Insurance in the face of earthquakes

San Francisco earthquake, 1906 Planet earth is in perpetual movement. Supporting both continents and oceans, its upper surface, earth's crust, is made up of the superposition of more or less stiff plates which derive at the speed of a few centimetres a year in a relentless interaction.

San Francisco earthquake, 1906 Planet earth is in perpetual movement. Supporting both continents and oceans, its upper surface, earth's crust, is made up of the superposition of more or less stiff plates which derive at the speed of a few centimetres a year in a relentless interaction.

Related Articles:

Earthquake insurance

While many regions of the world are regularly devastated by earthquakes and as major megalopolis, located in high-risk areas, are living in dread of a disaster to come, the insurance business has, until recent years, displayed particular withdrawal on the front of natural catastrophes. The fact that earthquakes quite often affect in great numbers low-income populations could account for such reluctance. In most affected countries, it is the governments that traditionally take in charge the claim losses and reconstruction costs. Due to the magnitude of the damage caused, insurers have been very reluctant about covering earthquake risks. Even in industrialized countries, earthquake covers are rarely compulsory and exist only as an optional extension clause in the homeowners insurance policies.

San Francisco: earthquake risk, nightmare of the insurance companies

|

California (USA), April 18, 1906. The date is inscribed in the collective memory as one of the biggest disaster for the country and for the insurance business. A powerful earthquake followed by a fire has ravaged the city of San Francisco. Designed to combat seat of fire, explosives did amplify the destruction. The loss toll of the insured goods amounted to 235 million USD, that is, the 2005 equivalent of 4.9 billion USD.

The number of loss notifications reached 100 000, the bulk of which pertained to homeowners and fire insurance policies. Even though insurers refunded only 180 million USD (the 2005 equivalent of 3.75 billion USD) of the total claim amount, the San Francisco earthquake did drive 12 American, one Australian and one German companies out of business. The San Francisco claim alone swallowed up all of the profits amassed by insurance companies during the previous 47 years.

The fear of “the Big One” is still hunting the minds. The losses of an equivalent cataclysm would amount to figures comprised today between 30 billion and 105 billion USD. Even though the Earthquake Hazards Program agency has put off the probability of the event recurrence to 200 years, seismologists consider that there is a 60% chance for an earthquake of a magnitude equal or higher than 6.7 to take place in California in the 30 years to come. Despite this perspective, the rate of insured Californians does not exceed 13% for the time being.

Practical lessons

The development of earthquake insurance is a matter of paradox as if the event was the master of the game. It was indeed the earthquakes of recent years that triggered the institution of the most effective insurance schemes. The countries which best learned from their woes are the United States, Japan, Mexico and Turkey.

The earthquake insurance in the United States

San Andreas Fault San Andreas Fault |

The earthquake insurance is a national political business. It regards in the first place the most exposed state, California which gathers the highest number of insured inhabitants of the country.

Following the 1994 Northridge earthquake which caused 15 billion USD in insured damages, companies have almost stopped homeowners' comprehensive policies because of the so-called “Mandatory offer law” obliging them to integrate an earthquake guarantee in this kind of policy.

In light of this situation, the government took a couple of decisions: the launching of a “mini policy”, of limited cover, marketed by the private companies and the creation of the California Earthquake Authority (CEA) in 1988, a public agency operating as a pool of insurance and endowed with a capital of 2.5 billion USD. CEA, which collects an annual gross premium volume of 500 million USD, has 750 000 insured members. Its financial capacity has currently reached 8 billion USD.

In 2003, The California Earthquake Authority Strategic adopted a plan for the 2003-2007 period designed to develop prevention, the education of the population, claim management devices and to enhance the role and build the capacity of CEA.

The earthquake insurance in Japan

Tōhoku earthquake and tsunami, Japan, 2011 Tōhoku earthquake and tsunami, Japan, 2011 |

Located on four tectonic plates, the Japanese archipelago is one of the countries that is most exposed to earthquakes, and the most advanced in terms of prevention, minimizing damage, insurance and management earthquake risks. Thanks to investments commensurate with the huge risks it sustains, Japan has developed research programs and cutting edge technology in the field of (engineering, cartography of risky zones, regulation of construction standards, paraseismic tools and equipment, civic education). The Japanese experience stands as the model to be emulated worldwide.

Among the most sophisticated devices set up in Japan, a unique system of sub-marine seismic surveillance, constantly operational in real time, an instrument which drastically failed to prevent the 2005 tsunami.

Read also:

- Japan (2011): the earthquake costs 211 billion USD

- Kumamoto earthquake (2016): compensations on the rise

A non-profit insurance for the protection of the population

7.5 magnitude earthquake, Niigata, Japan, 1964 7.5 magnitude earthquake, Niigata, Japan, 1964 |

Following the 1964 Niigata earthquake, an earthquake insurance for homeowners' risks was established in 1966 within the framework of the reinsurance program Japanese Earthquake Reinsurance (JER). According to this law, the State's indemnification sums could cover 50% to 95% of the claim in case the accumulated damage reaches 8.75 billion USD. The annual maximum sums that may be refunded by JER amount to 39.4 billion USD.

The earthquake insurance for “homeowner” risk regards houses (buildings used exclusively or partially for residence) and the content (furniture goods for domestic use). Contracts are necessarily attached to a fire policy and cannot be separately underwritten. The standard premium rates are calculated by the Japanese Non-Life Insurance Rating Body. Premiums are divided into four classes according to region and into two categories according to type of construction. Reinsurance is shared between the government and the private sector.

Several other systems coexist:

- With the support of foreign reinsurers, the private sector covers the risks of commercial and industrial firms within the framework of endorsement to fire policies.

- The cooperative sector, such as the federation of agricultural insurance mutuals, Zenkyoren, Japan's biggest cooperative body, has proposed as of 1960 a thirty-year flat tariff earthquake cover.

Yet, until 1995, the business insurance had had too low financial capacities to face risks. It is estimated that the share of inhabitants covered by an earthquake insurance is limited to 7%. In Kobe, this rate, which was of 3%, rose to 15% following the 1995 disaster (magnitude: 7.3, toll: 6 432 deaths, 100 billion EUR damages).

7.3 magnitude earthquake, Kobe, Japan, 1995 7.3 magnitude earthquake, Kobe, Japan, 1995 |

Kobe, 1995, was regarded as the most important seismic event since 1923 when earthquake Kanto hit (magnitude 8.3, followed by a fire, toll: 143 000 deaths, 100 billion USD in damages) which remains a base event in statistical models.

Another lesson learned from Kobe, the finding that the scale of earthquake damages depends on a number of parameters such as coincidence, exposure, vulnerability, hence the necessity of a risk probability approach.

That is why as of 2001, the tariff of earthquake insurance premiums has been calculated according to housing anti seismic classification standards.

Following the 2005 south eastern Asian tsunami and under the pressure of public opinion, the government decided to extend the value of JER's cover by 11% raising it to 50 billion USD.

The earthquake insurance in Turkey

8.2 magnitude earthquake, Izmit, Turkey, 1999 8.2 magnitude earthquake, Izmit, Turkey, 1999 |

Particularly exposed, the country is run, along a 1000 Km stretch, by the north-Anatolian fault, the thrust fault between the African and the Euro Asian plates.

The most striking earthquake insurance event in Turkey is the Kocaeli earthquake, (August 17, 1999, magnitude: 7.4, toll: 17 118 deaths, amount of insured risks: 800 million USD, economic losses: 6 billion USD).

In the first place, companies reacted by increasing policies tariffs or by abstaining from underwriting earthquake risks. But in light of a forced deal with the sector, the government set up the Turkish Catastrophe Insurance Pool (TCIP). Since its implementation in 2000, TCIP has covered about 2 million people. The proven efficiency of the plan has made it a model which is currently exported.

In the national earthquake insurance plan implemented, two formulas coexist:

- A compulsory policy, run by the Turkish Catastrophic Insurance Pool-TCIP (DASK), regards all dwellings except public buildings.

- A non-compulsory policy, available on the market and that remains optional for damage, fire or theft insurance policies.

In the previous century, 115 earthquakes with a magnitude above 5 on the Richter scale hit the country.

Read also:

The earthquake insurance in Mexico

Being a high-risk country sustaining very serious losses, Mexico put in place as of 1996 a natural catastrophe fund, Fondo de Desastres Naturales (FONDEN). The scheme has been completed in 2006 with the reinsurance agreement brokered with Swiss Re, the first of its kind in earthquake insurance.

Named “parametric triggering cover”, the guarantee does not pertain to the indemnification of material damage but to the funding of the reconstruction. The program has been established according to three geographic regions with predefined high risk and a given level of earthquake magnitude. The plan provides for the compensation on a three-year period of damages triggered by three earthquakes causing losses of 150 million USD each.

China: a high risk and under-insured country

7.9-8.3 magnitude earthquake, Sichuan, China, 2008 7.9-8.3 magnitude earthquake, Sichuan, China, 2008 |

With the exception of the mentioned example, most of the emerging countries do not have any prevention or insurance schemes, as is the case with China, a country that is highly exposed, though, and whose recent history is marked by major disasters such as the Tangshan in July 1976: Toll: 1 000 000 deaths, 1.25 billion USD economic damages. Statistics show that 35% of earthquakes with a magnitude above 7 have occurred in China. In terms of exposure, 23 out of the 31 provinces of the country and 2/3 of the most populated cities are located in the risky zones. But since the integration of China in the World Trade Organisation and the deregulation of the insurance sector, the issue of creating a national earthquake insurance plan has been on the table. The project has been under study since 2003 when the international conference on continental earthquakes was held in Beijing.

Read also:

- The earthquake which hit the Sichuan province

- Sichuan earthquake: 306.6 million CYN disbursed to victims

- China: Launch of the first earthquake insurance

Catastrophe scenario

For seismologists, the worst is still to come. The chance of a major disaster occurrence is high, especially in high-density and populated urban regions. The concerns are about the numerous megalopolises located in risky areas: Los Angeles, San Francisco, Tokyo, Djakarta, Istanbul, Cairo, Teheran, Lanzhu (China).

Enrich your knowledge

Earthquakes, the outcome of material activity

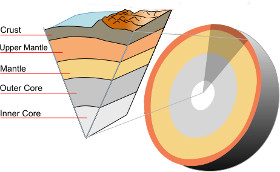

Earth cutaway (modified picture) Earth cutaway (modified picture) |

Earthquakes result from the rupture of resistant rocks triggered by the abrupt sliding of the two terrestrial areas along a fault line. They are in most cases caused by the movements of the lithosphere plates that are moving at the surface of the globe in relation to one another. It is the phenomenon of plate tectonics whose two major phenomena are subduction and collision.

- The lithosphere: It is the stiff and floating layer of the earth. It is made up of the crust and of the superficial part of the mantle.

- Subduction: It is the result of the friction of two plates, one is oceanic while the other is continental, one of which plunges under the other. This thrust fault instantly releases the stored energy which causes earthquakes and volcanic eruptions.

- Collision: It is the outcome of the friction between the two continental plates. The compressed matter emanating from magma crystallizes, rises and forms a mountainous chain, either under water or in the air.

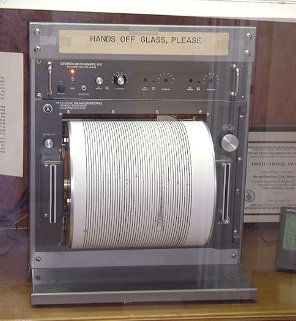

- Magnitude: The power of an earthquake may be quantified according to its magnitude, a notion that was first introduced in 1935 by the seismologist Charles Francis Richter. The magnitude calculates, by means of a standard seismograph, the scale of the earthquake at the hypocentre. Magnitude is not a scale but a logarithmic continuous function. There are other scales of intensity which measure the earthquake effects on the surface such as the Mercalli modified scale and the Rossi-Forel scale.

The risks geography

Located in the subduction areas, the regions that are the most exposed to the risk are:

- The Africa — Eurasia — India convergence field which includes the Mediterranean region, the Iran — Pakistan — Afghanistan region, Central Asia, northern India and China

- Circum-Pacific subduction fields which includes North-Western America, Central America and South America in the East, and Japan, Taiwan, the Philippines, Indonesia and Papua New Guinea in the West

- Volcanic arcs such as the West Indies and the Caribbean

- The fields emerging from the sliding between plates such as California

Preventive measures

Despite the progress achieved in earth science, the current level of knowledge does not allow earthquake forecast, that is, to determine with accuracy the date and place of its occurrence. However, the medium-term forecast allows us to estimate the probability of an earthquake occurrence in a given place.

Earthquakes remain unpredictable natural accidents for many reasons:

- Lack of knowledge of triggering factors and of precursors

- The complexity and diversity of the parameters at stake

- The difficulty in controlling physical phenomena happening a few kilometres inside the earth

The major preventive measures are:

- Constructions that are adapted and suited to town planning meeting paraseismic rules,

- Consolidation of the already built areas,

- The institution of efficient emergency plans,

- Preparing the population to face the event.

Observation instruments and methods in use

Thanks to the GPS systems, the earth's movements are now the subject of studies that analyse and reconstruct plates distribution and moves for 200 million years.

Thanks to the GPS systems, the earth's movements are now the subject of studies that analyse and reconstruct plates distribution and moves for 200 million years.

Ocean Bottom Seismometer (OBS) are autonomous instruments, set in the bottom of oceans in order to record soil vibrations. Among the devices of measurements and observation devised in recent years:

- The VAN method designed in 1981 by Greek physicists and which is based on the detection of electromagnetic anomalies generated in the subsoil by tremors.

- The Global Earth Observation System of Systems (GEOSS), launched by the European Union in 2005 and which makes use of 30 satellites.

- The latest news refer to an original brainwave in China: a system of detection based on the observation of animal instinct, especially reptiles regarded to be the living creatures that are most sensitive to telluric tremors.