Systemic risk in reinsurance

In the first part, published in October 2014, Atlas has drawn up the status of reinsurance in the Middle East and Africa, presenting major renewal trends in 2015 and proposing some insights into the profitability of reinsurers. The second part, published in November 2014, was devoted to major reinsurance markets, the rating of reinsurers, the toll of natural catastrophes and to the aviation market.

Recent financial crises and the fall of emblematic institutions as Lehman Brothers and AIG have shaken the world economy, making systemic risk the topic that stirs the bank and insurance industries. Since the 2008 events, this concept that feeds think tanks has resulted in much research and in the publication of a high number of reports.

While the banking sector has obviously come under the spotlight, insurance and reinsurance also raise questions, especially after the sinking of the American insurer AIG. To prevent such a scenario from happening again, the Financial Stability Board (FSB) intends to exercise greater control over insurers and reinsurers.

While the banking sector has obviously come under the spotlight, insurance and reinsurance also raise questions, especially after the sinking of the American insurer AIG. To prevent such a scenario from happening again, the Financial Stability Board (FSB) intends to exercise greater control over insurers and reinsurers.

While banks and insurance companies are heavily involved in the latest financial crisis, they nevertheless played different roles. These two institutions have also been affected to varying degrees. To rescue AIG, the American Federal Reserve (FED) has had to inject 182 billion USD of loans in the insurer’s accounts.

In Europe, several tens of billions of dollars were needed to clean up some insurers and separate their banking and insurance activities. A tlas Magazine is publishing the third and final part of its special reinsurance report. This component defines systemic risk and its relevant features.

The banking system has been more heavily penalized. States had to intervene massively to support some players. Nearly 1 000 billion USD were needed to save the banks and put out the fire that threatened the global economy by a domino effect.

The definition of systemic risk

There is no common definition of systemic risk. However, a systemic risk is referred to when a particular event causes by chain reactions a major malfunction of the financial system and the collapse of the entire global economy. This dysfunction can later trigger defiance against all banks, insurance, and other similar institutions. This definition is particularly the one adopted by the Financial Stability Board (FSB) whose role is to preserve the stability of the financial sector.

In 2009, the FSB and the International Monetary Fund (IMF) adopted a similar approach defining systemic risk as the risk of disruption to financial services that is caused by a disruption of all components of the financial system and that has a strong negative impact on the real economy. This approach is supported by the G20 and the governors of central banks.

The approach of systemic risk

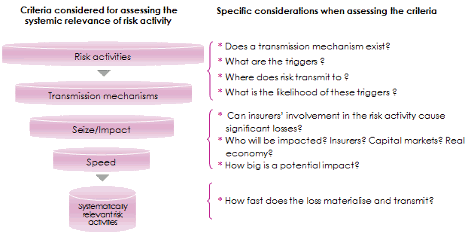

Three key criteria used to identify systemic potential for markets and institutions:

- The size, which is measured by the volume of financial services provided by an individual component of the financial system,

- The substitutability, that is to say, the possibility for another component of the system to provide the same services in the event of failure,

- The interconnection or the existence of links between system components.

The key element to remember is the fact that systemic events are associated with external shocks.

Risk activities are deemed systematically relevant if all three criteria are met. Source: Systemic Risk Insurance, Geneva association

Risk activities are deemed systematically relevant if all three criteria are met. Source: Systemic Risk Insurance, Geneva associationBanking and insurance industries: different economic models

Insurers and reinsurers have exhibited good stability throughout the 2008 crisis. The turmoil that affected some reinsurers had nothing to do with the subprime problems but was due to an underestimation of the reserves of some third party liability (TPL) policies in the United States.

Capital increases were then necessary. Despite the turmoil, reinsurers have always been able to meet their obligations vis-à-vis their ceding companies. Only the underwriting of directors and officers TPL policies and those relative to credit were submitted to greater oversight. Insurers and reinsurers who have followed a traditional business model managed to withstand the crisis well.

AIG’s headquarters © AIG, CC BY-SA 3.0 AIG’s headquarters © AIG, CC BY-SA 3.0 |

Despite an overall satisfactory situation for the entire market, some insurers have experienced serious difficulties. The collapse of AIG has been a haunting memory. The troubles of the US giant had originated from the quasi-banking activities of some of its subsidiaries and not from its insurance business.

Other insurers and reinsurers failed to honor their commitments in non-traditional operations such as purely financial covers.

Reinsurers’ bankruptcies are rare events. Insurers have a long history with that fact, even if their failure has, to date, never destabilized the sector, and much less the economy of a country.

According to statistics from the Federal Deposit Insurance Corporation (FDIC), 140 American banks were closed in 2009 and 157 in 2010 whereas only 29 reinsurers had gone bankrupt during the period from 1980 to 2011.

The banking business model

The business model of banks is based on medium and long-term loan financing through savings and short-term deposits.

The Basel Committee, in charge of banking supervision, adopted a series of reforms designed to strengthen the regulatory framework of the sector. Measures have been taken to prevent systemic risk of major banking institutions. They would allow:

- to reduce default likelihood for large banks in order to prevent the collapse of the system. The ultimate objective is to increase banks’ ability to absorb losses.

- to mitigate the impact of a possible default triggered by a domino-effect. This is mainly to improve procedures for dispute settlement and bail-out systems.

In order to identify the systemic risk of banks, the Basel Committee has developed an indicator that takes into account the size of the bank, its overall activity, its network, its interconnections with the market and the possibility of substitution of the bank by one or other banking institutions.

Insurers and reinsurers’ business model

The business model of insurers and reinsurers is different from that of the banks. It has specific features that enhance its stability within the financial system. This model includes several lines of defense, including:

- Risk underwriting method:

- Business assessment with forward-looking models and strict procedures,

- Underwriting methods that leave no room for speculation.

- The reversal of the economic cycle:

- Advance premiums payment to obtain coverage.

- Compensation after the occurrence of an event whose happening was initially regarded to be random during risk underwriting.

- In non life insurance, the settlement of claims is not always immediate: the liabilities are not immediately due to insurers. This compensation may take months or even years for the classes of business requiring long liquidation. Liquidity risk is therefore low. In addition, claim occurrence is independent of the economic situation, even if a link can be established between recession and insurance fraud. This phenomenon remains, nonetheless, marginal.

- In life insurance, benefits are often paid according to previously-set dates.

- Insurers and reinsurers’ risks are accounted for in the balance sheet. It is worth noting that the recent international financial crisis originated in the banks’ off balance sheet activities.

The structure of insurers and reinsurers’ liabilities protect them from any possibility of rapid or enforced liquidation of their assets at unfavorable market conditions. Insurance companies settle compensation only after the occurrence of an event, sometimes even waiting for the findings of an investigation to be disclosed after months or years.

The structure of insurers and reinsurers’ liabilities protect them from any possibility of rapid or enforced liquidation of their assets at unfavorable market conditions. Insurance companies settle compensation only after the occurrence of an event, sometimes even waiting for the findings of an investigation to be disclosed after months or years.Insurers and reinsurers have liquid assets in return for commitments devoid of liquid assets.

- Safeguards:

The regulatory authorities have adopted a set of safeguards to protect policyholders, insurers and reinsurers. Furthermore the business itself creates its own review mechanisms and engagement monitoring tools. Many barriers can be mentioned such as:

- Regular review of premium rate (annual review for reinsurance).

- Build-up of reserves that reflect insurers and reinsurers’ liabilities. Payment of compensation is guaranteed by the level of reserves established using actuarial methods.

- Atomisation of risk between insurers and reinsurers at a first level, then between reinsurers and retrocessionaires at a second level.

- Maintaining adequate level of capital which must be invested according to strict rules that promote safety, liquidity, and profitability. Likewise for assets guaranteeing coverage of technical provisions.

- Oversight by regulatory authorities that ensure compliance with the rules established.

As for banks, the insurance market and its players are scrutinized by rating agencies. Reinsurers generally have a comfortable solvency margin, with leaders getting ratings between A+ and AA, an indication of solid financial position.

As for banks, the insurance market and its players are scrutinized by rating agencies. Reinsurers generally have a comfortable solvency margin, with leaders getting ratings between A+ and AA, an indication of solid financial position.

Another point of comparison shows that insurers and reinsurers have very large portfolios of assets they manage according to their commitments. These investments are not only much lower than those of banks, but their management significantly differs from that conducted by traditional financial institutions whose baseline references the financial market itself.

The specificities of the reinsurance market

The insurers cede a share of the risks underwritten to reinsurers who, on their turn, will cede another part to retrocessionaires. Seldom does a reinsurer accept a risk that he, himself, had ceded before. An explosive accumulation of the same risks between the same reinsurers causing the collapse of a set of actors is, therefore, almost nonexistent.

This phenomenon known as LMX spiral (London Market Excess of Loss) had emerged on the London market during 1980-1990. Today, changes in regulations prevent such a scenario from resurfacing.

Risk sharing between insurers, reinsurers, and retrocessionaires is effectively conducted. Risk dispersion chain among the different stakeholders paves the way for some mutualization whereby each player commits to maintain part of the undertakings. In addition, due to diversity of the geographical areas and classes of business covered, portfolios consist of risks that are not or are hardly correlated. A claim, even a catastrophic one, can only impact a portion of the portfolio.

Finally, the disappearance of a reinsurer does not happen overnight. It is a long and orderly process in which the reinsurer itself or the liquidator will honor all or part of the payment of claims. Repudiation of previously signed contracts is not possible. This run-off situation may spread over many years and can be performed by specialized companies. Defaulting reinsurers constitute an asset that is appreciated by the market.

Finally, the disappearance of a reinsurer does not happen overnight. It is a long and orderly process in which the reinsurer itself or the liquidator will honor all or part of the payment of claims. Repudiation of previously signed contracts is not possible. This run-off situation may spread over many years and can be performed by specialized companies. Defaulting reinsurers constitute an asset that is appreciated by the market.

Systemic risk in reinsurance

End 2013, the Global Reinsurance Forum conducted a study of systemic risk in the reinsurance industry. Several factors were analyzed, including:

- the possibility of replacing a reinsurer by another,

- the domino effect exerted by the disappearance of a reinsurer,

- the disappearance of a major reinsurer.

The conclusion of the study is categorical; reinsurers cannot represent a systemic risk:

- Reinsurance capacity is all sufficient. Technical knowledge is diversified and well spread around the market. The disappearance of a reinsurer can be easily offset by another reinsurer thanks to the intervention of brokers.

- Professional relations between insurers and reinsurers and reinsurers themselves are limited rendering the domino effect unlikely.

- Substitution capacities exist for all standard and personal risks such as terrorism or credit risks with specialized pools (TRIA GAREAT, Fair Pool, AWRIS, etc.). Alternative reinsurance is also there to provide substitute solution.

Even the disappearance of a leading insurance company cannot have a major impact on a reinsurer.

Hence, reinsurers do not seem to represent a systemic threat greater than that provided by any other non-banking company of comparable size. In fact, their risk profile fits more with that of a long-term asset manager.

A list of nine international insurers that may represent a systemic risk to the global financial system was established by the G20 in 2013. This list does not include any reinsurer. Are regarded as systemic insurers: Axa, Allianz, Assicurazioni Generali, Aviva, Prudential, Ping An Insurance of China, AIG, MetLife and Prudential Financial.

The G20 committee © Kremlin.ru, CC BY 3.0 The G20 committee © Kremlin.ru, CC BY 3.0 |

Within the financial system, the business model of banks is completely different from that of insurers and reinsurers. The latter are not treated with the same severity and are therefore not subject to strict screening of the systemic risk. The nine insurers listed by the G20 will nevertheless accept close oversight and comply with the new requirements in particular to increase their shareholder’s equity by 2019.