The Omani insurance market

Insurance market features

- Regulatory authority: Capital Market Authority - Directorate General of Insurance Regulation

- Premiums (2007): 439 million USD

- Insurance density (2007): 162 USD

- Penetration rate (2007): 1.1%

Market structure in 2007

Actors | Number |

|---|---|

National companies | 11 |

Foreign companies | 9 |

Employees | 1 325 |

Identity

- Area: 212 460 Km2

- Population (2007): 2 700 000 inhabitants

- GDP (2007): 40.343 billion USD

- GDP per capita (2007):14 941 USD

- GDP growth rate (2007): 5.9%

- Inflation rate (2007): 6.6%

- Main economic sectors: crude oil production and refining, natural gas, asbestos, copper, marble, optic fiber, metal manufacturing, textiles, fish export

Major cities

(in number of inhabitants)

- Muscat (capital): 400 000

- Matrah: 175 000

- Salalah: 132 000

Breakdown of Life and Non Life premiums: 2003-2007

in thousands USD| 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|

| National companies | |||||

Non life | 156 802 | 161 913 | 209 334 | 255 319 | 292 455 |

Life | 29 125 | 30 782 | 31 342 | 51 871 | 64 256 |

Total | 185 927 | 192 695 | 240 676 | 307 190 | 356 711 |

| Foreign companies | |||||

Non life | 61 442 | 64 733 | 49 180 | 52 728 | 64 594 |

Life | 8 779 | 10 008 | 11 648 | 16 036 | 18 337 |

Total | 70 221 | 74 741 | 60 828 | 68 754 | 82 931 |

Grand total | 256 148 | 267 436 | 301 504 | 375 944 | 439 642 |

Life and Non Life's premiums: 2003-2007

in thousands USD| 2003 | 2004 | 2005 | 2006 | 2007 | |

|---|---|---|---|---|---|

| National companies | |||||

Dhofar Insurance Company | 69 573 | 72 166 | 74 731 | 93 514 | 118 913 |

Oman United Insurance | 43 998 | 40 592 | 46 682 | 54 406 | 67 752 |

Al Ahlia Insurance Company | 36 264 | 34 046 | 40 316 | 54 515 | 44 076 |

National Life Insurance | 14 326 | 14 767 | 16 072 | 31 102 | 34 553 |

Royal & Sun Alliance Insurance1 | 6 638 | 31 159 | 21 187 | 26 090 | |

Muscat Insurance | 14 748 | 15 387 | 14 041 | 15 483 | 15 180 |

Oman & Qatar Insurance2 | 350 | 7 215 | 13 442 | 15 037 | |

Falcon Insurance3 | 2 889 | 15 358 | 14 588 | ||

Muscat Life Insurance | 7 017 | 8 749 | 7 571 | 8 144 | 10 848 |

Al Madina Gulf Insurance4 | - | 39 | 9 674 | ||

Total | 185 927 | 192 695 | 240 676 | 307 190 | 356 711 |

| Foreign companies | |||||

New India Assurance | 11 382 | 13 292 | 15 429 | 17 563 | 28 181 |

American Life Insurance | 17 595 | 22 829 | 22 326 | 25 369 | 20 613 |

Axa Insurance | 46 | - | 10 538 | 13 867 | 16 512 |

Arabia Insurance | 7 475 | 8 519 | 7 951 | 7 169 | 11 643 |

Al Nisr Insurance | 2 345 | 2 275 | 2 348 | 2 703 | 3 076 |

Life Insurance Corporation Inter5 | 783 | 1 463 | 1 609 | 2 424 | |

Iran Insurance | 1 150 | 1 069 | 773 | 474 | 482 |

Norwich Union Insurance | 8 117 | 7 466 | - | - | - |

Royal & Sun Alliance Insurance | 19 464 | 15 385 | - | - | - |

Al Ittihad Al Watani | 2 647 | 2 275 | - | - | - |

Total | 70 221 | 74 741 | 60 828 | 68 754 | 82 931 |

Grand total | 256 148 | 267 436 | 301 504 | 375 944 | 439 642 |

Loss ratio by class of business: 2003-2007

| National companies | Foreign companies | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 2003 | 2004 | 2005 | 2006 | 2007 | 2003 | 2004 | 2005 | 2006 | 2007 | |

| Non life | ||||||||||

Marine | 54% | 11% | 17% | 21% | 22% | 20% | 21% | 34% | 37% | 20% |

Motor | 44% | 84% | 84% | 83% | 150% | 63% | 59% | 49% | 76% | 106% |

Property | 82% | 37% | 109% | 34% | 666% | 60% | 0% | 150% | 86% | 2245% |

Miscellaneous | 31% | 36% | 24% | 10% | 85% | 33% | 25% | 17% | 19% | 52% |

| Life | ||||||||||

Life | NA | 59% | 57% | 35% | 41% | NA | 114% | 63% | 47% | 32% |

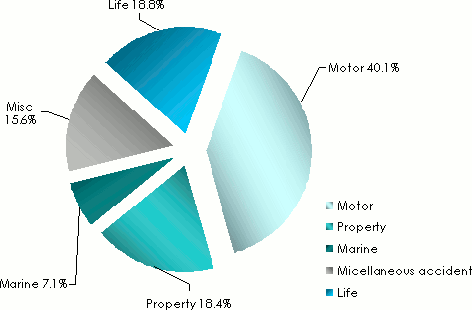

Market's breakdown by class of business in 2007

in thousands USD| National companies | Market shares (%) | Foreign companies | Market shares (%) | Total | Market shares (%) | |

|---|---|---|---|---|---|---|

| Non life | ||||||

Motor | 147 976 | 41.5 | 28 366 | 16.1 | 176 342 | 40.1 |

Property | 76 661 | 21.5 | 4 259 | 5.1 | 80 920 | 18.4 |

Marine | 24 936 | 7.0 | 6 228 | 7.5 | 31 164 | 7.1 |

Miscellaneous | 42 882 | 12.0 | 25 741 | 31.1 | 68 623 | 15.6 |

| Life | ||||||

Life | 64 256 | 18.0 | 18 337 | 22.1 | 82 593 | 18.8 |

Grand total | 356 711 | 100.0 | 82 931 | 100.0 | 439 642 | 100.0 |

Premiums' breakdown by company in 2007

in thousands USD| Life & Non Life premiums | Market shares in % | |

|---|---|---|

| National companies | ||

Dhofar Insurance Company | 118 913 | 27.0 |

Oman United Insurance | 67 752 | 15.4 |

Al Ahlia Insurance Company | 44 076 | 10 |

National Life Insurance | 34 553 | 7.9 |

Royal & Sun Alliance Insurance | 26 090 | 5.9 |

Muscat Insurance | 15 180 | 3.5 |

Oman & Qatar Insurance | 15 037 | 3.4 |

Falcon Insurance | 14 588 | 3.3 |

Muscat Life Insurance | 10 848 | 2.5 |

Al Madina Gulf Insurance | 9 674 | 2.2 |

Total | 356 711 | 81.1 |

| Foreign companies | ||

New India Assurance | 28 181 | 6.4 |

American Life Insurance | 20 613 | 4.7 |

Axa Insurance | 16 512 | 3.8 |

Arabia Insurance | 11 643 | 2.6 |

Al Nisr Insurance | 3 076 | 0.7 |

Life Insurance Corporation Inter | 2 424 | 0.6 |

Iran Insurance | 482 | 0.1 |

Total | 82 931 | 18.9 |

Grand total | 439 642 | 100 |

Exchange rate OMR/USD as at 31/12 | 2003 | 2004 | 2005 | 2006 | 2007 |

2.59943 | 2.60410 | 2.60268 | 2.60702 | 2.60695 |

0

Your rating: None

Fri, 17/05/2013 - 11:59

The online magazine

Live coverage

15:27

14:22

14:12

10:33

04/25

Latest news