The Egyptian insurance market

Characteristics of the insurance market

- Regulatory body: Egyptian Insurance Supervisory Authority (EISA)

- Written premium in 2001/2002 : 370.7 millions USD

- 3rd insurance market in Africa behind South Africa and Morocco.

- 4th Arabic market behind Saudi Arabia, Morocco, and United Arab Emirates.

- Insurance density: 5 USD per capita

- Insurance penetration ratio : 0.41%

- Mandatory insurance: Motor liability, decennial liability and engineering.

- Mandatory reinsurance cessions to the Egyptian Reinsurance Company

Market structure 2001/02

- Insurance companies: 16 (3 of which specialized in Life insurance)

- Reinsurance companies: 1

Identity

- Area: 995,450 Km²

- Population (2002): 70,000,000 inhabitant

- GDP (2002): 90 billion USD

- GDP per capita : 1 285 USD

- GDP growth rate (2002): +1.7%

- Inflation rate (2002): 4.3%

- Main activity sectors : textile, food products, tourism, chemical products, hydrocarbons, cement, metals

Main cities

(in millions of inhabitants)

- Cairo: 12

- Alexandria: 3.5

- Tanta: 3.5

- Shobra: 0.8

- Port Said: 0.5

- Suez: 0.5

The market figures (2001/02)

Life turnover | Non-Life turnover | |

|---|---|---|

| in thousands USD | in thousands USD |

| Companies | Written premium | Market share |

|---|---|---|

Al Chark Insurance | 43 236 | 37.0% |

Misr Insurance | 36 585 | 31.3% |

Pharaonic American Life | 11 078 | 9.5% |

National Insurance | 9 629 | 8.2% |

Mohandes Insurance | 6 495 | 5.7% |

Delta Insurance | 3 899 | 3.3% |

Commercial International Life | 3 855 | 3.2% |

Suez Canal Insurance | 2 162 | 1.8% |

Total | 116 940 | 100% |

| Companies | Written premium | Market share |

|---|---|---|

Misr Insurance | 103 139 | 40.7% |

Al Chark Insurance | 46 314 | 18.3% |

National Insurance | 31 554 | 12.4% |

Suez Canal Insurance | 23 345 | 9.2% |

Mohandes Insurance | 11 794 | 4.6% |

Pharaonic Insurance | 10 911 | 4.3% |

Delta Insurance | 10 109 | 4.0% |

Arab International | 8 574 | 3.4% |

Arab Misr Insurance Group | 6 356 | 2.5% |

Cooperative Ins. Society | 1 495 | 0.6% |

Export Credit Garantee | 130 | 0.1% |

Total | 253 721 | 100% |

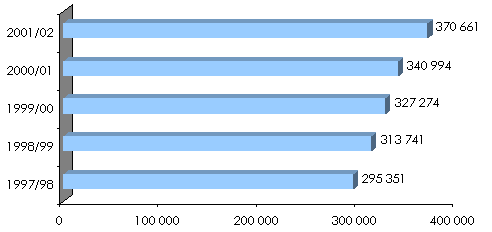

Development of the market turnover

in thousands USD

Non-life turnover by branch and by insurer

in thousands USD| Companies | Total | Fire | Marine | Aviation | Accident | Health | Engineering | Energy | Motor |

|---|---|---|---|---|---|---|---|---|---|

Misr Insurance | 103 139 | 17 134 | 8 963 | 28 806 | 7 864 | 2 131 | 6 347 | 9 240 | 22 653 |

Al Chark Insurance | 46 314 | 5 662 | 4 925 | 529 | 4 983 | 1 392 | 2 270 | 6 642 | 19 911 |

National Insurance | 31 554 | 5 437 | 3 623 | 0 | 6 535 | 1 094 | 1 625 | 0 | 13 239 |

Suez Canal Insurance | 23 345 | 1 960 | 4 058 | 0 | 5 837 | 264 | 6 197 | 0 | 5 030 |

Mohandes Insurance | 11 794 | 3 838 | 1 374 | 0 | 1 978 | 190 | 710 | 0 | 3 704 |

Pharaonic Insurance | 10 911 | 2 066 | 1 458 | 180 | 1 986 | 0 | 1 233 | 0 | 3 989 |

Delta Insurance | 10 109 | 2 083 | 901 | 0 | 1 572 | 591 | 477 | 0 | 4 485 |

Arab International | 8 574 | 2 868 | 1 426 | 0 | 4 280 | 0 | 0 | 0 | 0 |

Arab Misr Ins. Group | 6 356 | 1 444 | 1 080 | 0 | 1 109 | 242 | 153 | 0 | 2 327 |

Cooperative Ins. Society | 1 495 | 142 | 6 | 0 | 940 | 335 | 0 | 0 | 73 |

Export Credit Guarantee | 130 | 0 | 0 | 0 | 130 | 0 | 0 | 0 | 0 |

Total | 253 721 | 42 635 | 27 815 | 29 515 | 37 214 | 6 239 | 19 010 | 15 882 | 75 411 |

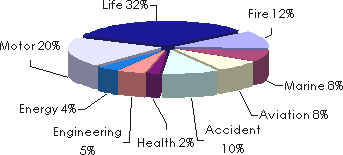

Turnover apportionment by branch

Source: Egyptian Insurance Supervisory Authority

0

Your rating: None

Thu, 09/05/2013 - 17:27

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news