What is insurtech?

The improvements they are trying to introduce to the sector are designed to develop and enrich the services offered to policyholders while cutting down costs in the process.

Insurtech, definition

Insurtech start ups are companies operating in the insurance sector. They rely on new technologies to introduce innovations that are necessarily conducive to the advent of new economic paradigms, new processes and new products.

Insurtech start ups are companies operating in the insurance sector. They rely on new technologies to introduce innovations that are necessarily conducive to the advent of new economic paradigms, new processes and new products.

These profound mutations are able to modify behavior of all players on the market: insured, insurance intermediaires, insurers and reinsurers. Regulators are also required to take part in the debates resulting from their activities.

The areas favored by insurtech are wrapped around :

- customer relationship,

- cost and therefore, tariff reduction,

- the use of data surfing online, in particular data retrieved from connected objects and from big data,

- driverless cars,

- digitization of insurance contracts,

- online underwriting and management of insurance contracts,

- online claim management,

- customization of insurance supply and the role of artificial intelligence,

- customization of customer relationship thanks in particular to conversational tools,

- the provision of new services to policyholders.

Insurtech business activity

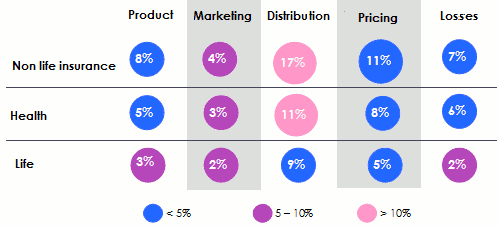

The solutions provided by start-ups are more numerous in non life insurance. The investments realized in that class of business are more important in view of the strong presence of telemetry in motor, health and housing (home automation) insurance plans. Life insurance is lagging behind.

Insurtech areas of expertise

Insurance start-ups are active in various fields. They are particularly operational in:

- comparators, sale assistance,

- big data and internet of things or insurance of connected objects,

- online life insurance,

- prevention,

- product innovation,

- services provided to policyholders,

- peer to peer, bulk purchases,

- artificial intelligence.

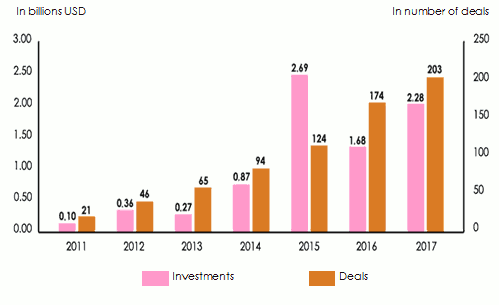

Investments in insurtech (2011-2017)

In terms of technological evolution, insurance has for a long time been lagging behind banks and finance. Banking and financial start-ups accounted for almost all investments. With the advent of new technologies, investment opportunities in the insurance business have multiplied.

In 2014, the funds invested in insurtech reached 870 million USD for 300 start-ups at the global level. A year later, these companies attracted nearly 2.69 billion USD in investments, 55% of which in non life insurance start-ups and 45% of which in life insurance.

In late 2016, the threshold of 1000 companies was exceeded with investments worth approximately 1.68 billion USD. This upward trend was followed in 2017 with 2.28 billion USD in investments. It was in the fourth quarter of the same year that seven operations worth more than 30 million USD had been sealed. They included fund raising of 120 million USD achieved by Lemonade where the takeover of ISalud (Spain) and Azimut (France) by CNP Assurances was made for 48 million USD.

According to KPMG, the United States account for nearly 60% of insurtech followed by Germany 6% and Great Britain 5%:

| Country | Shares |

|---|---|

United States | 59% |

Germany | 6% |

United Kingdom | 5% |

China | 5% |

India | 3% |

France | 3% |

Canada | 3% |

Brazil | 2% |

Japan | 2% |

Sweden | 1% |

Spain | 1% |

Australia | 1% |

United Arab Emirates | 1% |

Others | 8% |

Insurtech in emerging countries

Nearly 160 insurtech were identified in the emerging countries of Africa, Asia and Latin America in 2016, differing according to the technologies developed there. Some applications range from hard paper mode to digital system whereas others tend to be guided towards more advanced technologies such as artificial intelligence.

Paradoxically, and according to the magazine "Insurtech for Development 2017”, it is Africa that showcases the highest number of projects followed by Asia where India stands as the driving force with 28 initiatives. Africa, with a particularly high number of cellular phones, stands as a large investigation site for insurtech. South Africa accounts for 17 projects while Kenya features 14. Brazil and China account for 16 and 12 initiatives respectively.

Different categories of insurtech

| Number of projects | |

|---|---|

Latin America | 45 |

Africa | 93 |

Asia | 86 |