ZEP RE

Endowed with an authorized capital of 100 million USD and benefiting from a preferential market stretching from Djibouti to Mozambique and Angola, the new company is undergoing a steady development of its turnover which more than doubled since the posting of its first balance sheet in 2003.

Endowed with an authorized capital of 100 million USD and benefiting from a preferential market stretching from Djibouti to Mozambique and Angola, the new company is undergoing a steady development of its turnover which more than doubled since the posting of its first balance sheet in 2003.

Just like Cica Re in West Africa, ZEP RE brings in a substantive reinsurance capacity to the local insurers whom they value as an important technical support.

In an effort to face the growth of its premium volume and provide a proximity service to its customers, ZEP RE has established underwriting offices in Douala (Cameroon), Lusaka (Zambia) and Khartoum (Sudan).

There is no doubt that after its promising start, ZEP RE will soon become the reference reinsurer that Eastern Africa has been seeking for a long time.

|  |

| Michael Gondwe | Rajni Varia |

| Chairman | Managing Director |

ZEP RE in 2008

| Authorized capital | 100 000 000 USD |

| Paid up capital | 29 998 013 USD |

| Turnover | 45 986 500 USD |

| Shareholder's equity | 31 322 584 USD |

| Total assets | 64 463 431 USD |

| Underwriting profit | 4 187 865 USD |

| Net result after tax | 1 910 268 USD |

| ROE | 6.1% |

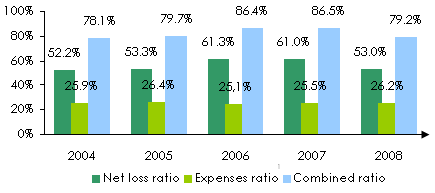

| Loss ratio | 52.96% |

| Combined ratio | 79.2% |

| Number of branches | 3 (Cameroon, Zambia and Sudan) |

| Number of employees | 38 (including branches ) |

Management

| Managing Director | Rajni Varia |

| General Manager | Hope Murera |

| Operations Director | Ronald Kasapatu |

| Finance Director | Benjamin Kamanga |

| Secretary General | Jerry Sogoli |

| Chief Accountant | Sammy Silamoi |

| Human Resources and Administration Manager | Joseph Nabimanya |

| ICT Manager | Victor Chasinda |

Main shareholders

| The member States |

| The insurance and reinsurance companies of the COMESA zone |

Main financial highlights: 2004-2008

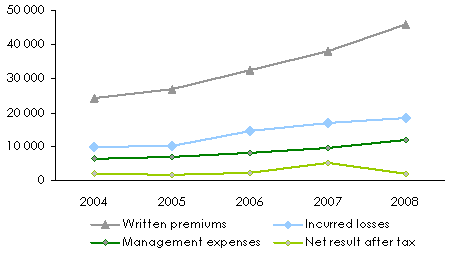

in USD| 2004 | 2005 | 2006 | 2007 | 2008 | |

|---|---|---|---|---|---|

Gross written premiums | 24 373 057 | 26 900 035 | 32 474 910 | 37 923 564 | 45 986 500 |

Written premiums net of reinsurance | 18 834 065 | 19 520 505 | 25 163 239 | 29 536 935 | 36 892 542 |

Net earned premiums | 19 054 067 | 19 098 228 | 23 759 751 | 27 720 241 | 34 894 101 |

Net incurred losses | 9 943 515 | 10 181 593 | 14 562 673 | 16 927 172 | 18 479 657 |

Net loss ratio | 52.19% | 53.30% | 61.30% | 61.06% | 52.96% |

Management expenses • Overhead expenses • Commission expenses | 6 309 688 1 781 027 4 528 661 | 7 089 892 1 822 216 5 267 676 | 8 145 314 2 098 537 6 046 777 | 9 683 269 2 649 034 7 034 235 | 12 043 556 3 295 040 8 748 516 |

Underwriting profit | 2 357 652 | 1 729 418 | 979 383 | 971 684 | 4 187 865 |

Net result after tax | 2 036 919 | 1 837 349 | 2 475 385 | 5 255 987 | 1 910 268 |

Evolution of premiums, losses, management expenses and results

in thousands USD in thousands USD

in thousands USD

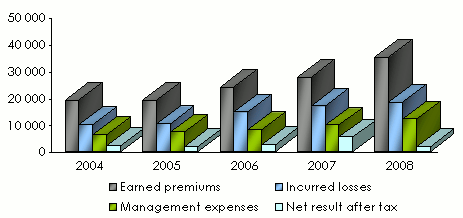

Turnover's evolution per class of business: 2004-2008

in thousands USD| 2004 | 2005 | 2006 | 2007 | 2008 | 2008 shares | 2007/08 growth | |

|---|---|---|---|---|---|---|---|

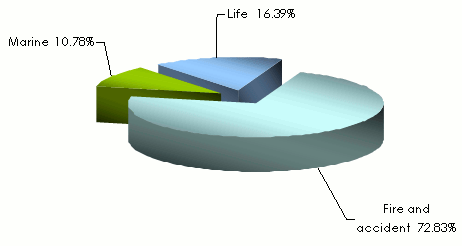

Fire and accident | 20 894 | 22 430 | 25 088 | 28 797 | 33 491 | 72.83% | 16.30% |

Marine | 2 916 | 3 342 | 3 870 | 5 253 | 4 957 | 10.78% | -5.63% |

Life | 563 | 1 128 | 3 516 | 3 873 | 7 538 | 16.39% | 94.63% |

Total | 24 373 | 26 900 | 32 474 | 37 923 | 45 986 | 100% | 21.26% |

Breakdown per class of business in 2008

Ratios' evolution 2004-2008

1 Management expenses on written premiums

1 Management expenses on written premiums

Contact

| Head office | 8th Floor, ZEP–RE Place, Longonot Road, Upperhill, Nairobi, Kenya |

| Phone | (+254) 20 497 3000 |

| Fax | (+254) 20 273 8444 |

mail [at] zep-re [dot] com | |

| Website |

Thanks: We thank ZEP RE for their kind assistance in the conception of of this survey.