The Indian insurance market

Insurance market features

- Regulatory authority: Insurance Regulatory and Development Authority

- Gross premiums (2003): 15 593.9 millions USD

- Insurance density (2003): 14.8 USD

- Penetration rate (2003): 2.6%

2003 insurance market structure

| Class of business | Public Sector | Private Sector | Total |

|---|---|---|---|

Non life insurance | 5 | 8 | 13 |

Life insurance | 1 | 12 | 13 |

Reinsurance | 1 | 0 | 1 |

Total | 7 | 20 | 27 |

Identity

- Area: 3 287 590 Km2

- Population (2003): 1 056 300 000 inhabitants

- GDP (2003): 601 billion USD

- GDP per capita(2003): 569 USD

- GDP growth rate (2003): 7.1%

- Inflation rate (2003): 3.9 %

- Main economic sectors:textile industries, mining exploitation, chemical industries, precious stones and jewels production, agriculture

Major towns

(in number of inhabitants)

- Mumbai: 19 000 000

- Calcutta: 13 000 000

- New Delhi (capital): 12 300 000

- Chennai: 4 000 000

2003 non life insurance figures

Split by company

in millions USD| Gross premiums | Net premiums | Net claims | Loss ratio* | |

|---|---|---|---|---|

| Public sector | ||||

NEW INDIA | 1 057.3 | 772.5 | 593.0 | 76.8% |

UNITED | 652.4 | 459.7 | 418.6 | 91.1% |

NATIONAL | 630.5 | 468.1 | 355.8 | 76.0% |

ORIENTAL | 630.1 | 417.1 | 322.2 | 77.2% |

ECGC | 82.3 | 80.5 | 73.4 | 91.2% |

Total | 3 052.6 | 2 197.9 | 1 763.0 | 80.2% |

| Private sector | ||||

BAJAJ ALLIANZ | 65.1 | 39.7 | 23.4 | 58.9% |

TATA-AIG | 51.4 | 27.8 | 13.2 | 47.5% |

IFFCO-TOKIO | 46.9 | 15.4 | 6.3 | 40.9% |

ICIC-LOMBARD | 46.5 | 9.8 | 3.9 | 39.8% |

RELIANCE | 40.8 | 4.2 | 4.2 | 100% |

ROYAL SUNDARAM | 40.5 | 24.0 | 12.9 | 53.8% |

CHOLAMANDALAM MS | 3.2 | 1.0 | 0.1 | 10% |

HDFC CHUBB | 2.1 | 1.4 | 0.2 | 14.3% |

Total | 296.5 | 123.3 | 64.2 | 52.1% |

Grand total | 3 349.1 | 2 321.2 | 1 827.2 | 78.7% |

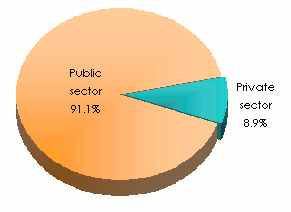

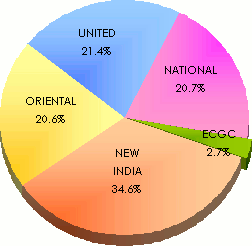

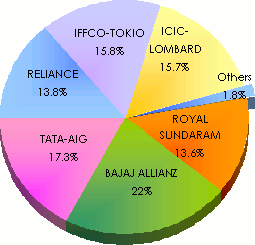

Market share by sector and by company

Non life gross premiums : 2002-2003

| ||

Public sector | Private sector | |

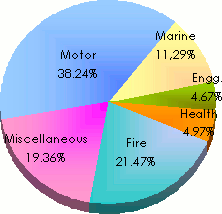

Split by class of business

Non life gross premiums: 2002-2003

2003 Life premiums split by company

in millions USDCompanies | Gross premiums |

|---|---|

LIFE INSURANCE CORPORATION | 12 001.0 |

ICICI-PRUDENTIAL LIFE | 91.7 |

HDFC STANDARD LIFE | 32.7 |

BIRAL SUN LIFE | 31.6 |

MAX NEW YORK LIFE | 21.2 |

SBI LIFE | 15.9 |

TATA-AIG | 15.8 |

ALLIANZ BAJAJ LIFE | 15.2 |

OM KOTAK LIFE | 8.9 |

ING VYSYA LIFE | 4.6 |

AVIVA | 3.0 |

METLIFE INDIA INSURANCE | 1.7 |

AMP SANMAR | 1.4 |

TOTAL | 12 244.7 |

Exchange rate USD/INR as at 31/12 | 2000 | 2001 | 2002 | 2003 |

47.256 | 48.485 | 47.925 | 45.519 |

0

Your rating: None

Tue, 14/05/2013 - 10:03

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news