SOCABU

With a +12.8% average annual growth of its turnover between 2005 and 2009, SOCABU has managed to consolidate its position as a leader of the Burundi market. Despite the increase of its loss experience in 2009, the company is posting an excellent result thanks to sound financial incomes. Estimated at about 1.4 million USD, the latter account for 21.5% of the written premiums of the year.

With a +12.8% average annual growth of its turnover between 2005 and 2009, SOCABU has managed to consolidate its position as a leader of the Burundi market. Despite the increase of its loss experience in 2009, the company is posting an excellent result thanks to sound financial incomes. Estimated at about 1.4 million USD, the latter account for 21.5% of the written premiums of the year.

More than thirty years after its creation, SOCABU is reporting substantial growth in the recent five years. With life insurance growing at a +36.2% pace per year against a +6.1% for non life business, the company could bring a new breath in its endeavour for critical size.

|  |

| NDUWIMANA Onésime | SINDAYIGAYA Augustin |

| General Manager | Life insurance manager |

SOCABU in 2009

| Capital | 237 000 USD |

| Turnover | 6 631 372 USD |

| Shareholder’s equity | 6 294 227 USD |

| Net result after tax | 924 541 USD |

| ROE | 14.7% |

| Loss ratio | 74.5% |

| Combined ratio | 115.9% |

| Number of agencies | 2 agencies and a nationwide presence via the National Postal Administration |

| Number of employees | 173 |

Management

| General Manager | NDUWIMANA Onésime |

| Life insurance manager | SINDAYIGAYA Augustin |

| Administrative manager | KANYANGE Geneviève |

| Financial manager | KIGEME Elsie Carmen |

| Sales manager | BAREGERANYE Pierre Claver |

| Counsellor to the general manager | NDIKUBWAYO Athanase |

| Head of the internal audit department | HAKIZIMANA André |

Main shareholders

| State of Burundi | 25% |

| Other companies and individuals | 75% |

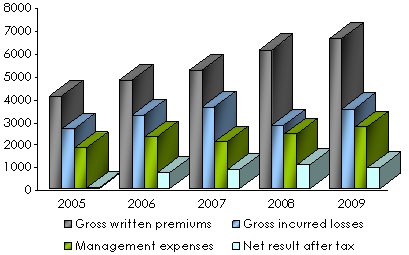

Main technical highlights: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | |

|---|---|---|---|---|---|

Gross written premiums | 4 100 067 | 4 777 290 | 5 217 004 | 6 125 145 | 6 631 372 |

Written premiums net of reinsurance | 3 410 824 | 3 985 674 | 4 385 276 | 4 976 794 | 5 398 915 |

Gross earned premiums | NA | NA | 3 531 462 | 4 312 114 | 4 752 532 |

Gross incurred losses | 2 640 297 | 3 258 803 | 3 592 486 | 2 811 418 | 3 542 673 |

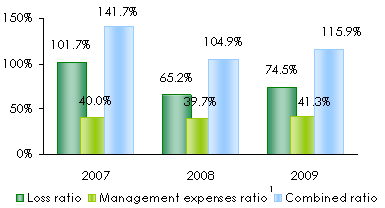

Loss ratio* | NA | NA | 101.7% | 65.2% | 74.5% |

Management fees | 1 824 400 | 2 307 465 | 2 084 543 | 2 430 044 | 2 741 389 |

Technical result | 640 933 | 782 988 | 873 601 | 1 213 315 | 1 193 109 |

Financial income | 1 216 317 | 956 975 | 1 225 533 | 1 497 713 | 1 426 609 |

Net result | 48 061 | 710 409 | 828 175 | 1 058 459 | 924 541 |

Evolution of premiums, losses, management expenses and results

in thousands USD

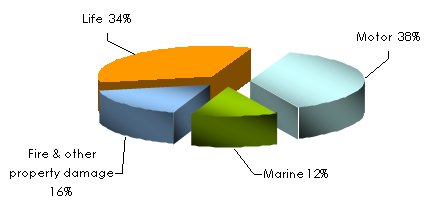

Turnover’s evolution per class of business: 2005-2009

in USD| 2005 | 2006 | 2007 | 2008 | 2009 | 2009 shares | 08/09 growth | ||

|---|---|---|---|---|---|---|---|---|

| Non life | ||||||||

Motor | 2 000 802 | 2 035 015 | 1 960 254 | 2 106 234 | 2 484 009 | 37.5% | 17.9% | |

Marine | 922 371 | 842 268 | 977 654 | 1 194 843 | 820 027 | 12.4% | -31.4% | |

Fire & other property damage | 518 715 | 651 276 | 559 001 | 1 007 660 | 1 060 893 | 16% | 5.3% | |

Total non life | 3 441 888 | 3 528 560 | 3 496 908 | 4 308 737 | 4 364 929 | 65.8% | 1.3% | |

| Life | ||||||||

Total life | 658 179 | 1 248 731 | 1 720 096 | 1 816 407 | 2 266 443 | 34.2% | 24.8% | |

Grand total | 4 100 067 | 4 777 290 | 5 217 004 | 6 125 145 | 6 631 372 | 100% | 8.3% | |

Breakdown per class of business in 2009

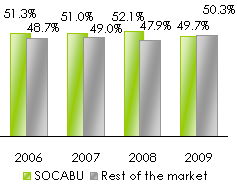

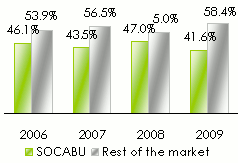

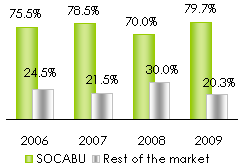

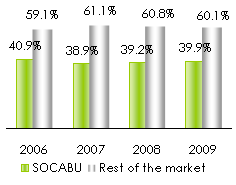

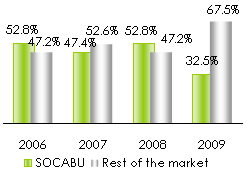

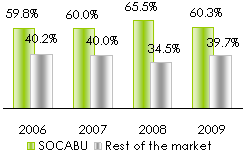

SOCABU’s market shares in Burundi: 2006-2009

Life and non life markets  | Non life market  |

Life market  | Motor  |

Marine  | Fire and other property damage  |

Evolution of ratios: 2007-2009

Exchange rate BIF/USD as at 31/12 | 2005 | 2006 | 2007 | 2008 | 2009 |

0.00098 | 0.00096 | 0.00088 | 0.00081 | 0.00079 |

Contact

| Head office | P.O. Box 2440 Bujumbura Burundi |

| Phone | (+257) 22 20 90 00 |

| Fax | (+257) 22 22 68 03 |

socabu [at] socabu-assurances [dot] com | |

| Website |

0

Your rating: None

Mon, 20/05/2013 - 17:09

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news