BH Assurance : 2022 provisional results

BH Assurance is expecting an 11.4% increase in its turnover by 31 December 2022. At that date, the premium volume would reach 164.3 million TND (50.6 million USD) against 147.5 million TND (51.1 million USD) in 2021.

BH Assurance is expecting an 11.4% increase in its turnover by 31 December 2022. At that date, the premium volume would reach 164.3 million TND (50.6 million USD) against 147.5 million TND (51.1 million USD) in 2021.

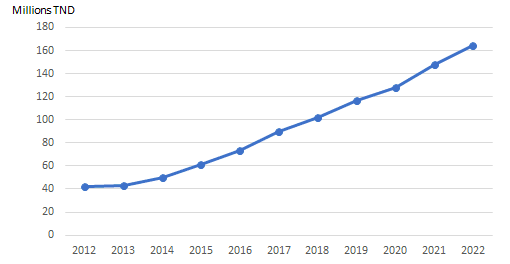

BH Assurance turnover evolution (2012-2022*)

* provisional figures

Turnover breakdown per class of business (2019-2022*)

In millions| Class of business | 2019 | 2020 | 2021 | 2022* | ||||

|---|---|---|---|---|---|---|---|---|

| TND | USD | TND | USD | TND | USD | TND | USD | |

| Health | 32.5 | 11.6 | 38.9 | 14.4 | 43.6 | 15.1 | 49 | 15.1 |

| Motor | 24.3 | 8.7 | 26.6 | 9.8 | 29.7 | 10.3 | 31.2 | 9.6 |

| Fire and miscellaneous risks | 11 | 3.9 | 10.9 | 4 | 13.5 | 4.7 | 14.8 | 4.6 |

| Marine | 3.4 | 1.2 | 3.5 | 1.3 | 4.1 | 1.4 | 4 | 1.2 |

| Engineering | 3.1 | 1.1 | 3.3 | 1.2 | 2.4 | 0.8 | 2.8 | 0.9 |

| Total non-life | 74.3 | 26.5 | 83.2 | 30.7 | 93.3 | 32.3 | 101.8 | 31.4 |

| Total life | 42.4 | 15.1 | 44.4 | 16.4 | 54.3 | 18.8 | 62.5 | 19.2 |

| Grand total | 116.7 | 41.6 | 127.6 | 47.1 | 147.5 | 51.1 | 164.3 | 50.6 |

* provisional figures

Main activity indicators (2017-2021)

In millions| Indicators | 2017 | 2018 | 2019 | 2020 | 2021 | |||||

|---|---|---|---|---|---|---|---|---|---|---|

| TND | USD | TND | USD | TND | USD | TND | USD | TND | USD | |

| Gross written premiums | 90.2 | 36.4 | 102.1 | 33.9 | 116.7 | 41.6 | 127.6 | 47.1 | 147.5 | 51.1 |

| Net result | 6.1 | 2.5 | 7.6 | 2.5 | 9.5 | 3.4 | 9.6 | 3.5 | 13.1 | 4.5 |

| Shareholder’s equity | 42.5 | 17.1 | 46.1 | 15.3 | 53.7 | 19.2 | 60.6 | 22.4 | 81.3 | 28.2 |

| Share capital | 13.3 | 5.4 | 13.3 | 4.4 | 13.3 | 4.7 | 13.3 | 4.9 | 13.3 | 4.6 |

| Technical reserves | 147.3 | 59.4 | 164.4 | 54.6 | 184.5 | 65.9 | 208.01 | 208.01 | 227.7 | 227.7 |

| Loss ratio | 72.06% | 64.79% | 60% | 62.11% | 60.73% | |||||

| Combined ratio | 86% | 92.03% | 87.05% | 80% | 87.06% | |||||

* provisional figures

0

Your rating: None

Mon, 07/11/2022 - 12:08

The online magazine

Live coverage

04/26

04/26

04/26

04/26

04/25

Latest news