The Zimbabwean insurance market

Insurance market features

- Regulatory authority : Insurance and Pensions Commission

- Life and non life premiums (2011): 158 967 000 USD

- Insurance density (2010): 9.33 USD

- Penetration rate (2010): 1.56%

Market structure 2011

Market actors | Number |

|---|---|

Insurance companies | 26 |

Reinsurance companies | 8 |

Brokers | 27 |

Country profile

- Area : 390 757 km2

- Population (2010): 12 571 000 inhabitants

- GDP (2010): 7 475 995 911 USD

- GDP per capita (2010): 595 USD

- GDP growth rate (2010): 9%

- Inflation rate (2010): 17.5%

- Main economic activities: tobacco culture, mining (coal, gold, platinum, copper, nickel, tin, clay, ore), metallurgy industry, wood, chemicals and fertilisers, textile and shoes, food industry and beverages.

Major cities

(in number of inhabitants)

- Harare (capital): 2 million

- Bulawayo: 1 million

- Mutare: 162 000

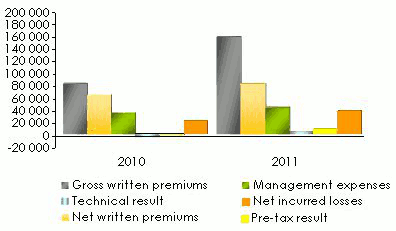

Main technical highlights: 2010-2011

in USD| 2010 | 2011 | 2010/11 evolution | |

|---|---|---|---|

Gross written premiums | 117 314 000 | 158 967 000 | 35.5% |

Net written premiums | 64 076 000 | 82 431 000 | 28.6% |

Net earned premiums | 56 963 000 | 80 749 000 | 41.8% |

Net incurred losses | 21 734 000 | 37 389 000 | 72% |

Management expenses* | 35 039 000 | 43 689 000 | 24.7% |

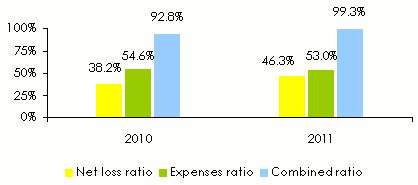

Net loss ratio | 38.2% | 46.3% | 21.4% |

Net expenses ratio | 54.6% | 53% | -2.9% |

Combined ratio | 92.8% | 99.3% | 7.1% |

Technical result | - 5 363 000 | 3 545 000 | - |

Financial income | 1 826 000 | 2 487 000 | 36.2% |

Pre-tax result | - 2 206 000 | 7 937 000 | - |

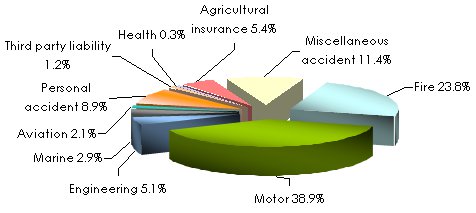

Turnover’s breakdown per class of business in 2011

in USD| 2011 | 2011 shares | |

|---|---|---|

Fire | 37 902 000 | 23.8% |

Motor | 61 821 000 | 38.9% |

Engineering | 8 182 000 | 5.1% |

Marine | 4 572 000 | 2.9% |

Aviation | 3 385 000 | 2.1% |

Personal accident | 14 083 000 | 8.9% |

Third party liability | 1 843 000 | 1.2% |

Health | 554 000 | 0.3% |

Agricultural insurance | 8 531 000 | 5.4% |

Miscellaneous accident | 18 094 000 | 11.4% |

Total | 158 967 000 | 100% |

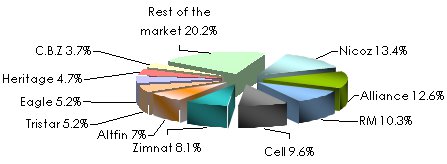

2011 ranking of premiums and results per company

in USD| Gross written premiums | Market shares | Net written premiums | Underwriting result | Net result* | |

|---|---|---|---|---|---|

Nicoz | 21 245 000 | 13.4% | 13 410 000 | -104 000 | 648 000 |

Alliance | 19 974 000 | 12.6% | 11 849 000 | 759 000 | 751 000 |

RM | 16 422 000 | 10.3% | 10 497 000 | 1 190 000 | 1 232 000 |

Cell | 15 303 000 | 9.6% | 5 807 000 | 1 127 000 | 1 130 000 |

Zimnat | 12 933 000 | 8.1% | 4 455 000 | -877 000 | -436 000 |

Altfin | 11 074 000 | 7.0% | 5 765 000 | 47 000 | 113 000 |

Tristar | 8 309 000 | 5.2% | 3 077 000 | -1 001 000 | 562 000 |

Eagle | 8 216 000 | 5.2% | 3 115 000 | 778 000 | 855 000 |

Heritage | 7 386 000 | 4.7% | 3 726 000 | 461 000 | 508 000 |

C.B.Z | 5 904 000 | 3.7% | 2 413 000 | 375 000 | 331 000 |

Credsure | 4 304 000 | 2.7% | 1 635 000 | 420 000 | 360 000 |

Global | 4 201 000 | 2.6% | 846 000 | 24 000 | 38 000 |

Tetrad Hail | 4 007 000 | 2.5% | 1 082 000 | 2 268 000 | 2 532 000 |

SFG | 3 391 000 | 2.1% | 1 628 000 | -1 526 000 | -1 088 000 |

Champions | 3 213 000 | 2.0% | 2 484 000 | 471 000 | 775 000 |

Evolution | 2 623 000 | 1.7% | 1 531 000 | 465 000 | 446 000 |

Clarion | 2 013 000 | 1.3% | 1 859 000 | 69 000 | 57 000 |

Allied | 1 656 000 | 1.0% | 1 103 000 | 102 000 | 106 000 |

Quality | 1 643 000 | 1.0% | 1 470 000 | 205 000 | 207 000 |

KMFS | 1 459 000 | 0.9% | 1 386 000 | -20 000 | 75 000 |

Regal | 1 353 000 | 0.9% | 1 345 000 | 272 000 | 199 000 |

Jupiter | 1 239 000 | 0.8% | 1 148 000 | -1 858 000 | -1 848 000 |

Excellence | 659 000 | 0.4% | 494 000 | 49 000 | 49 000 |

Hamilton | 244 000 | 0.2% | 140 000 | -69 000 | -347 000 |

Suremed | 156 000 | 0.1% | 156 000 | -91 000 | -91 000 |

Sanctuary | 40 000 | 0.0% | 10 000 | 9 000 | 54 000 |

Total | 158 967 000 | 100% | 82 431 000 | 3 545 000 | 7 218 000 |

Breakdown per class of business of the main ten companies in 2011

Premiums, incurred losses and management expenses of the main ten companies in 2011

in USD| Net written premiums | Net earned premiums | Net incurred losses | Management expenses* | |

|---|---|---|---|---|

Nicoz | 13 410 000 | 12 600 000 | 7 098 000 | 5 776 000 |

Alliance | 11 849 000 | 12 014 000 | 7 582 000 | 3 640 000 |

RM | 10 497 000 | 10 278 000 | 4 998 000 | 4 134 000 |

Cell | 5 807 000 | 5 187 000 | 2 451 000 | 1 663 000 |

Zimnat | 4 455 000 | 4 303 000 | 1 840 000 | 3 340 000 |

Altfin | 5 765 000 | 5 630 000 | 2 884 000 | 2 674 000 |

Tristar | 3 077 000 | 3 823 000 | 1 154 000 | 3 671 000 |

Eagle | 3 115 000 | 3 201 000 | -1 211 000 | 4 636 000 |

Heritage | 3 726 000 | 3 282 000 | 1 070 000 | 1 807 000 |

C.B.Z | 2 413 000 | 2 359 000 | 703 000 | 1 259 000 |

Total | 64 114 000 | 62 677 000 | 28 569 000 | 32 600 000 |

Rest of the market | 18 317 000 | 18 072 000 | 8 820 000 | 11 089 000 |

Grand total | 82 431 000 | 80 749 000 | 37 389 000 | 43 689 000 |

Technical ratios of the main ten companies in 2011

| Net loss ratios | Net expenses ratio* | Combined ratio | |

|---|---|---|---|

Nicoz | 56.3% | 43.1% | 99.4% |

Alliance | 63.1% | 30.7% | 93.8% |

RM | 48.6% | 39.4% | 88% |

Cell | 47.3% | 28.6% | 75.9% |

Zimnat | 42.7% | 75% | 117.7% |

Altfin | 51.2% | 46.4% | 97.6% |

Tristar | 30.2% | 119.3% | 149.5% |

Eagle | -37.8% | 148.8% | 111% |

Heritage | 32.6% | 48.5% | 81.1% |

C.B.Z | 29.8% | 52.2% | 82% |

Total | 45.6% | 50.8% | 96.4% |

Rest of the market | 48.8% | 60.5% | 109.3% |

Grand total | 46.3% | 53% | 99.3% |

0

Your rating: None

Tue, 21/05/2013 - 12:18

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news