Leadway Assurance Company

- Date of creation: 1970, Kaduna, Nigeria

- Classes of business: Life and non-life

- Distribution Network: 24 subsidiaries

- Number of employees: 331

Leadway Assurance Company in 2022

|

| Share capital | 23 613 000 USD |

| Turnover | 202 597 000 USD |

| Assets | 1 182 241 000 USD |

| Shareholder’s equity | 181 103 000 USD |

| Net result | 26 023 000 USD |

| Net non-life loss ratio | 65.85% |

| Net non-life management expenses ratio | 40% |

| Net non-life combined ratio | 105.85% |

Management

| Martin Luther Agwai | Chairman of the Board of Directors |

| Tunde Hassan-Odukale | Managing Director/CEO |

| Adetola Adegbayi | Executive Director. Technical Service |

| Gboyega Lesi | Executive Director. Commercial |

| Yemisi Rotimi | Chief Financial Officer |

| Kunbi Adeoti | Head HR and Admin |

| Odalo Aimufia | Chief Information Officer |

| Ernest Aziagba | Actuary, General Business |

| Bamidele Lawal | Chief Technical Officer |

| Kikelomo Fischer | Chief Risk Officer |

Shareholding

| Shareholders | Shares |

| Sir Hassan Olusola Odukale Trust | 25% |

| Leadway Trustees Limited | 13% |

| OHO Investments Limited | 8% |

| Others | 54% |

Leadway Assurance Company : main technical highlights

Figures in thousands USD

| Highlights | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Gross written premiums | 239 804 | 248 234 | 140 036 | 170 361 | 202 597 |

| Gross non-life written premiums | 82 853 | 96 028 | 80 252 | 88 546 | 90 278 |

| Gross life written premiums | 156 951 | 152 206 | 59 784 | 81 815 | 112 319 |

| Net written premiums | 194 278 | 199 034 | 94 598 | 120 701 | 157 621 |

| Net non-life written premiums | 40 408 | 48 369 | 38 197 | 43 785 | 48 455 |

| Net earned premiums | 195 610 | 194 261 | 96 675 | 114 426 | 141 824 |

| Net non-life earned premiums | 41 740 | 45 392 | 39 900 | 38 024 | 47 504 |

| Net non-life incurred losses | 23 002 | 17 395 | 18 671 | 19 335 | 31 283 |

| Non-life management expenses | 9 056 | 14 097 | 13 880 | 15 539 | 19 382 |

| Net non-life loss ratio (1) | 55.11% | 38.32% | 46.79% | 50.85% | 65.85% |

| Net non-life management expenses ratio (2) | 22.41% | 29.14% | 36.34% | 35.49% | 40.00% |

| Net non-life combined ratio (3) | 77.52% | 67.46% | 83.13% | 86.34% | 105.85% |

| Net result | 25 162 | 29 734 | 29 518 | 29 026 | 26 023 |

(1) Net non-life loss ratio = Non-life incurred losses / Net non-life earned premiums

(2) Net non-life management expenses ratio = Non-life management expenses / Net non-life written premiums

(3) Net non-life combined ratio = Net non-life loss ratio + Net non-life management expenses ratio

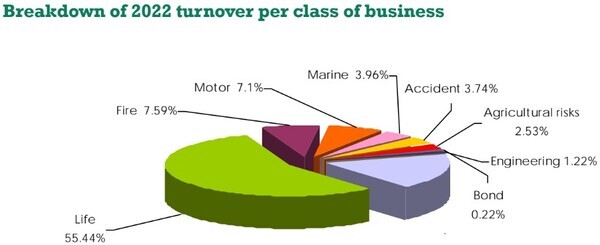

Leadway Assurance Company : turnover breakdown per class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | Shares 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|---|

| Fire | 8 361 | 9 146 | 9 609 | 12 841 | 15 381 | 7.59% | 30.52% |

| Motor | 9 467 | 10 427 | 10 928 | 12 685 | 14 378 | 7.10% | 23.52% |

| Marine | 4 521 | 4 668 | 5 405 | 5 962 | 8 029 | 3.96% | 46.75% |

| Accident | 4 528 | 4 727 | 6 723 | 7 518 | 7 568 | 3.74% | 9.69% |

| Agricultural risks | - | 1 576 | 3 687 | 3 535 | 5 136 | 2.53% | 58.31% |

| Engineering | 3 663 | 2 837 | 1 562 | 3 150 | 2 478 | 1.22% | -14.29% |

| Bond | 1 907 | 2 448 | 1 012 | 593 | 439 | 0.22% | -19.28% |

| Special risks | 50 406 | 60 199 | 41 326 | 42 262 | 36 869 | 18.20% | -4.94% |

| Non-life total | 82 853 | 96 028 | 80 252 | 88 546 | 90 278 | 44.56% | 11.10% |

| Annuities/pension | 141 833 | 132 629 | 39 775 | 55 607 | 59 853 | 29.54% | 17.29% |

| Group insurance | 11 254 | 14 882 | 14 930 | 17 912 | 41 124 | 20.30% | 150.18% |

| Individual insurance | 3 864 | 4 695 | 5 079 | 8 296 | 11 342 | 5.60% | 48.96% |

| Life total | 156 951 | 152 206 | 59 784 | 81 815 | 112 319 | 55.44% | 49.60% |

| Grand total | 239 804 | 248 234 | 140 036 | 170 361 | 202 597 | 100% | 29.59% |

(1) Growth rate in local currency

Leadway Assurance Company : net written premiums by non-life class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire | 4 392 | 4 145 | 5 837 | 7 762 | 8 650 | 21.44% |

| Motor | 9 087 | 10 002 | 10 625 | 12 197 | 13 794 | 23.24% |

| Marine | 3 266 | 2 545 | 3 085 | 2 782 | 4 492 | 75.97% |

| Accident | 3 788 | 3 761 | 4 655 | 4 992 | 4 948 | 8.00% |

| Agricultural risks | - | 500 | 713 | 271 | 1 392 | 460.33% |

| Engineering | 2 485 | 2 052 | 513 | 1 521 | 390 | -72.06% |

| Bond | 537 | 1 231 | 687 | 416 | 267 | -29.95% |

| Special risks | 16 853 | 24 133 | 12 082 | 13 844 | 14 522 | 14.30% |

| Non-life total | 40 408 | 48 369 | 38 197 | 43 785 | 48 455 | 20.59% |

Leadway Assurance Company : net earned premiums by non-life class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire | 4 978 | 3 679 | 5 249 | 6 168 | 8 227 | 45.35% |

| Motor | 9 189 | 9 450 | 11 304 | 10 934 | 12 348 | 23.06% |

| Marine | 2 885 | 2 635 | 2 070 | 2 364 | 3 455 | 59.27% |

| Accident | 3 415 | 3 375 | 4 438 | 4 252 | 5 097 | 30.63% |

| Agricultural risks | - | 1 077 | 115 | 310 | 3 110 | 993.97% |

| Engineering | 2 477 | 2 451 | 709 | 502 | 850 | 84.30% |

| Bond | 556 | 1 165 | 734 | 327 | 251 | -16.36% |

| Special risks | 18 240 | 21 560 | 15 281 | 13 167 | 14 166 | 17.24% |

| Non-life total | 41 740 | 45 392 | 39 900 | 38 024 | 47 504 | 36.14% |

(1) Growth rate in local currency

Leadway Assurance Company : net incurred losses by non-life class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire | 4 155 | 4 255 | 6 320 | 4 811 | 4 365 | -1.13% |

| Motor | 5 469 | 6 378 | 5 438 | 6 601 | 7 395 | 22.07% |

| Marine | 891 | 2 917 | 2 859 | 1 707 | 3 632 | 131.85% |

| Accident | 917 | 1 303 | 1 136 | 1 036 | 1 919 | 101.77% |

| Agricultural risks | - | 403 | 227 | 164 | 1 245 | 729.03% |

| Engineering | 194 | 243 | 966 | -225 | 930 | 551.37% |

| Bond | 727 | 1 280 | -601 | -216 | -199 | -0.32% |

| Special risks | 10 649 | 616 | 2 326 | 5 457 | 11 996 | 139.57% |

| Non-life total | 23 002 | 17 395 | 18 671 | 19 335 | 31 283 | 76.31% |

Leadway Assurance Company : management expenses by non-life class of business

Figures in thousands USD

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 | 2021-2022 evolution (1) |

|---|---|---|---|---|---|---|

| Fire | 1 971 | 2 310 | 2 447 | 3 083 | 4 355 | 53.94% |

| Motor | 1 602 | 1 992 | 2 381 | 2 388 | 3 049 | 39.18% |

| Marine | 874 | 1 067 | 1 394 | 1 489 | 2 447 | 79.09% |

| Accident | 1 022 | 1 157 | 1 737 | 1 715 | 2 046 | 30.02% |

| Agricultural risks | - | 297 | 518 | 600 | 1 124 | 103.88% |

| Engineering | 764 | 741 | 483 | 653 | 794 | 32.52% |

| Bond | 115 | 188 | 133 | 99 | 119 | 30.52% |

| Special risks | 2 708 | 6 345 | 4 787 | 5 512 | 5 448 | 7.69% |

| Non-life total | 9 056 | 14 097 | 13 880 | 15 539 | 19 382 | 35.92% |

(1) Growth rate in local currency

Leadway Assurance Company : net loss ratio by non-life class of business

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire | 83.47% | 115.64% | 120.40% | 78.00% | 53.06% |

| Motor | 59.51% | 67.49% | 48.11% | 60.37% | 59.89% |

| Marine | 30.88% | 110.68% | 138.08% | 72.22% | 105.13% |

| Accident | 26.85% | 38.59% | 25.59% | 24.37% | 37.65% |

| Agricultural risks | - | 37.38% | 198.09% | 52.81% | 40.02% |

| Engineering | 7.85% | 9.92% | 136.21% | -44.68% | 109.43% |

| Bond | 130.77% | 109.95% | -81.81% | -66.19% | -79.39% |

| Special risks | 58.38% | 2.86% | 15.22% | 41.44% | 84.68% |

| Non-life total | 55.11% | 38.32% | 46.79% | 50.85% | 65.85% |

Leadway Assurance Company : net management expenses ratio by non-life class of business

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire | 44.88% | 55.73% | 41.92% | 39.72% | 50.35% |

| Motor | 17.64% | 19.92% | 22.41% | 19.58% | 22.11% |

| Marine | 26.75% | 41.90% | 45.18% | 53.53% | 54.48% |

| Accident | 26.98% | 30.75% | 37.31% | 34.35% | 41.35% |

| Agricultural risks | - | 59.41% | 72.67% | 221.84% | 80.72% |

| Engineering | 30.75% | 36.11% | 94.09% | 42.89% | 203.43% |

| Bond | 21.47% | 15.30% | 19.44% | 23.86% | 44.46% |

| Special risks | 16.07% | 26.29% | 39.62% | 39.82% | 37.51% |

| Non-life total | 22.41% | 29.14% | 36.34% | 35.49% | 40.00% |

Leadway Assurance Company : net combined ratio by non-life class of business

| Classes of business | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|

| Fire | 128.35% | 171.37% | 162.32% | 117.72% | 103.41% |

| Motor | 77.15% | 87.41% | 70.52% | 79.95% | 82.00% |

| Marine | 57.63% | 152.58% | 183.26% | 125.75% | 159.61% |

| Accident | 53.83% | 69.34% | 62.90% | 58.72% | 79.00% |

| Agricultural risks | - | 96.79% | 270.76% | 274.65% | 120.74% |

| Engineering | 38.60% | 46.03% | 230.30% | -1.79% | 312.86% |

| Bond | 152.24% | 125.25% | -62.37% | -42.33% | -34.93% |

| Special risks | 74.45% | 29.15% | 54.84% | 81.26% | 122.19% |

| Non-life total | 77.52% | 67.46% | 83.13% | 86.34% | 105.85% |

Source: Leadway Assurance Company's annual reports

Exchange rate as at 31/12/2022: 1 NGN = 0.00223 USD ; at 31/12/2021: 1 NGN = 0.00243 USD ; at 31/12/2020: 1 NGN = 0.00261 USD ; at 31/12/2019: 1 NGN = 0.00274 USD ; at 31/12/2018: 1 NGN = 0.00274 USD

Leadway Assurance Company : Contact

| Head office | 121/123 Funso Williams Avenue. Iponri Surulere. Marina Lagos Nigeria |

| Phone | 01-2700 700 |

insure [at] leadway [dot] com | |

| Website |