The Togolese insurance market

Insurance market features

- Regulatory authority : Togo Insurers' Committee

- Premiums (2004): 31 310 000 USD

- Insurance density (2004): 5.13 USD

- Penetration rate (2004): 1.4%

Market structure in 2004

Actors | Number |

|---|---|

Insurance companies | 8 |

Life companies | 3 |

Non life companies | 5 |

Reinsurance companies | 1 |

Brokers | 18 |

General agents | 11 |

Commercial agents | 121 |

Identity

- Area: 56 785 Km2

- Population (2004): 6 100 000 inhabitants

- GDP (2004): 2.229 billion USD

- GDP per capita (2004): 365 USD

- GDP growth rate (2004): 3%

- Inflation rate (2004): 1.2%

- Main economic sectors: phosphate mining, cement, cocoa, coffee, cotton, subsistence agriculture

Major cities

(in number of inhabitants)

- Lomé (capital): 796 000

- Sokodé: 123 000

- Kara: 110 000

- Kpalimé: 102 000

Main economic indicators: 2000-2004

in USD| 2000 | 2001 | 2002 | 2003 | 2004 | |

|---|---|---|---|---|---|

GDP | 1 359 000 000 | 1 288 000 000 | 1 609 000 000 | 1 887 000 000 | 2 229 000 000 |

GDP per capita | 295 | 274 | 335 | 385 | 365 |

Insurance density | 3.17 | 3.53 | 4.38 | 5.02 | 5.13 |

Penetration rate | 1.07% | 1.28% | 1.3% | 1.3% | 1.4% |

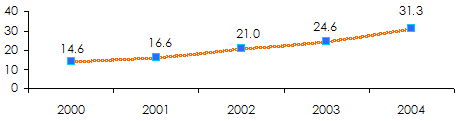

Turnover evolution: 2000-2004

in millions USD

| Written premiums | 2000 | 2001 | 2002 | 2003 | 2004 | 2003/2004 growth rate |

|---|---|---|---|---|---|---|

Non life | 11.8 | 13.2 | 16.7 | 19.2 | 24.9 | +26.88% |

Life | 2.8 | 3.4 | 4.3 | 5.4 | 6.4 | |

Total | 14.6 | 16.6 | 21.0 | 24.6 | 31.3 |

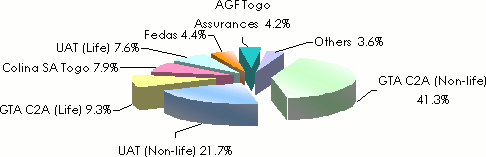

Main companies' life & non-life turnover split in 2004

in millions XOF/USD| Turnover in XOF | Turnover in USD | Market share | |

|---|---|---|---|

GTA - C2A (Non life) | 6 221 | 12.93 | 41.3% |

UAT Non life | 3 260 | 6.78 | 21.7% |

GTA - C2A (Life) | 1 401 | 2.91 | 9.3% |

Colina SA Togo | 1 201 | 2.50 | 7.9% |

UAT Life | 1 140 | 2.37 | 7.6% |

Fedas | 664 | 1.38 | 4.4% |

AGF Togo Assurances | 626 | 1.30 | 4.2% |

Others | 547 | 1.14 | 3.6% |

Total | 15 060 | 31.31 | 100.0% |

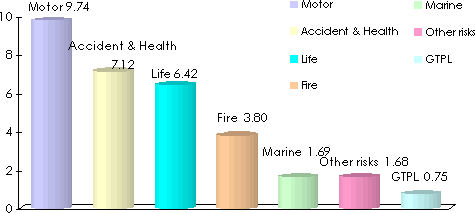

Premiums* split by class of business: 2003-2004

in millions USD| 2003 | % | 2004 | % | |

|---|---|---|---|---|

| Non life | ||||

Motor | 8.91 | 36% | 9.74 | 32% |

Accident & Health | 5.00 | 20% | 7.12 | 23% |

Fire | 2.59 | 11% | 3.80 | 12% |

Marine | 1.53 | 6% | 1.69 | 5% |

Other risks | 0.37 | 2% | 1.68 | 5% |

GTPL | 0.75 | 3% | 0.75 | 2% |

Non life total | 19.15 | 78% | 24,78 | 79% |

| Life | ||||

Life total | 5.48 | 22% | 6.42 | 21% |

Grand total | 24.63 | 100% | 31.20 | 100% |

Premiums* split by class of business in 2004

in millions USD * Figures excluding reinsurance acceptances

* Figures excluding reinsurance acceptances Life & Non–life loss ratio: 2000-2004

| 2000 | 2001 | 2002 | 2003 | 2004 | |

|---|---|---|---|---|---|

Non-life L/R | 191% | 97% | 43% | 47% | 51% |

Life L/R | 69% | 44% | 60% | 50% | 76% |

Non-life & life L/R | 167% | 86% | 46% | 48% | 56% |

Exchange rate USD/XOF as at 31/12 | 2000 | 2001 | 2002 | 2003 | 2004 |

696 | 740 | 625 | 522 | 481 |

Source: FANAF - Insurance market in Africa : Figures 2000 - 2004

0

Your rating: None

Wed, 15/05/2013 - 11:11

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news