Samsung, insurance at the heart of the empire

The empire has been shaken by several scandals: failure of the last smartphone Galaxy Note 7, recall of several million electrical appliances, suspicions of corruption and fraud.

Samsung Group: the giant operates also in insurance

Samsung head office, South Korea © Oskar Alexanderson, CC BY-SA 2.0 Samsung head office, South Korea © Oskar Alexanderson, CC BY-SA 2.0 |

Set up in 1983 by Lee Byung-Chul, Samsung was initially a small company specialized in the export and shipping of food products to China.

80 years later, the company became a gigantic conglomerate operating in electronics, armament, heavy industry, advanced technologies, the construction of skyscraper and of factories, finance, petrochemicals, fashion, medicine, hospitality industry, entertainment and insurance.

By the end of 2014, this important chaebol(1) accounted for 74(2) companies which reported a global turnover of 305 billion USD, nearly 20% of South Korea's GDP. The group has now 489 000 wage earners scattered worldwide and eight Samsung towns. Located at the heart of Suwon City, the Samsung Digital City is hosting approximately 40 000 staff members. It is outfitted with stadiums, banks, hospitals, schools and restaurants.

(1) Chaebol: Typically South Korean conglomerate, composed of a set of companies, operating in various sectors and controlled by the members of the same family. These companies are conducting cross shareholdings among themselves.(2) Following numerous acquisitions-mergers, the number of companies has been brought from 74 down to 59 by the end of June 2016

Samsung Group: main business units

Three main clusters of activities have emerged: electronics, insurance and construction.

Samsung Electronics is the main component of the group, world leader of advanced technology and big audience electronics. Operational in mobile telephony, in particular, this division has provided 24.4% of smartphone's global production, 325 million sets a year, well ahead of Apple 16.4% (231.5 million sets) and Huawei 7.7% (106.6 million sets). Endowed with a turnover of 188 billion USD in 2014, the electronic business has accounted for 62% of the overall revenues reaped by the conglomerate.

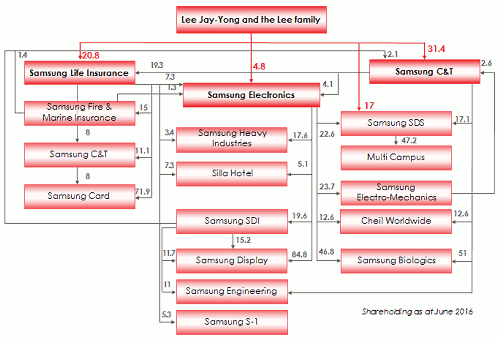

Samsung Life Insurance Company ranks high within the group. The company was set up in 1963 following the acquisition of Dongbang Life Insurance. The life insurer found itself in the middle of the chaebol activities as it detains substantial shareholdings in various insurance and other subsidiaries such as Samsung Fire & Marine Insurance (15%), Samsung Electronics (7.3%), Samsung C&T (11.1%), Samsung Card (71.9%).

Samsung Life, therefore, supervises the group’s finance activities which include life insurance, non life insurance, brokerage, credit cards, investment,… The premiums written by Samsung Life Insurance amounted to 23.4 billion USD in 2015, thus boosting the company to the first rank in the standings of South Korean life insurers with 23.4% of market shares.

Samsung C&T Engineering & ConstructionSamsung C&T Engineering & Construction is the giant group specialized in building and public works. Burj Khalifa (Dubai), the highest tower in the world, over 828 meters high, Taipei 101 skyscrapers (Taiwan) and Petronas Tower 2 (Kuala Lumpur, Malaysia) are among the group’s top building masterpieces.

Samsung Group: overhaul and governance crisis

In frail health, Lee Kun-Hee, son of the founder, manager of the group since 1987, is no longer able to lead the conglomerate. His three children are now entrusted with the management of the Samsung empire. In order to ensure succession and maintain control over the group, they will have to increase their shareholdings in various companies.

The complex imbroglio of cross shareholdings among the 59 entities that make up the group in 2016 resulted in only minority stakes detained by Lee family.

For instance, Samsung Electronics, center-piece of the puzzle, is detained at 18% by Lee family and its subsidiaries. Only 3.4% belong directly to the father Lee Kun-Hee whereas the elderly son Lee Jay-Yong and related family control 4.8% of the capital, with eventually a small shareholding of 0.58% for Lee Jay-Yong.

In order to have a firm grip over the group, Lee’s children, especially the elderly son Lee Jay-Yong, portrayed as the natural heir to the empire, are required to raise their capital by acquiring shares of companies. The conglomerate is therefore considering an overhaul of its structure in order to facilitate the takeover by Lee’s descendants.

Following the restructuring process, the heirs will ultimately become majority stakeholders. Lee Jay Yong would be in the driving seat of Samsung Electronics and of the different financial subsidiaries. Both sisters would be tasked each with one unit: distribution and entertainment or fashion and media.

Shareholding, by June 2016, of the Lee family in the main companies of the group Samsung

| Lee Kun-hee (Father) | Lee Jay-yong (Eldest son) | Lee Boo-jin (Eldest daughter) | Lee Seo-hyun (Youngest daughter) | |

|---|---|---|---|---|

Samsung Electronics | 3.44% | 0.58% | - | - |

Samsung C&T | 2.86% | 17.23% | - | - |

Samsung SDS | 0.01% | 9.2% | 5.51% | 5.51% |

Samsung Life | 20.76% | 0.06% | 3.9% | 3.9% |

Samsung Fire & Marine | - | 0.09% | - | - |

Some shareholders have come up with other forms of restructuring, exerting pressure on Lee family in order to push for the reconfiguration of the group into two distinct entities: an operational entity that would run Samsung Electronics’ industrial activities and a financial holding that would control the conglomerate’s other companies.

At the end of 2016, Samsung Life Insurance came under the limelight by increasing its shareholding on the market in various subsidiaries of the group at levels close to those enabling it to claim the title of financial holding according to the Korean law.

Samsung Group: failure of the last smartphone and consumers’ pressure

Marketed in late August 2016, Galaxy Note 7, last opus of Samsung, supposed to compete with Apple’s iPhone 7, has been withdrawn from the market a few days after its launch. Numerous cases of overheating batteries followed by explosion of the device have been reported. The problem has not been resolved despite the recall of the 2.5 million sets marketed and the replacement of faulty batteries. In October 2016, the world’s number one manufacturer of smartphones, eventually decided to stop the production of its Note 7 which has been withdrawn from the market.

According to estimates of Crédit Suisse, this misfortune may cost Samsung 15.8 billion USD in future-lost earnings. It may also cost the company five billion USD in recall expenses for the faulty sets, production costs of the telephone itself, sale suspension, recycling expenses for the 19 million sets produced.

What is worse, the loss of consumer confidence toward Samsung is inestimable. This incident has seriously impacted the group’s notoriety, compromising its position as the number one manufacturer of first-class smartphones.

Galaxy Note 7 fiasco is not just limited to material and immaterial losses. Indeed, numerous lawsuits have been lodged in the United States where users have claimed damages for the marketing of faulty products.

South Korean manufacturer’s ordeal is not over yet; nor is it confined to telephony. In early November 2016, Samsung Electronics was shaken by a new scandal which pushed it to recall approximately 3 million washing machines. This recall comes as a result to faulty manufacturing of the appliances which posed injury risks for users.

Organisation of Samsung Group in %