 | -12.03 | +4.46 |

General Insurance Corporation of India (1) | 376 | 429 | 434 | 481 | 497 | +10.83 | +32.18 |

PartnerRe | 673 | 1 068 | 107 | 447 | 264 | -40.94 | -60.77 |

Everest Re | 1259 | 1199 | 978 | 996 | 469 | -52.91 | -62.75 |

XL Group | 1 059 | 188 | 1 207 | 440 | -560 | -227.27 | -152.88 |

Transatlantic Holdings (2) | - | 717 | 626 | 580 | -19 | -103.28 | - |

MS&AD | 908 | 1 150 | 1 509 | 1 814 | 1 366 | -24.70 | +50.44 |

R+V Versicherung AG | 169 | 118 | 141 | 57 | 23 | -59.65 | -86.39 |

MAPFRE RE | 149 | 172 | 167 | 196 | 195 | -0.51 | +30.87 |

RenaissanceRe | 842 | 686 | 542 | 630 | -355 | -156.35 | -142.16 |

The Toa Reinsurance (1) | 86 | 48 | 50 | 93 | 86 | -7.53 | - |

Total | 26 463 | 26 608 | 23 351 | 21 036 | 2 379 | -88.69 | -91.01 |

(1) Fiscal year ending March 31st

(2) Before taxes

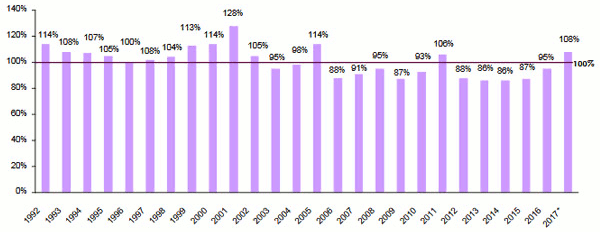

Combined ratio of the major reinsurers: 1992-2017

The analysis of combined ratios for all reinsurers over a long period has revealed a sharp improvement of technical results since 2006.

During the 1992-2003 period, that is over 11 consecutive years, all combined ratios had been set above 100%, peaking at 128% in 2001. The situation improved considerably as of 2006 with an average combined ratio of 94% despite two loss-making years: 2011 and 2017.

* Estimates | Source: S&P Global Reinsurance Highlights |

Combined ratio and ROE of the top 20 reinsurers

Following the occurrence of large-scale natural disasters, the combined ratio of the top twenty reinsurers drastically decreased in 2017. This loss experience triggered at 1% decline in ROE, that is a decrease of 10.5 points in a single year.

| Indicator | 2013 | 2014 | 2015 | 2016 | 2017 | 2018* | 2019* |

|---|---|---|---|---|---|---|---|

Global combined ratio in % | 84.6 | 84.6 | 87.5 | 91.9 | 111.8 | 96-99 | 96-99 |

Combined ratio excluding natural catastrophes losses in % | 86 | 88.8 | 92.7 | 93.9 | 94.7 | 93-96 | 93-96 |

ROE in % | 13.9 | 13.4 | 11 | 9.5 | -1 | 7-9 | 7-9 |

* Estimates