UAB Assurances Group

The first two decades have enabled the group to lay the foundations of the organization and build a portfolio. In a relatively short time, UAB became the pioneer of life microinsurance in West Africa. Its product “Cauri d’Or” (“Golden Cowrie”), launched in 2003, has been a success that should inspire African insurers looking for a life product adapted to low-income populations.

The first two decades have enabled the group to lay the foundations of the organization and build a portfolio. In a relatively short time, UAB became the pioneer of life microinsurance in West Africa. Its product “Cauri d’Or” (“Golden Cowrie”), launched in 2003, has been a success that should inspire African insurers looking for a life product adapted to low-income populations.

To consolidate the group’s financial bases, shareholders appealed in 2010 to a new partner, Alpha West Africa, entrusted with the task of boosting the insurance activity.

Ever since, UAB has been profoundly changing: capital increase in 2010, restructuring in 2011, launching a new formula of microinsurance in 2011, adoption of TOEME project 2015 "company’s structural, economic and managerial transformation."

The group has embarked on major restructuring projects: establishment of joint departments, overhaul of the computer system, development of new procedures, implementation of an ambitious training program, adopting a customer-focused approach.

Nothing ventured nothing gained.

|  |

| Jean-Damascène Nignan | Soumaïla Sorgho |

| General manager UAB IARDT (non life) | General manager UAB Vie (life) |

UAB IARDT in 20121

| Share capital | 2 606 529 USD |

| Turnover | 4 769 414 USD |

| Gross loss ratio | 4 578 744 USD |

| Gross management expenses | 3 011 394 USD |

| Number of agencies 2 | 12 |

| Number of employees | 47 |

UAB VIE in 20121

| Share capital | 2 019 000 USD |

| Turnover | 12 912 892 USD |

| Gross loss ratio | 7 548 464 USD |

| Gross management expenses | 2 435 793 USD |

| Number of agencies 2 | 12 |

| Number of employees | 25 |

Management UAB IARDT (non life)

| Chairman of the board | Paul-Marie Compaore |

| General manager | Jean-Damascène Nignan |

| Technical manager | Antoine Compaore |

| Non life marketing manager | Socrate Bassonon |

| Internal audit and inspection manager | Céline Rasmata Ouedraogo |

| Human resources manager | Mahamadi Bouda |

| Finance manager | Jean Claude Kini |

| Accounting manager | Fulbert Kafando |

| Organisation and IT manager | Moumouni Maiga |

Main shareholders

| Alpha West Africa | 81.52% |

| AXA, Côte d’Ivoire | 4.18% |

| Other legal entities | 3.87% |

| Other natural persons | 10.31% |

| Employees | 0.12% |

Direction UAB Vie (life)

| Chairman of the board | Victor Tiendrabeogo |

| General manager | Soumaïla Sorgho |

| Technical manager | Marie M’Po Batienon |

| Interim non life marketing manager | Emmanuel To |

| Microinsurance manager | Emmanuel To |

| Internal audit and inspection manager | Céline Rasmata Ouedraogo |

| Human resources manager | Mahamadi Bouda |

| Financial manager | Jean Claude Kini |

| Accounting manager | Fulbert Kafando |

| Organisation and IT manager | Moumouni Maiga |

Main shareholders

| Alpha West Africa | 92.84% |

| Other legal entities | 2.00% |

| Other natural persons | 5.10% |

| Employees | 0.06% |

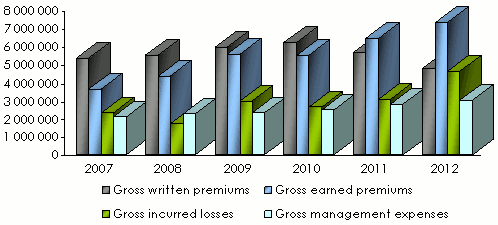

UAB IARDT (non life): Main technical highlights: 2007-2012

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|

Gross written premiums | 5 308 191 | 5 484 600 | 5 929 140 | 6 190 124 | 5 620 745 | 4 769 414 |

Net written premiums 1 | 4 710 762 | 4 699 200 | 4 787 892 | 5 068 396 | 4 520 728 | 3 640 305 |

Gross earned premiums | 3 621 198 | 4 303 200 | 5 519 004 | 5 503 478 | 6 437 211 | 7 296 889 |

Gross incurred losses | 2 284 422 | 1 696 200 | 2 964 570 | 2 633 174 | 3 058 731 | 4 578 744 |

Net incurred losses | 1 398 579 | 2 120 800 | 2 810 769 | 1 639 290 | 2 831 488 | 3 970 394 |

Gross management expenses | 2 096 724 | 2 263 800 | 2 280 267 | 2 445 532 | 2 805 345 | 3 011 394 |

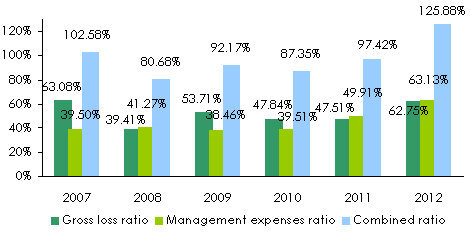

Gross loss ratio | 63.08% | 39.41% | 53.71% | 47.84% | 47.51% | 62.75% |

Gross expenses ratio | 39.50% | 41.27% | 38.46% | 39.51% | 49.91% | 63.13% |

Combined ratio | 102.58% | 80.68% | 92.17% | 87.35% | 97.42% | 125.88% |

Financial income | 624 897 | 563 200 | 552 792 | 451 578 | 653 575 | NA |

Net technical result | 1 600 011 | 1 401 400 | 1 555 842 | 2 761 018 | 2 493 640 | 2 391 911 |

Net result | 219 744 | 402 600 | 465 861 | 249 502 | 207 133 | NA |

Breakdown of gross written premiums per class of business: 2007-2012

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2012 shares | |

|---|---|---|---|---|---|---|---|

Motor | 3 266 403 | 3 513 400 | 3 642 186 | 3 627 058 | 2 294 551 | 1 456 316 | 30.54% |

Bodily injury & health | 821 751 | 737 000 | 1 134 561 | 1 270 192 | 2 262 375 | 2 348 139 | 49.23% |

Fire* | 567 672 | 459 800 | 519 357 | 571 174 | 438 398 | 565 294 | 11.85% |

Third party liability | 265 524 | 235 400 | 240 732 | 247 440 | 229 254 | 248 113 | 5.20% |

Marine | 329 616 | 286 000 | 263 022 | 387 656 | 213 166 | 151 552 | 3.18% |

Property damage | 57 225 | 253 000 | 129 282 | 84 542 | 185 012 | - | - |

Total | 5 308 191 | 5 484 600 | 5 929 140 | 6 188 062 | 5 622 756 | 4 769 414 | 100% |

Breakdown of gross earned premiums and gross incurred losses per class of business in 2012

in USD| Gross earned premiums | Gross incurred losses | Loss ratio | |

|---|---|---|---|

Motor | 3 726 068 | 1 810 263 | 48.58% |

Bodily injury and health | 2 336 872 | 1 566 721 | 67.04% |

Fire* | 591 825 | 374 279 | 63.24% |

Third party liability | 275 810 | 196 450 | 71.22% |

Marine | 285 780 | 159 743 | 55.89% |

Other risks | 80 534 | 471 288 | 585.20% |

Total | 7 296 889 | 4 578 744 | 62.75% |

Technical ratios: 2007-2012

UAB Vie (life): Main technical highlights: 2007-2012

in USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2012* | |

|---|---|---|---|---|---|---|

Gross written premiums | 6 409 200 | 7 084 000 | 9 098 778 | 10 307 938 | 11 299 809 | 12 912 892 |

Net written premiums 1 | 5 928 510 | 6 701 200 | 8 606 169 | 9 773 880 | 10 891 576 | 12 704 554 |

Gross earned premiums | 6 409 200 | 7 084 000 | 9 098 778 | 10 307 938 | 11 299 809 | 12 912 892 |

Gross incurred losses | 3 126 774 | 4 195 400 | 5 162 364 | 6 864 398 | 8 188 792 | 7 548 464 |

Net incurred losses | 3 126 774 | 4 098 600 | 5 104 410 | 6 860 274 | 8 182 759 | 7 487 766 |

Gross management expenses | 1 254 372 | 1 518 000 | 1 751 994 | 1 682 592 | 1 946 648 | 2 435 793 |

Net management expenses | 1 137 633 | 1 405 800 | 1 602 651 | 1 509 384 | 1 815 933 | 2 411 886 |

Financial income | 659 232 | 972 400 | 971 844 | 1 334 114 | 1 634 943 | NA |

Technical result | 393 708 | 316 800 | 733 341 | 965 016 | 327 793 | NA |

Net result | 38 913 | 103 400 | 28 977 | 342 292 | 414 266 | NA |

Exchange rate FCFA/USD as at 31/12 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 |

0.002289 | 0.0022 | 0.002229 | 0.002062 | 0.002011 | 0.002019 |

Contact

| Head office | 382, avenue Dr Kwamé N’Krumah, 08 BP 11041 Ouagadougou 08 |

| Phone | (+226) 50 30 18 18 |

| Fax non life insurance | (+226) 50 31 26 20 |

| Fax life insurance | (+226) 50 31 28 50 |

uab [at] fasonet [dot] bf | |

| Website |