Risk mapping, cornerstone of the insurance activity

|

The emergence of new risks such as cybercrimes and their proliferation worldwide are likely to jeopardize the stability of the industry.

To avoid getting caught in the crossfire, many insurance companies and financial institutions are more and more investing in projects of research and advanced technologies in order to be proactive and capable of foreseeing disaster scenarios.

Risk mapping: definition

Risk mapping is a graphic representation of a certain number of risks. It makes it possible to take stock of the threats and risks incurred by organizations, portraying them in a synthetic way under a hierarchized fashion.

This hierarchization rests on certain criteria such as:

- the likelihood of occurrence,

- the potential impact,

- the level of risk control.

Mapping has been designed to illustrate the probability or the frequency of risk occurrence and also to measure their impact on companies and on the environment.

Objectives of the risk mapping

For insurance companies, the benefit of mapping consists in the ability to better contain risks of natural, economic and social catastrophes that are likely to compromise their operations.

While it is impossible to keep certain hazards from happening, recourse to prevention remains the best way of controlling potential risks and mitigating their impact. Insurers are therefore required to keep an eye on economic, climate and geopolitical changes that loom ahead, without losing sight of individual behaviors triggered by those changes.

The crafting of risk mapping pursues several objectives:

- analyze the overall risks (climate, social, political…) with a view to better managing their financial and non-financial impact like damage to corporate reputation.

- provide decision-makers with a comprehensive vision of the markets’ vulnerabilities and strengths.

- provide better rating of risks.

- come up with action plans to avoid the occurrence of these risks and mitigate their impact.

Risk mapping methodology

The crafting of risk mapping requires meticulous methodology which entails collaboration with several experts and managers, picked for their specific expertise about risks and corporate chain of activities. Their job makes it possible to establish a risk nomenclature.

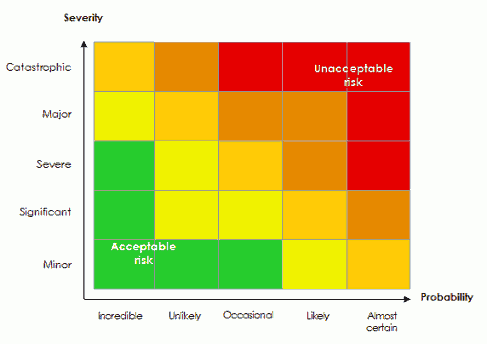

Concretely, mapping makes it possible to identify, quantify and hierarchize risks, oftentimes taking the shape of a two-dimensional grid or a criticality matrix (1) . On one axis, the frequency or probability of event occurrence is mentioned. Their impact measured in degrees (generally financial degrees) is reported on another axis. Risks falling in the high-frequency and strong-impact quadrant are most threatening. They are subject to special attention by heads of companies and economic decision-makers.

The criteria of seriousness and frequency are generally supplemented by a security criterion measuring the level of risk control.

Example of a criticality matrix

(1) Criticality is the determination of the accident likelihood via the gravity of its consequences: criticality = probability × gravity. Source : The Global Risks Landscape 2016- World Economic Forum

(1) Criticality is the determination of the accident likelihood via the gravity of its consequences: criticality = probability × gravity. Source : The Global Risks Landscape 2016- World Economic Forum  |

In risk mapping, each event is connected to a category: economic, environmental, geopolitical, social, technological,… The aim is to render data analysis easier and faster.

The elaboration of a mapping is generally wrapped around the three following stages:

- the stage of risk identification which consists of a large collection of information, a stage that makes it possible to establish the “Risk Model” (list of risks along with definitions and examples).

- a hierarchization stage that allows classification of the risks according to their frequency or likelihood of occurrence, their impact and their level of control.

- a synthesis stage which determines most important risks, that is, those that require the crafting of an appropriate action plan.

Risk mapping, a concrete example

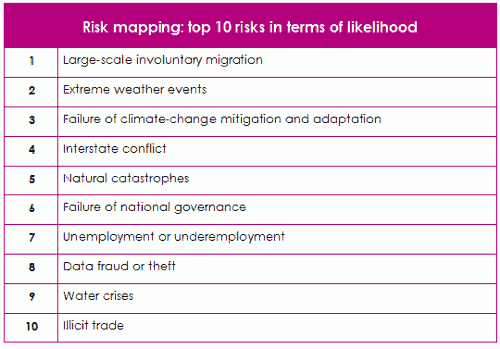

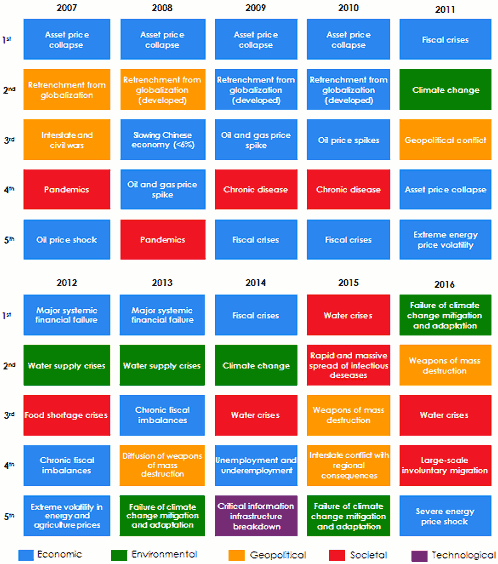

Since 2007, the World Economic Forum has been publishing a global risk mapping on an annual basis. This publication examines the probability for the occurrence of risks and their impact over a 10- year horizon. For 2016, the global investigation of risk perception has been designed to identify 29 global risks broken down into five categories: economic, environmental, geopolitical, social and technological. It has been carried out with 750 specialists from various areas of expertise throughout the world.

The survey draws up a bleak picture of the current situation, depicting the world in which risks have become imminent, with greater and more consistent impact. The lack of political visibility, social tensions, refugee crisis, terrorist attacks, climate change, technological risks are all the more new threats that mankind is currently up against.

Risk mapping and the he perception of global risks

|

Failure of the measures aimed at mitigating natural catastrophes stands among the most worrisome risks in 2016 both in terms of occurrence probability and impact. This perception rests on the findings of the COP 21(1). Consequently, temperatures are poised to rise well above the recommended threshold of 2° C, with ensuing increase of frequency and intensity of extreme weather events (tropical cyclones, floods, droughts, rising sea levels…)

This is the first time, since the start of publication of the review in 2007, that an environmental risk has been placed in pole position in terms of impact. Such a finding is worth taking into account by insurers.

Uncontrolled migratory trends also stand among most threatening risks. The risk of involuntary migration is in the high occurence-probability and strong-impact quadrant.

Water shortage, cyber criminality, unemployment, social unrest and inter-state conflicts are also among the major concerns of global economic decision makers.

Weapons of mass destruction are regarded as risks of unlikely occurrence, but are ranking as the second most important in terms of impact.

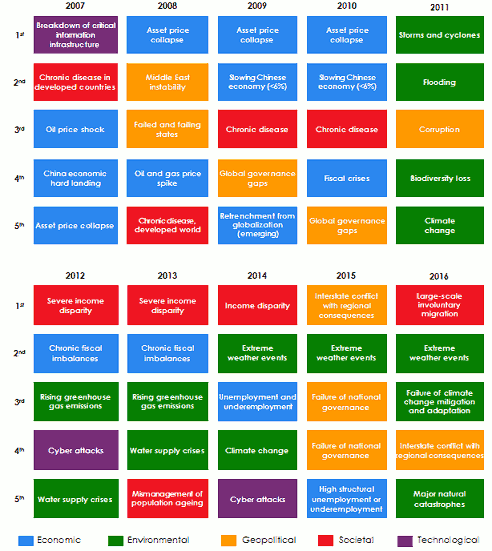

Evolution of risk perception

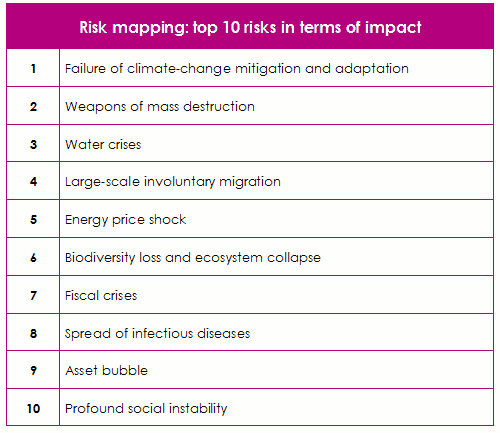

Top 5 global risks in terms of likelihood: 2007-2016

Source: World Economic Forum

Source: World Economic ForumTop 5 global risks in terms of impact: 2007-2016

Risk perception has profoundly evolved in recent years. Economic risks, long perceived as most worrying (fueled by the 2008 subprime crisis, the collapse of prices, budget crises and systemic financial defaulting), have been substituted in recent years by social and environmental risks.

Lack of political vision, aggravating social disparities, uncontrolled migratory flows and upsurge of extreme weather events are all the more major events that account for this new global perception.

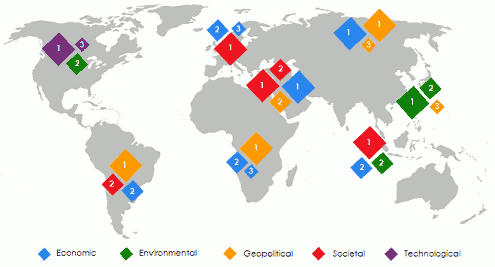

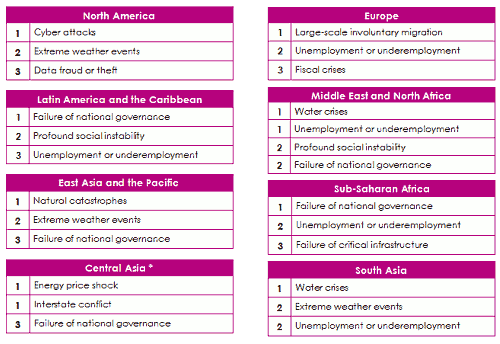

Risk mapping: breakdown of risks per region in 2016

The most likely global risks 2016: a regional perspective

No region is immune to the occurrence of major risks.

Environmental risks

Unbridled industrial development and global warming have triggered a disconcerting decrease in natural resources, especially fresh water reserves. This fact is particularly noticeable in the semi-arid areas of the Middle East and South East Asia.

Global warming has also resulted in increased probability for the occurrence of extreme weather events, especially in North America and Asia Pacific.

Social risks

Europe is the most affected by the risk of involuntary migration. A recent survey(1) published by management firm “Control Risk” has found that the biggest threat for Europe today is no longer the collapse of the euro zone but rather “the migrants’ crisis coupled with terrorism”. The phenomenon of migrant influx in Europe stands as “the biggest threat that The European Union has ever confronted for a long time”, the report added.

The same document mentions that the “terrorism” risk is poised to remain high in Europe, but also in Egypt and in Turkey.

Refugees influxes have attained unprecedented levels. In 2014, 59.5 million people around the world, pushed by poverty, violence and wars, were compelled to migrate. More than half the refugees came from the most affected countries: Syria, Iraq, Afghanistan and Somalia. This figure was limited to just 40 million during the Second World War. In 2014, the number of people who left their native countries amounted to 42 500 a day, a trend that is likely to impoverish border areas that generally host the highest number of refugees. In emerging economies, resource constraints may be substantial as UNO estimates housing costs for Syrian refugees in Jordan at more than 7% of Jordanian GDP.

In view of the extension of turmoil in Africa, Asia and Middle East, asylum seekers are more and more moving towards stable regions, especially Europe.

Geopolitical risks

Risk map shows that Africa and South America are the regions that are most vulnerable to geopolitical crises, especially the “national governance failure” risk. The social and political revolutions started in the MENA region(2) , such as the Arab Spring, repeated coups in sub-Saharan African countries and political unrest in Latin America account for this perception.

Technological risks

Cyber-risks which have considerably increased in the recent three years are an ever-increasing source of concern for insurers. This scourge now stands among the most probable risks. Moreover, the economic impact of such an event may be substantial. This threat is essentially felt in North America.

Unlike geopolitical and climate risks likely to happen in developing countries, technological risks, generally concentrated in developed countries, represent a turnover opportunity for insurance companies that lost no time to market cyber-risk policies.

According to a survey conducted by “Data Breach Investigation”, the cyber-risk market is poised to yield a turnover of 7.5 billion USD in 2020. For Allianz, cyber-risks are likely to generate a premium volume worth 20 billion USD in 2025.

(1) http://www.lesechos.fr/14/12/2015/lesechos.fr/021558499678_carte-mondiale-des-risques---l-europe-sous-une-menace-inedite.htm(2) Middle East and North Africa

Interconnection of risks

Apart from the imminent nature for their occurrence and expansion at the international level, the risks mentioned in the survey of the World Economic Forum are also characterized by their strong interconnection. Climate change-related events are, therefore, likely to trigger a collapse of the ecosystem in upcoming years with a shortage of raw material and a loss of biodiversity. These problems will generate food crisis and allow the spread of infectious diseases.

|

Migratory movements are, among others, encouraged by climate upsets and water shortages. These same migratory movements may trigger inter-state tensions along with economic and social problems such as illicit trade and unemployment.

The absence of an effective refugee integration policy in most host countries is likely to cause the establishment of isolated, marginalized communities vulnerable to radicalization, hence the emergence of a new connected risk: terrorism.

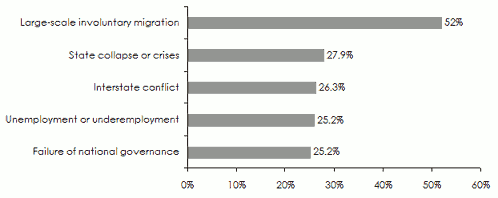

Perception of risks in the long and short terms

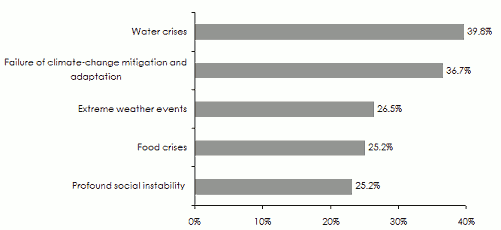

Top 5 global risks in the short term

Top 5 global risks in the long term

Risk mapping: the five major global long-term risks

|

llapse, inter-state conflicts, unemployment and failure of national governance constitute most urgent concerns for heads of companies and decision makers according to the investigation of the World Economic Forum.

This finding reveals that recent events such as the refugees’ crisis, the collapse of political regimes in the Middle East, political risks involving several countries (Russia, Europe, Turkey) have had their toll on the reflection and perception of risks for the persons polled.

The longer-term concerns (over the next ten years) pertain particularly to underlying risks like water shortage. Agricultural production and industrial activities are likely to increase in the next decades, thus providing enough to feed the ever-increasing populations. Fresh water demand is expected to exceed supply by 40% in 2030. The water demand for industrial and energy use is also expected to increase by 70%. Currently, Europe is dedicating 30% of its fresh water to the energy sector, a rate that amounts to 40% in the United States.

Between 80% and 90% of the reserves of the river basins in arid and semi-arid regions have been exhausted. Water scarcity coupled with poor sewerage are likely to render 2.4 billion people exposed to pandemics thought to be a thing of the past (Cholera, tuberculosis…)

The direct consequence of climate change and water mismanagement, the water crisis will in upcoming years constitute a major challenge for economic development, especially for the agricultural insurance business.

The failure of the measures designed to mitigate natural catastrophes, extreme weather events, the food crisis and social unrest also stand among long-term risks.