The Mauritian insurance market

Insurance market features

- Regulatory authority: Financial Services Commission

- 2002 written premiums: 213.7 millions USD

- Insurance density: 193 USD per capita

- Insurance penetration ratio: 5%

- The insurance sector is regulated by the «Insurance Act 1987»

Market structure

| Insurance companies and bodies | Number |

|---|---|

Life insurance companies | 4 |

Non-life insurance companies | 7 |

Life and non-life insurance companies | 12 |

Agents | 169 |

Insurance brokers | 11 |

Identity

- Area: 2 040 Km²

- Population (2002): 1 200 000 inhabitants

- GDP (2002): 4.5 billion USD

- GDP per habitant (2002): 3 750 USD

- GDP growth rate (2002): +4%

- Inflation rate (2002): +6%

- Main economic sectors: food processing industry (sugar), textiles, tourism and other services

Major cities

(in number of inhabitants)

- Port Louis: 150 000

- Curepipe: 79 000

- Quatre Bornes: 76 000

New regulations

- A new bill would grant the Financial Services Commission (FSC) more supervising powers to allow intervention before insurance companies be in deficit.

- New insurance legislation projecting to make segregation between life and non-life insurance business.

- The amendment to the "Road Traffic Act", voted on August 19th, 2003 inaugurates easier compensation procedures by instituting: the «amicable» accident report form, a scale for responsibilities, and the «Motor Vehicle Insurance Arbitration Committee» which examines disputes between the insurers and the insured regarding the compensation amount.

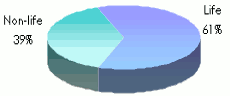

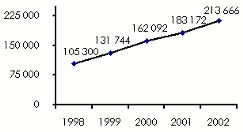

2002 market turnover

Total written premiums | 1998-2002 | |

| in thousands USD |

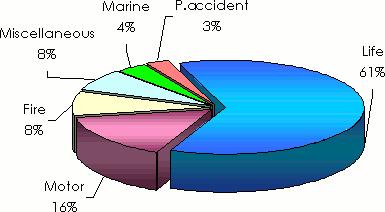

The 2002 turnover by class of business

in millions USD

|  |

2002 Turnover per company

Non-life | Life | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

The first 3 companies own 46% of the non-life market premium |

The first 3 companies own 80% of the life market premium | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

0

Your rating: None

Mon, 13/05/2013 - 12:32

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news