Saudi Reinsurance Company

It is with an extremely high capital, worth over 250 million USD, that the company embarked on the reinsurance market. Unfortunately, the starting year coincided with the outbreak of the global financial crisis. Consequently, the company’s beginnings were all the more difficult. Focused on the local market following its establishment in 2008, Saudi Re has been penalized by the poor results of direct insurance operations.

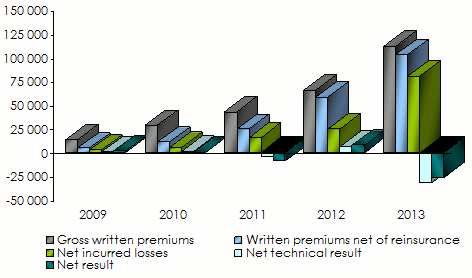

Despite strong growth in premiums which went more than eightfold within a period of five years (2009-2013), the company has been struggling to report positive results. The year 2013 was particularly disappointing with a net loss of over 26.5 million USD for gross written premiums of 112 million USD.

This poor temporary performance cannot overshadow the significant potential of the local market and the Gulf region in which Saudi Arabia is a major player. With a technical team, accustomed to hardships and a financial capacity rising to its ambitions, Saudi Re has the means to redress the balance and become one of the reinsurance leaders in the Middle East.

|  |

| Hesham Al-Sheikh | F. Abdulrahman Al-Hesni |

| Chairman | Managing director/CEO |

Saudi Re in 2013

| Share capital | 266 660 000 USD |

| Turnover | 112 020 222 USD |

| Assets | 461 452 733 USD |

| Shareholder's equity | 219 133 728 USD |

| Net loss | 26 573 779 USD |

| Non life net loss ratio | 109.1% |

| Management expenses ratio | 25% |

| Net combined ratio | 134.1% |

| Number of branches | 1 branch in Labuan, Malaysia |

| Number of employees | 47 |

Board of directors and management

| Chairman of the board | Hesham Al-Sheikh |

| Managing director/CEO | Fahad Abdulrahman Al-Hesni |

| Chief operating officer | Tarik Aouad |

| Chief financial officer | Nilmin Pieries |

| Marketing manager | Ahmed Al Jabr |

| Chief investment officer | Anirban Kundu |

Main technical highlights: 2009-2013

in USD

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Gross written premiums | 13 613 315 | 28 663 632 | 42 566 226 | 65 418 629 | 112 020 222 |

Net earned premiums (3) | 4 343 213 | 10 799 382 | 24 411 127 | 58 544 891 | 102 882 861 |

Net earned premiums | 2 224 442 | 7 762 208 | 14 637 591 | 42 497 158 | 77 268 086 |

Non life net earned premiums | 2 224 442 | 7 762 208 | 14 012 763 | 40 187 501 | 68 438 305 |

Life net earned premiums | - | - | 624 828 | 2 309 657 | 8 829 781 |

Net incurred losses | 1 353 652 | 5 116 873 | 15 588 570 | 24 625 815 | 80 066 484 |

Non life net incurred losses | 1 353 652 | 5 116 873 | 15 432 108 | 24 227 714 | 74 698 453 |

Life net incurred losses | - | - | 156 462 | 398 101 | 5 368 031 |

Management expenses (1) | 7 048 520 | 12 125 428 | 13 990 217 | 17 973 813 | 27 969 553 |

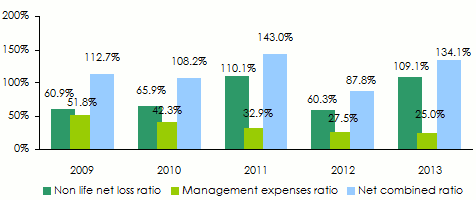

Non life net loss ratio | 60.9% | 65.9% | 110.1% | 60.3% | 109.1% |

Management expenses ratio (2) | 51.8% | 42.3% | 32.9% | 27.5% | 25.0% |

Non life net combined ratio | 112.7% | 108.2% | 143.0% | 87.8% | 134.1% |

Net technical result | 146 412 | 889 221 | -5 076 449 | 5 886 986 | -31 640 394 |

Net loss/profit | 1 287 705 | 15 009 | -9 149 035 | 7 729 544 | -26 573 779 |

1 management expenses = overhead expenses + gross acquisition costs

2 management expenses ratio = management expenses / gross written premiums

3 Net of reinsurance

Evolution of premiums, losses and results: 2009-2013

in thousands USD

Evolution of ratios: 2009-2013

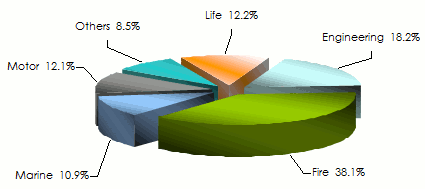

Turnover’s breakdown per class of business: 2009-2013

in USD

| 2009 | 2010 | 2011 | 2012 | 2013 | 2013 shares | |

|---|---|---|---|---|---|---|

Engineering | 3 875 980 | 8 468 333 | 10 387 509 | 16 601 665 | 20 436 376 | 18.2% |

Fire | 5 740 610 | 12 545 575 | 19 595 263 | 25 529 333 | 42 654 563 | 38.1% |

Marine | 2 477 461 | 3 381 361 | 5 787 193 | 8 093 312 | 12 169 842 | 10.9% |

Motor | 804 399 | 2 663 469 | 2 350 053 | 3 262 205 | 13 499 895 | 12.1% |

Health | - | - | 460 069 | 400 510 | - | - |

Others | 714 865 | 1 604 894 | 2 757 032 | 7 324 537 | 9 576 131 | 8.5% |

Life | - | - | 1 229 107 | 4 207 067 | 13 683 415 | 12.2% |

Total | 13 613 315 | 28 663 632 | 42 566 226 | 65 418 629 | 112 020 222 | 100% |

Turnover’s breakdown per class of business in 2013

Net technical results per class of business: 2009-2013

in USD

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Engineering | -25 222 | 543 692 | 232 280 | 1 665 009 | -3 859 527 |

Fire | -105 594 | -687 400 | -5 652 471 | -34 911 | -29 314 751 |

Marine | 65 348 | 421 098 | 94 816 | 2 094 878 | 993 876 |

Motor | 174 978 | 352 767 | -834 385 | 393 123 | -322 503 |

Health | - | - | 160 049 | 332 323 | - |

Others | 36 902 | 259 064 | 469 492 | -335 944 | -2 084 731 |

Total non life | 146 412 | 889 221 | -5 530 219 | 4 114 478 | -34 587 636 |

Life | - | - | 453 770 | 1 772 507 | 2 947 242 |

Total | 146 412 | 889 221 | -5 076 449 | 5 886 985 | -31 640 394 |

Net earned premiums: 2009-2013

in USD

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Engineering | 409 848 | 1 232 924 | 2 663 805 | 7 880 598 | 10 510 119 |

Fire | 851 429 | 2 876 896 | 5 562 015 | 17 891 316 | 32 531 379 |

Marine | 344 364 | 1 086 694 | 2 197 769 | 5 895 005 | 9 418 954 |

Motor | 502 562 | 2 087 436 | 2 358 579 | 2 433 983 | 8 155 268 |

Health | - | - | 231 291 | 430 927 | - |

Others | 116 239 | 478 259 | 999 303 | 5 655 672 | 7 822 585 |

Total non life | 2 224 442 | 7 762 209 | 14 012 762 | 40 187 501 | 68 438 305 |

Life | - | - | 624 828 | 2 309 657 | 8 829 781 |

Total | 2 224 442 | 7 762 209 | 14 637 590 | 42 497 158 | 77 268 086 |

Net incurred losses: 2009-2013

en USD

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Engineering | 268 614 | 376 948 | 1 561 176 | 3 326 696 | 10 028 975 |

Fire | 702 894 | 2 975 800 | 9 548 496 | 12 571 435 | 45 595 253 |

Marine | 118 028 | 346 698 | 1 276 158 | 1 584 649 | 5 331 272 |

Motor | 207 690 | 1 284 888 | 2 713 488 | 1 597 718 | 5 567 088 |

Health | - | - | 68 942 | 96 601 | - |

Others | 56 426 | 132 539 | 263 847 | 5 147 216 | 8 175 865 |

Total non life | 1 353 652 | 5 116 873 | 15 432 108 | 24 324 315 | 74 698 453 |

Life | - | - | 156 462 | 398 101 | 5 368 031 |

Total | 1 353 652 | 5 116 873 | 15 588 569 | 24 722 416 | 80 066 484 |

Non life net loss ratio: 2009-2013

| 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|

Engineering | 65.5% | 30.6% | 58.6% | 42.2% | 95.4% |

Fire | 82.6% | 103.4% | 171.7% | 70.3% | 140.2% |

Marine | 34.3% | 31.9% | 58.1% | 26.9% | 56.6% |

Motor | 41.3% | 61.6% | 115.0% | 65.6% | 68.3% |

Health | - | - | 29.8% | 22.4% | - |

Others | 48.5% | 27.7% | 26.4% | 89.3% | 104.5% |

Total | 60.9% | 65.9% | 110.1% | 60.3% | 109.1% |

Sources: Figures extracted from the different balance sheets of Saudi Re

Exchange rate SAR/TND as at 31/12 | 2009 | 2010 | 2011 | 2012 | 2013 |

0.26665 | 0.26670 | 0.26669 | 0.26698 | 0.26666 |

Saudi Reinsurance Company

| Headquarters | 4130 Northern Ring rd. - Exit 7 P Box 300259 - Riyadh 11372 - Saudi Arabia |

| Tel | +966 11 510 2000 |

| Fax | +966 11 510 2111 |

info [at] kic-kw [dot] com (info [at] saudi-re [dot] com ) | |

| Website |