Insurance in the Gulf countries (Part 2)

The establishment of insurance market

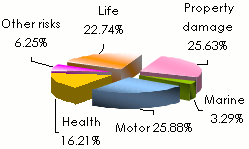

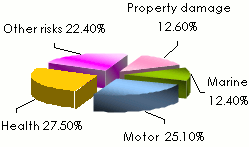

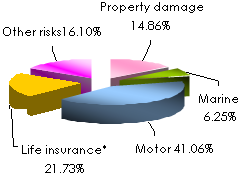

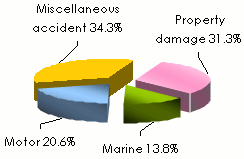

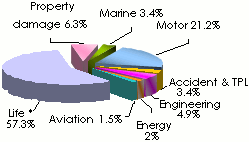

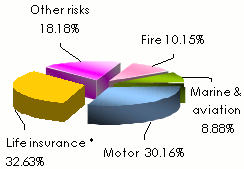

In most Gulf countries, motor and health insurance are the two main classes of business with the exception of Saudi Arabia where health insurance, alone, accounts for more than half of the premiums.

The intense market segmentation pushes companies into a fierce price battle targeting all classes of business.

Breakdown of premiums per country and per class of business

| Bahrain 2011 | United Arab Emirates 2010 |

Source: Insurance Market Review 2011, Central Bank of Bahrain Source: Insurance Market Review 2011, Central Bank of Bahrain |  Source: Axco Global Statistics Source: Axco Global Statistics |

| Oman 2011 | Qatar 2010 (non life premiums only) |

|  |

| * Including health Source: Insurance Market Review 2011, Capital Market Authority, Oman | |

| Saudi Arabia 2011 | Kuwait 2011 |

* Including health * Including health |  * Including health * Including health |

Compulsory insurance covers

Following economic development and the improvement in the living environment, the governments of the region have proceeded to a gradual introduction of compulsory insurance, a move which boosted premiums volume, especially in third party liability and health insurance.

We are reviewing hereafter the main insurance obligations introduced in recent years in the Gulf countries.

Saudi Arabia

Motor third party liability, professional liability of insurance and reinsurance agents and brokers, professional liability of actuaries, professional liability of insurance adjusters and advisors, health insurance for expatriates residing in the country and Saudi employees in the private sector, professional liability of physicians and dentists. Al Anoud tower, Riyadh, Saudi Arabia

Al Anoud tower, Riyadh, Saudi ArabiaBahrain

Motor third party liability, professional liability of insurance intermediaries, workmen’s compensation (state-run schemes for companies having at least two employees).Kuwait

Motor third party liability, professional liability of insurance intermediaries, yacht liability, oil pollution for ships carrying more than 2 000 tons of oil.United Arab Emirates

Motor liability, professional liability of insurance brokers, medical professional liability, health insurance for expatriates living in Abu Dhabi, health insurance for workers in the public sector.Oman

Motor third party liability, professional liability of insurance brokers, professional liability of physicians, workmen’s compensation.Qatar

Motor third party liability, professional liability of energy consultants, liability of architects and engineers, aviation liability for aircraft body damage.

Takaful insurance

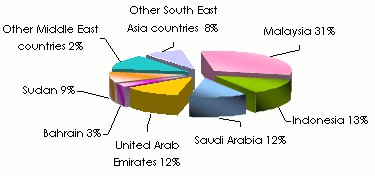

Islamic insurance is witnessing a steady increase, with an overall takaful premiums volume estimated at 9.4 billion USD in 2010, 3.3 billion USD of which underwritten only in the Gulf countries, that is 35% of global islamic insurance.

Breakdown of takaful insurance market shares in 2010

Source: Swiss Re

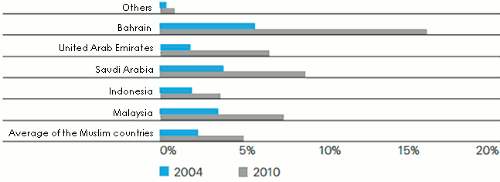

Source: Swiss Re It is in Saudi Arabia and the United Arab Emirates that islamic insurance is most important: +30% between 2007 and 2010.

Islamic insurance in percentage of the overall written premiums per country in 2004 and 2010

Reinsurance

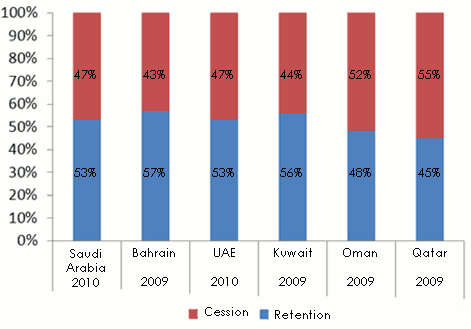

The rate of reinsurance cession is quite significant in the Gulf countries. Due to the prevalence of petrochemical risks, this rate is one of the highest in the developing countries. Health insurance, whose premiums are largely retained by insurers, is the class of business that allows markets to increase their retention.

Several factors are behind the high rate of reinsurance cession:

- The capitalization of insurers is generally inadequate

- Insurers’ apathy for risk

- Lack of qualified staff to better assess risks

- The imbalance of companies’ portfolios where mega risks coexist with simple risks.

Companies’ retention per country

Source: Axco, Alpen Capital

Source: Axco, Alpen Capital Market imbalance is partly maintained by the competition involving reinsurers. Low exposure to natural events allows reinsurers to generate profits despite the low rates applied at the direct level.

Alongside the "Bermudans", the new players, and the traditional reinsurers, some of whom locally represented, regional entities are also present: Trust Re, Q-Re, Arig, Kuwait Re, Saudi Re, Gulf Re, ACR Retakaful, Fajer Re, IGI, Best Re.

Growth factors

Doha view, Qatar © Bruno befreetv, CC BY-SA 3.0 (modified picture) Doha view, Qatar © Bruno befreetv, CC BY-SA 3.0 (modified picture) |

Between 2007 and 2011, the six Gulf countries together have reported an 80% growth of their overall turnover. By the end of 2011, the area had been dominated by the United Arab Emirates with a premiums volume of 6.641 billion USD and Saudi Arabia with 4.971 billion USD in premium income. In terms of growth rate, Saudi Arabia is the fastest-growing (+117% over the 2007-2011 period), followed by Qatar (+79%), Oman (+75%) and the United Arab Emirates (+67%).

Evolution of Gulf countries’ premiums: 2007-2011

in millions USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2007/2011 evolution | |

|---|---|---|---|---|---|---|

United Arab Emirates | 3 973 | 4 976 | 5 456 | 5 970 | 6 641 | 67% |

Saudi Arabia | 2 290 | 2 912 | 3 896 | 4 370 | 4 971 | 117% |

Qatar | 538 | 846 | 773 | 878 | 961 | 79% |

Kuwait | 675 | 670 | 589 | 718 | 812 | 20% |

Oman | 439 | 542 | 619 | 691 | 766 | 75% |

Bahrain | 361 | 497 | 533 | 560 | 579 | 60% |

Total | 8 276 | 10 443 | 11 866 | 13 187 | 14 730 | 80% |

The demographic factor

The steady trend of the demographic curve, with a 3.9% progression rate reported between 2000 and 2011, along with the presence of an important expatriate community have promoted development. Youth population, coupled with a favourable economic situation is likely to boost consumption, savings and therefore the demand for insurance. Expatriates, with a purchasing power above average, have a positive impact on this trend, especially since they are sometimes subject to compulsory health insurance.

The economic factor

Regional economies have slowed down due to the economic crisis of 2008. This decline was, nonetheless temporary, as stronger oil prices supported GDP growth of all producing countries. The combined GDP of the Gulf countries has risen from 1 132 billion USD in 2008 to 921 billion USD in 2009 and then to 1 294 billion USD in 2011. Per capita GDP has followed the same trend, reaching 31 000 USD per capita by December 31, 2011.

Diversification of the economy

Revenues from the sale of hydrocarbons weigh heavily on the economies of regional countries. The activity is too dependent on the fluctuation of raw materials prices. Diversification into other industries was initiated to reduce this dependency and to prepare a future without oil. This reorientation of the economic model has resulted in higher demand for insurance.

Compulsory insurance

Non-life insurance has witnessed significant growth following the introduction of many compulsory insurance schemes, which triggered a significant increase in turnover particularly in the motor and health business. It is around these two covers that the market is poised to continue growing in the short and medium terms.

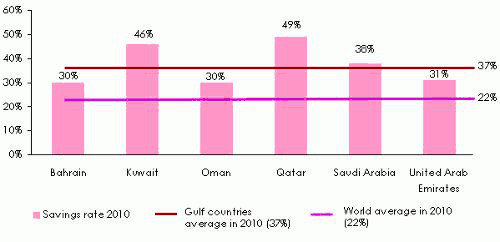

The importance of savings

In the Gulf countries, savings rate available is well above the global average set at 22% in 2010. However, only 4% of these savings is currently dedicated to insurance. These figures show a significant margin increase for regional insurers.

Islamic insurance

Islamic insurance is particularly well established in the Gulf, prompting traditional insurance business by attracting new customers. It is currently regarded as an essential component of the market. No company can afford to ignore this segment, poised for a promising future, especially in Saudi Arabia, the United Arab Emirates and Qatar.

Savings rate of Gulf countries in 2010

Source: Qatar Financial Centre Authority

Source: Qatar Financial Centre Authority Market constraints and limitations

Even if all the indicators are positive, the growth of Gulf markets is still facing some constraints. The return on equity, the lack of human resources and the absence of insurance culture stand, among other things, as barriers to markets development.

Structure of insurance companies’ investments

Muscat Securities Market, Oman Muscat Securities Market, Oman |

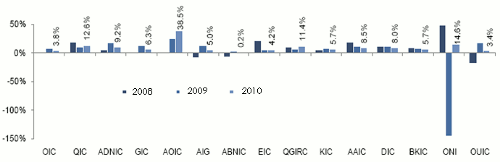

Insurance companies in the Gulf are highly exposed to the fluctuations of the financial markets. The real estate and stocks are overrepresented in the balance sheets of insurance companies. The weight of these investments has introduced volatility affecting financial returns and results, especially after the 2008 subprime crisis. The bursting of the speculative bubble in real estate and the sharp fall in the stock market have seriously eroded insurers’ shareholders’ equity. The Emirate of Dubai, on the brink of bankruptcy in 2008, was particularly affected by the global economic crisis.

Since this episode, insurance companies have tentatively opted for more secure investments. While real estate investments are important because of the potential price growth in the medium and long-term levels, investments in equity markets have dwindled down in favour of secure engagements: bonds, government loans.

Nowadays, the investments of insurers in Gulf countries consist, on average, of 69% equities, 27% real estate and 4% bonds.

This investment structure is likely to strain the solvency of insurers, some of whom have sustained a rating downgrade by Standard & Poor’s, Fitch, Moody’s and A.M. Best.

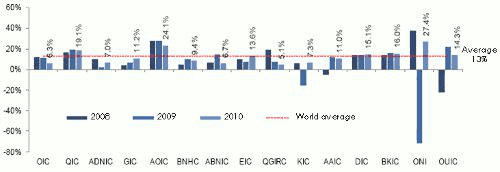

Investment return 2008-2010 *

* For companies’ abbreviations, see the table belowSource: Zawya, Alpen Capital

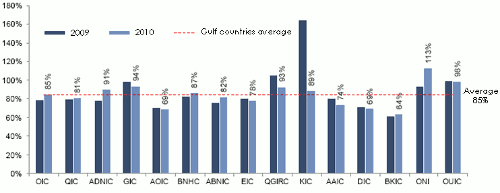

* For companies’ abbreviations, see the table belowSource: Zawya, Alpen Capital Combined ratio 2009-2010

Financial performance of some Gulf countries in 2010-2011

en USD| Company | Country | Gross written premiums | 2010/2011 evolution | Net result | 2010/2011 evolution | ||

|---|---|---|---|---|---|---|---|

| 2010 | 2011 | 2010 | 2011 | ||||

Oman Insurance Co. (OIC) | U.A.E | 659 384 505 | 637 625 032 | -3.29% | 25 620 831 | 29 451 423 | 14.95% |

Qatar Insurance Co. (QIC) | Qatar | 591 774 038 | 654 409 635 | 10.58% | 171 112 540 | 165 605 208 | -3.21% |

Abu Dhabi National Insurance Co. (ADNIC) | U.A.E | 482 042 345 | 562 528 504 | 16.69% | 38 776 944 | 43 066 151 | 11.06% |

Gulf Insurance Co. (GIC) | Kuwait | 426 744 723 | 481 451 732 | 12.81% | 33 911 162 | 32 545 569 | -4.02% |

Arab Orient Insurance Co. (AOIC) | U.A.E | 307 210 611 | 344 517 772 | 12.14% | 52 206 456 | 55 612 918 | 6.52% |

Bahrain National Holding Co. (BNHC) | Bahrain | 61 501 459 | 58 321 637 | -5.17% | 10 160 115 | 8 793 878 | 13.44% |

Al Buhaira National Insurance Co. (ABNIC) | U.A.E | 181 488 896 | 170 696 363 | -5.94% | 11 867 224 | 6 906 903 | -41.79% |

Emirates Insurance Co. (EIC) | U.A.E | 171 500 829 | 175 165 209 | 2.14% | 29 427 223 | 29 228 603 | -0.67% |

Qatar General Reinsurance Co. (QGIRC) | Qatar | 142 527 590 | 129 430 558 | -9.19% | 32 829 183 | 46 772 124 | 42.47% |

Kuwait Insurance Co. (KIC) | Kuwait | 108 249 082 | 94 069 763 | -13.09% | 13 884 315 | 15 645 838 | 12.68% |

Al Ahleia Ins. Co. (AAIC) | Kuwait | 110 979 735 | 116 277 940 | 4.77% | 29 484 562 | 27 235 216 | -7.62% |

Doha Ins. Co. (DIC) | Qatar | 101 670 174 | 115 159 849 | 13.26% | 16 675 250 | 18 081 827 | 8.43% |

Bahrain Kowait Insurance Co. (BKIC) | Bahrain | 88 976 061 | 96 460 885 | 8.41% | 11 022 587 | 11 039 715 | 0.15% |

Oman National Investment (ONI) | Oman | 62 462 719 | 83 487 919 | 33.66% | 33 981 265 | 4 039 327 | -88.11% |

Oman United Insurance Co. (OUIC) | Oman | 54 728 341 | 78 915 801 | 44.19% | 7 275 244 | 2 891 847 | -6.02% |

Return on equity

Source: Zawya, Alpen Capital

Source: Zawya, Alpen Capital Market fragmentation

With nearly 200 companies operating in the region, the market is extremely fragmented. Insurers find it hard to build a balanced portfolio. In addition, reinsurance cessions deprive ceding companies of significant resources. Retained premiums volumes were low and companies could not innovate.

The legislative framework

Countries in the region have initiated a transformation process of the legislative framework governing insurance. While decisive changes are underway (opening of corporate capital to foreign companies, introduction of compulsory insurance, ...), the legal framework is still lagging behind.

The disparity of laws is a serious obstacle to the development in the region. Insurers operating in several Gulf countries have to face a lack of homogeneity in insurance law, which incurs costs.

The lack of human resources

Insurance companies are faced with a critical shortage in skilled staff in the field of underwriting and asset management. This drawback increases the dependence of insurers vis-à-vis reinsurers.

Insurance culture

While non-life insurance now seems well established, life insurance is struggling to take off. The welfare state is still dominating the public mindset and the cultural factor is still a barrier to the penetration of insurance. The introduction of compulsory insurance has partially offset this gap.

| Exchange rate as at 31/12 United Arab Emirates AED/USD Qatar QAR/USD Bahrain BHD/USD Kuwait KWD/USD Oman OMR/USD | 2010 2.27231 0.27485 2.66390 3.5629 2.60688 | 2011 2.2723 0.27461 2.66078 3.59635 2.60512 |