The Nigerian insurance market

Insurance market features

- Regulatory authority:

National insurance commission - Premiums (2004): 522.3 million USD

- Insurance density (2004): 3.77 USD

- Penetration rate (2004): 0.87%

Market structure in 2004

Actors | Number |

|---|---|

Insurance companies | 105 |

Life companies | 6 |

Non-life companies | 51 |

Composite insurance companies | 48 |

Reinsurance companies | 5 |

Brokers | 509 |

Identity

- Area: 923 768 Km2

- Population (2004): 138 400 000 inhabitants

- GDP (2004): 60 billion USD

- GDP per capita: 433.5 USD

- GDP growth rate (2004): 6.1%

- Inflation rate (2004): 15%

- Main economic sectors: crude oil, natural gas, tin, coal, lead, zinc, cocoa, peanuts, rubber, timber

Major cities

(in number of inhabitants)

- Lagos: 9 250 000

- Kano: 3 600 000

- Ibadan: 3 500 000

- Abuja (capital): 400 000

Turnover evolution: 2000-2004

in millions USD/NGN| Premiums | 2000 | 2001 | 2002 | 2003 | 2004 | 2003/2004 Growth rate |

|---|---|---|---|---|---|---|

| USD | 250.3 | 297.7 | 369.0 | 432.5 | 522.3 | + 20.76 % |

| NGN | 27 666.3 | 33 114.5 | 44 503.8 | 55 940.5 | 69 410.8 | - |

Gross premiums evolution by class of business: 2000-2004

in thousands USD| 2000 | 2001 | 2002 | 2003 | 2004 | |

|---|---|---|---|---|---|

| Non life | |||||

Fire | 31 200 | 33 200 | 39 400 | 46 900 | 55 200 |

Motor | 63 800 | 79 100 | 89 700 | 106 800 | 113 400 |

General accident | 71 900 | 50 800 | 60 600 | 79 100 | 103 900 |

Marine-Aviation | 36 800 | 76 900 | 110 700 | 121400 | 158 000 |

Total | 203 700 | 240 000 | 300 400 | 354 200 | 430 500 |

| Life | |||||

Total | 46 600 | 57 700 | 68 600 | 78 300 | 91 800 |

Grand total | 250 300 | 297 700 | 369 000 | 432 500 | 522 300 |

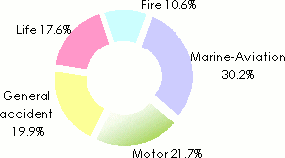

Gross premiums split by class of business in 2004

Split of non-life premiums and incurred losses, net of reinsurance: 2000-2004

in thousands USD| Motor | Fire | Accident | Marine Aviation | TPL | Others | Total | |

|---|---|---|---|---|---|---|---|

| 2000 | |||||||

Earned premiums | 43 700 | 16 500 | 15 700 | 14 700 | 2 500 | 10 400 | 103 500 |

Incurred losses | 12 800 | 5 600 | 6 600 | 2 500 | 400 | 2 600 | 30 500 |

Loss ratio | 29% | 34% | 42% | 17% | 16% | 25% | 29% |

2001 | |||||||

Earned premiums | 53 100 | 19 200 | 20 300 | 20 700 | 3 300 | 14 300 | 130 900 |

Incurred losses | 16 500 | 7 400 | 6 800 | 10 300 | 1 350 | 4 600 | 46 950 |

Loss ratio | 31% | 39% | 33% | 50% | 41% | 32% | 36% |

2002 | |||||||

Earned premiums | 70 200 | 20 500 | 25 800 | 25 400 | 4 500 | 7 600 | 154 000 |

Incurred losses | 14 900 | 7 200 | 4 900 | 6 200 | 3 350 | 738 | 37 288 |

Loss ratio | 21% | 35% | 19% | 24% | 74% | 10% | 24% |

2003 | |||||||

Earned premiums | 86 500 | 26 300 | 35 900 | 33 600 | 6 800 | 12 500 | 201 600 |

Incurred losses | 20 600 | 9 100 | 16 400 | 9 000 | 2 800 | 3 200 | 61 100 |

Loss ratio | 24% | 35% | 46% | 27% | 41% | 26% | 30% |

2004 | |||||||

Earned premiums | 96 500 | 28 500 | 51 300 | 55 600 | 3 800 | 16 200 | 251 900 |

Incurred losses | 24 000 | 8 100 | 13 900 | 7 800 | 900 | 5 600 | 60 300 |

Loss ratio | 25% | 28% | 27% | 14% | 24% | 35% | 24% |

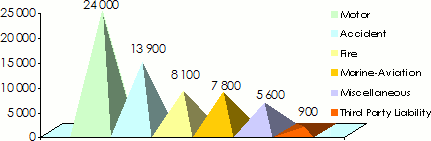

Breakdown of non-life net incurred losses in 2004

in thousands USD

Non life insurance companies' top ten in 2004

in thousands USDCompany | Turnover | Market shares |

|---|---|---|

Nicon Insurance Corporation | 117 100 | 27.2% |

Leadway Assurance Co.Ltd. | 21 700 | 5.0% |

Goldlink Insurance Co. Ltd. | 20 400 | 4.7% |

Industrial & General Ins. Co. Ltd. | 9 800 | 2.3% |

Cornerstone Insurance PLC | 9 650 | 2.2% |

Linkage Assurance Co. Ltd. | 9 600 | 2.2% |

Unitrust Insurance Co. Ltd. | 7 600 | 1.8% |

Wapic Insurance PLC | 6 400 | 1.5% |

Royal Exchange Ass. Nigeria PLC | 6 370 | 1.4% |

Law Union & Rock Insurance (Nigeria) PLC | 4 800 | 1.1% |

Total of non life companies' top ten | 213 420 | 49.5% |

Total | 430 500 | 100.0% |

Life insurance companies' top ten in 2004

in thousands USDCompany | Turnover | Market shares |

|---|---|---|

AIICO Insurance PLC | 20 080 | 21.9% |

Nicon Insurance Corporation | 11 120 | 12.1% |

Crusader Insurance Co. PLC | 8 995 | 9.8% |

Industrial & General Ins. Co. Ltd. | 7 700 | 8.4% |

Leadway Assurance Co. Ltd. | 7 250 | 7.9% |

Niger Insurance PLC | 6 850 | 7.5% |

ELMAC Assurance (Nigeria) Ltd. | 6 260 | 6.8% |

African Alliance Insurance Co. Ltd. | 5 300 | 5.8% |

Wapic Insurance PLC | 3 850 | 4.2% |

Great Nigeria Insurance Co. Ltd. | 2 370 | 2.6% |

Total of life companies' top ten | 79 775 | 87.0% |

Total | 91 800 | 100.0% |

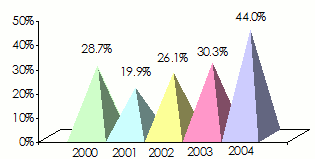

Life loss ratio: 2000-2004

Exchange rate USD/NGN as at 31/12 | 2000 | 2001 | 2002 | 2003 | 2004 |

110.50 | 111.23 | 120.58 | 129.22 | 132.89 |

0

Your rating: None

Tue, 14/05/2013 - 16:06

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news