The Kenyan insurance market

Insurance market features

- Regulatory authority: Ministry of Finance Insurance department

- Premiums (2004): 414 million USD

- Insurance density (2004): 12.77 USD

- Penetration rate (2004): 2.76%

Market structure in 2004

Actors | Number |

|---|---|

Insurance companies | 40 |

Life companies | 6 |

Non life companies | 19 |

Life & non life companies | 15 |

Reinsurance companies | 2 |

Brokers | 190 |

Identity

- Area: 582 650 Km2

- Population (2004): 32 400 000 inhabitants

- GDP (2004): 15 billion USD

- GDP per capita (2004): 463 USD

- GDP growth rate (2004): 2.1%

- Inflation rate (2004): 11.7%

- Main economic sectors: agricultural products (tea, coffee, corn, wheat, sugarcane) aluminium, cement, tourism

Major cities

(in number of inhabitants)

- Nairobi (capital): 3 000 000

- Mombasa: 900 000

- Kisumu: 400 000

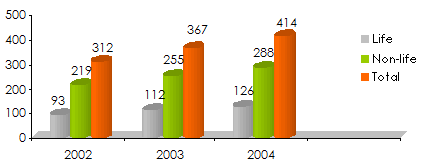

Turnover evolution: 2002-2004

in thousands USD| 2002 | 2003 | 2004 | 2003/2004 Growth rate | |

|---|---|---|---|---|

| Life | ||||

Written Premiums | 93 000 | 112 000 | 126 000 | 12.50% |

Market shares | 30% | 31% | 30% | - |

| Non life | ||||

Written Premiums | 219 000 | 255 000 | 288 000 | 12.94% |

Market shares | 70% | 69% | 70% | - |

Total | 312 000 | 367 000 | 414 000 | 12.81% |

in millions USD

2004 top ten of insurance companies

Non life companies | Life companies | |

|---|---|---|

| in thousands USD | in thousands USD |

Companies | Premiums | Market shares |

|---|---|---|

Kenindia Insurance | 26 700 | 9.27% |

Blue Shield Insurance | 21 500 | 7.47% |

APA | 19 700 | 6.83% |

ALICO | 16 900 | 5.87% |

UAP Provincial | 16 800 | 5.85% |

Invesco | 13 600 | 4.72% |

Jubilee Insurance | 13 500 | 4.67% |

Standard Insurance | 13 100 | 4.55% |

Madison Insurance | 12 900 | 4.47% |

Heritage AII | 11 900 | 4.14% |

Companies | Premiums | Market shares |

|---|---|---|

Insurance Co. of East Africa | 23 900 | 18.96% |

ALICO (CFC Life) | 18 500 | 14.65% |

British American Insurance Co. | 15 400 | 12.26% |

Pan Africa | 13 800 | 10.97% |

Jubilee Insurance | 12 700 | 10.10% |

Kenindia Assurance Co. | 8 500 | 6.74% |

Madison Insurance Co. | 7 600 | 6.02% |

Old Mutual Insurance Co. | 6 600 | 5.20% |

CIC | 6 000 | 4.73% |

Heritage AII | 2 800 | 2.26% |

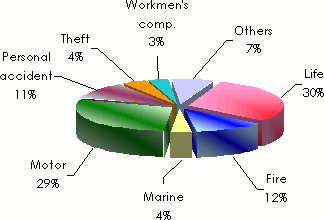

Premiums split by classes of business in 2004

in thousands USD| Written premiums | Market shares | |

|---|---|---|

| Non life | ||

Motor | 118 400 | 29% |

Fire | 48 700 | 12% |

Personal accident | 46 500 | 11% |

Theft | 16 600 | 4% |

Marine | 15 100 | 4% |

Workmen's compensation | 13 900 | 3% |

Engineering | 9 300 | 2% |

Miscellaneous | 8 300 | 2% |

TPL | 8 200 | 2% |

Aviation | 3 200 | 1% |

Non life total | 288 200 | 70% |

| Life | ||

Life total | 125 800 | 30% |

Grand total | 414 000 | 100% |

Non-life loss ratios: 2000-2004

| 2000 | 2001 | 2002 | 2003 | 2004 | |

|---|---|---|---|---|---|

Aviation | 68% | 48% | 50% | 72% | 132% |

Engineering | 95% | 23% | 17% | 53% | 36% |

Domestic fire | 42% | 29% | 37% | 26% | 27% |

Industrial fire | 32% | 38% | 47% | 37% | 39% |

TPL | 87% | 116% | 136% | 55% | 47% |

Marine | 60% | 46% | 42% | 34% | 36% |

Motor private | 67% | 63% | 70% | 68% | 71% |

Motor commercial | 86% | 75% | 44% | 55% | 51% |

Personal accident | 84% | 67% | 65% | 68% | 64% |

Theft | 78% | 72% | 67% | 69% | 56% |

Workmen's compensation | 80% | 79% | 92% | 106% | 115% |

Miscellaneous | 36% | 43% | 27% | 26% | 44% |

Market average | 72% | 59% | 56% | 62% | 60% |

Exchange rate USD/KES as at 31/12 | 2002 | 2003 | 2004 | 2005 |

78,75 | 75,94 | 79,17 | 76,38 |

Sources: Association of Kenyan Insurers, Ministry of Finance, Kenya - Insurance department

0

Your rating: None

Tue, 14/05/2013 - 15:31

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news