ADIR

For a long time, ADIR has deliberately chosen to confine its activities to underwriting only its parent company's business. Focused on the bank's clients' risks, this niche strategy turned out to be effective because, instead of seeking premiums, ADIR has privileged return on investment, which makes it one of the most successful operators on the market.

|

| Mr René Klat |

| CEO |

ADIR equally stands as a pioneer in terms of bancassurance, the field whose significance was sensed by the company from the outset.

The year 2001 marks a new era in the development of the company which gets allied to one of France's leaders in bancassurance, Natixys Assurances, becoming its shareholder with 34% stakes. Endowed with a well-established distribution network and with one of the most efficient computer system, ADIR is consolidating its position on the bancassurance segment striving after the deployment of a strategy of expansion targeting the regional countries.

ADIR in 2006

Capital | 5 billion LBP (3.18 million USD) |

Turnover | 26.3 billion LBP (16 783 344 USD) |

Net result | 4.11 billion LBP (2 620 342 USD) |

Number of employees | 57 |

Management

| Chairman & General Manager | Semaan Bassil |

| Managing Director & CEO | René Klat |

| Assistant General Manager | Jean Hleiss |

| Finance & Administrative Manager | Roger Noujaim |

| Claims Manager | Joseph Mrad |

| Sales Manager | Raja Moawad |

| Non Life Manager | Jean Saad |

| Life Manager | Carla Abdo |

| Reinsurance Manager | Jean-Marie Naaman |

| IT Manager | Marlene Abi Antoun |

| Marketing Manager | Rachid Abi Nader |

Main shareholders

Byblos Bank | 64% |

Natixis Assurances–France | 34% |

Mr René Klat | 2% |

Turnover split by class of business: 2001-2006

in USD

| Written premiums | 2001 | % | 2002 | % | 2003 | % | 2004 | % | 2005 | % | 2006 | % |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

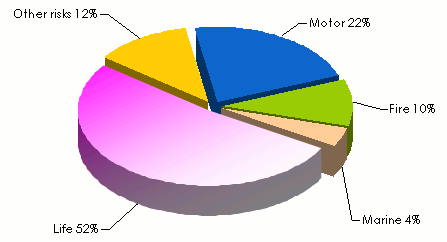

Motor | 1 084 657 | 19 | 1 112 556 | 17 | 2 077 763 | 23 | 2 595 126 | 20 | 3 180 853 | 22 | 3 758 667 | 22 |

Fire | 829 095 | 15 | 1 025 061 | 16 | 1 251 102 | 14 | 1 447 884 | 11 | 1 600 980 | 11 | 1 610 472 | 10 |

Marine | 345 668 | 6 | 304 396 | 5 | 362 454 | 4 | 525 978 | 4 | 876 183 | 6 | 653 511 | 4 |

Life | 2 290 136 | 40 | 2 472 174 | 38 | 3 269 224 | 37 | 6 411 812 | 49 | 6 626 693 | 47 | 8 692 132 | 52 |

Other risks | 1 139 515 | 20 | 1 600 711 | 24 | 1 929 374 | 22 | 2 136 243 | 16 | 1 955 363 | 14 | 2 068 562 | 12 |

Total | 5 689 071 | 100 | 6 514 898 | 100 | 8 889 917 | 100 | 13 117 043 | 100 | 14 240 072 | 100 | 16 783 344 | 100 |

Premiums' split by class of business in 2006

Main financial highlights: 2001-2006

in USD

| 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | |

|---|---|---|---|---|---|---|

Gross written premiums | 5 689 071 | 6 514 898 | 8 889 917 | 13 117 043 | 14 240 072 | 16 783 344 |

Written premiums* | 2 479 480 | 2 711 243 | 4 215 568 | 8 158 878 | 8 969 606 | 11 436 328 |

Gross earned premiums | 2 464 416 | 2 725 053 | 3 576 537 | 4 792 724 | 5 734 434 | 7 116 453 |

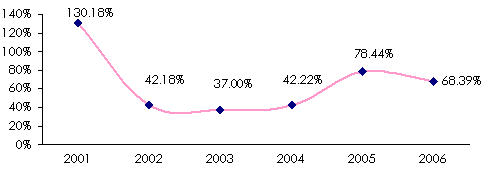

Gross incurred losses | 3 208 150 | 1 149 421 | 1 323 189 | 2 023 630 | 4 498 112 | 4 866 992 |

Net incurred losses | 1 623 972 | 624 902 | 1 080 834 | 1 723 630 | 2 116 316 | 3 327 955 |

Loss ratio | 130.18% | 42.18% | 37.00% | 42.22% | 78.44% | 68.39% |

Management fees | 1 708 968 | 2 304 637 | 2 569 153 | 3 076 916 | 3 487 289 | 4 135 256 |

Technical results | 1 103 801 | 1 026 609 | 1 100 298 | 1 174 403 | 1 271 123 | 1 094 234 |

Financial revenues | 675 721 | 753 570 | 814 524 | 1 004 784 | 1 133 735 | 1 583 126 |

Net result after tax | 1 577 017 | 1 691 332 | 1 831 138 | 2 131 188 | 2 371 258 | 2 620 342 |

* Net of reinsurance

Loss ratio: 2001-2006

Exchange rate LBP/USD as at 31/12 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 |

0.000637 | 0.000643 | 0.000643 | 0.000659 | 0.000661 | 0.000637 |

Contact

| Head office | Aya Commercial Center Dora highway, BP 90-1446 Jdeidet El Metn, Lebanon |

| Phone | +961 1 256290 |

| Fax | +961 1 256293 |

info [at] adirinsurance [dot] com | |

| Website |

Thanks : We thank ADIR for their kind assistance in the conception of this survey.