AIG, between bankruptcy and recovery

AIG ranked 29th in the "Forbes Global 2000" list before sustaining the downfall of September 2008 and prior to its bailout by the American Federal Reserve. Its large diversification and an overwhelmed management expedited its bankruptcy.

AIG ranked 29th in the "Forbes Global 2000" list before sustaining the downfall of September 2008 and prior to its bailout by the American Federal Reserve. Its large diversification and an overwhelmed management expedited its bankruptcy.

Prior to its dismantlement, the group’s entire subsidiaries had been broken down into four fields of activities: non-life insurance (gathered since 2009 under the name of Chartis), life insurance and retirement (split into entities "United States" and "outside United States"), financial services and asset management services.

AIG group is, in 2010

- an overall turnover of 77.301 billion USD

- a presence in 130 countries

- 96 000 staff members worldwide, 35 000 of whom in the United States

Chartis is, in 2010

- a turnover of 31.612 billion USD

- 45 million customers in 130 countries

- 40 000 employees worldwide

AIG: Group's ceation

Fond of Asia, American Cornelius Vander Starr settled in Shanghai in 1918, a city he admired so much. It was with a handful of dollars in his pocket that he landed in China. He was 26 then, working for various insurers. In 1919, he launched American Asiatic Underwriters (AAU), a small insurance agency representing American companies. When he first started operations, Vander Starr marketed fire and marine covers. He was the first westerner to sell insurance products in China.

AAU’s success and the identification of new opportunities enabled him to put in place a life insurance company called Asia Life Insurance Company (ALIC) whose task was then to distribute insurance policies among the local population. Less than ten years later, ALIC and AAU were present in China, Hong Kong, Philippines and Indochina. The low loss experience made it possible to reap important profits. In his business, Vander Starr emphasized training and the appointment of local employees in management positions. This strategy paid off as one of the keys to the outsanding development of his companies.

Not until 1926 did the company set foot on the American soil with the establishment of American International Underwriters (AIU) whose major task was to underwrite risks abroad on behalf of American insurers. Despite its modest size, this subsidiary provided the group with its very first diversification.

AIG Tower, Hong Kong © FF23-fr, CC BY-SA 3.0 AIG Tower, Hong Kong © FF23-fr, CC BY-SA 3.0 |

The different companies had prospered until the Second World War, when the business encountered more difficulties in Asia.

As a measure of security, Vander Starr decided in 1939 to relocate his group’s headquarters in New York. He then embarked on a glorious expansion in Latin America. As of 1941, the Pacific war seriously hindered the group’s ambitions in Asia for about two years.

The opening of representation offices in almost ten countries of Southern and Central America allowed a rapid expansion of the turnover reported in this part of the world as such that in 1945 the turnover climbed higher than the premiums volume posted in Asia.

AIG: Post-war years

By the end of the war, Vander Starr refocused on Asia where he endeavored to restore pre-war level of activities. The Shanghai and Manila offices had been reopened even before armistice was signed by the Japanese. In 1945, AIU started operating in India as an agent of Hannover Insurance and New Hampshire Insurance through the offices of Bombay, Calcutta and New Delhi where the company would operate until 1973, the year marking the start of the nationalization of the Indian insurance sector.

Even if business on the Chinese insurance market did not recover pre-war levels, it was otherwise rewarded through its development elsewhere on the Far Eastern markets, especially in Japan where AIU was integrated on the request of the American army to cover the latter’s goods. When foreign non-life companies were authorized to re-operate in China in 1951, AIU developed quickly. Since the beginning of the 2000s, the Japanese subsidiary in China which underwrites local non-life insurance became the most important subsidiary abroad.

In Europe, AIU entered Germany, still on the army’s request. Before the war, the group’s activities were confined to small representation in France, Belgium and the Netherlands. The difficult financial situation of European insurers and their inability to face capacity demand offered Vander Starr’s group a window of opportunities. Starting from the 1950s, AIU developed in Western Europe, North Africa then in Australia.

American International Group Building, New York© Chow Misey, CC BY-SA 3.0 American International Group Building, New York© Chow Misey, CC BY-SA 3.0 |

Meanwhile, the company consolidated its life insurance network in the countries of operation. In 1947, Philippine American Life Insurance Company joined the group. This life subsidiary also marketed non-life insurance and was then renamed Philippine American Life and General Insurance Company. it became Philippine’s greatest insurance company. A similar strategy was developed in South-East Asia with the acquisition of the entire capital of International Assurance Co. Ltd., the life and health insurer that Vander Starr renamed American International Assurance (AIA). Established in 1931, AIA was operational in most countries of the region.

In 1949, Mao Zedong’s troops were advancing on Shanghai. This military intervention prompted Vander Starr to leave the market in order to join New York and open offices in Hong Kong in an effort to offset the losses due to the operations conducted from Shanghai.

With the commercial success enjoyed by the group throughout the world, the board of directors decided in early 1950s to split the company’s operations into two distinct entities. One, whose head office is in New York, is in charge of operations on the American national territory. The other one, established in Bermuda, gathers all international operations. The attractive aspect of the Bermudas consists in its political stability, proximity to the United states, which provides fiscal advantages as well as prospects of rapid development. The group hired 300 employees there in the mid 1950s. During this decade, AIU was present in almost 75 countries. The relocation of a great number of oil companies in the Bermudas as of the 1960s consolidated the position of the company in the field of energy insurance.

Asia Life, the most ancient life insurance company owned by Vander Starr, had its name changed in 1951. It was renamed American Life Insurance (ALICO) and it started focusing on other new markets in Africa and the Middle East. ALICO was the first life insurance company able to set foot on the Japanese market in 1972.

In 1952, Vander Starr’s interests in the United States grew bigger with the takeover of a major stake in the capital of Globe & Rutgers Fire Insurance and its subsidiaries including American Home Assurance. Two years later, all of the subsidiaries merged keeping American Home as its name.

AIG: Modern times

As of 1960, the size of American Home required the nomination of a new managerial team. The distribution of policies by insurance agents did not meet expectations. It was Maurice R. Greenberg, appointed by Vander Starr at the management in 1962, who came up with the solution to the problem. He parted way with the agents’ network and started underwriting exclusively through brokers. American Home gradually focused on industrial risks at the detriment of household risks. This strategy enabled the company to impose its rates. Greenberg also introduced new product and new services. His willingness to increase operational margins pushed him to systematically introduce policies deductibles. Ever since, American Home’s profits improved and the company’s credibility picked up among brokers and big industrialists.

American Home built the image of an aggressive, profit-oriented company. It was during this period that various acquisitions were made on the American market and abroad. In brokerage, direct insurance and in reinsurance, the main acquisitions were named: New Hampshire Insurance, National Union Fire Insurance, Lexington Insurance, Commerce & Industry Insurance, Transatlantic Reinsurance. Greenberg’s strategy was then to identify creeping companies, integrate them in his group then proceed to their reorganization.

In 1968, Vander Starr passed away. Greenberg was logically appointed chairman of the group. A year earlier, he set up AIG holding which owns all of the group’s companies and became its chief executive officer.

The next twenty years were characterized by the big expansion of the group which then became the market’s undisputed leader. The capital soundness and the close connections weaved with brokers enabled the group’s various companies to take shareholdings in peak risks, requiring specific expertise. Numerous tailor-made products and services were made, enabling AIG to cover all kinds of risks. A risk-management body designed for important customers was set up, and acquisitions and foundations of specialized companies meeting the market’s new demands were achieved: aviation insurance, claims management, real estate credit-related insurance, ...

The next twenty years were characterized by the big expansion of the group which then became the market’s undisputed leader. The capital soundness and the close connections weaved with brokers enabled the group’s various companies to take shareholdings in peak risks, requiring specific expertise. Numerous tailor-made products and services were made, enabling AIG to cover all kinds of risks. A risk-management body designed for important customers was set up, and acquisitions and foundations of specialized companies meeting the market’s new demands were achieved: aviation insurance, claims management, real estate credit-related insurance, ...

In 1979, AIG established joint-ventures with several European socialist countries and with the People’s Insurance of China in 1980. In the 1990s, these forerunner agreements were consolidated by the acquisition of companies in most of those countries.

The diversification of AIG outside the insurance sector was then a priority and a key element in Greenberg’s strategy. In 1987, a new company named AIG Financial Services was entrusted with the development of these operations, with AIG Financial Products and AIG Trading, then International Lease Corporation (one of the most important plane charter companies) acquired in 1990, all being under its guardianship. At the beginning of the 2000s, AIG Financial Services accounted for about 15% of the operational revenues of the whole group.

Numerous acquisitions in the insurance sector had also followed from the mid 1980s to early 2000. Were mainly bought back, SunAmerica, HSB Group and American General Group.

AIG: Unveiling fraudulent practices and the advent of the financial crisis

In early 2005, AIG was charged with fraud by the commission in charge of overseeing American financial markets, the United States’ justice department and by New York’s district attorney. The company carried out suspicious transactions with a view to artificially overstate its accounts. This accounting frauds gave rise to an enormous scandal which pushed Greenberg to give up his position of CEO to Martin J. Sullivan who started his career at AIG London in 1970.

A settlement was reached with New York’s district attorney and a 1.6 billion USD penalty was inflicted upon the group. Most of the company’s leaders had to face charges in criminal and civil courts for fraudulent practices, fraud on financial markets, infringement of laws governing insurance and stock market transactions and breach of common law. While charges against Greenberg in criminal courts were dropped, accusations in the civil tribunals were maintained. He was convicted and made to pay 15 million USD in fine as accessory to the falsification of the group’s books. In July 2010, an agreement was signed with three Ohio pension funds whereby the charges pressed against AIG for accounting fraud would be dropped. In return, the group committed to disbursing 1 billion USD to those funds.

AIG: 2008 financial crisis

When the 2008 crisis broke out, AIG’s financial situation could be summarised as follows:- Stock market capitalization: 7.23 billion USD, by September 18, 2008

- Turnover: 110.06 billion USD, for the whole of 2007

- Operating revenues: 8.94 billion USD, for the whole of 2007

- Net revenues: 5.36 billion USD, as at the second quarter of 2008

- Total assets: 758.2 billion USD, as at the second quarter of 2008

- Equity capital: 78.09 billion USD as at the second quarter of 2008

- Number of employees: 116 000 in 130 countries

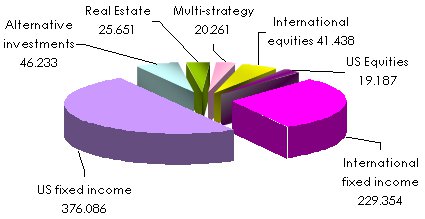

Total assets under management as at 30 June 2008: 758.2 billion USD

in billions USD

In 2008, AIG was the world’s third insurer, ahead of AXA but behind ING and Allianz.

As at the third quarter of 2008, the financial crisis triggered by the inability of millions of Americans to refund their mortgages affected AIG. The group was vulnerable to the real estate market through some by-products. Total losses in the three previous quarters attained then 18 billion USD. The commission in charge of overseeing financial markets and the justice department focused on the veracity of the evaluations of AIG’s portfolio’s by-instruments, pointing their finger to the existence of new opaque accounting practices. The inspectors established the weakness of the financial oversight system combined to an over-exposure of the company to securities debt derivatives and to their underestimation.

On September 16, 2008, AIG was faced with a problem of liquidity following the downgrade of its credit rating from AAA to A- by Standard & Poor’s (A2 by Moody’s). The group’s title then reached its historic minimum with the threat of imminent bankruptcy. The re-evaluation of the portfolio for securities debt derivatives and the downgrade of the group’s financial rating compelled it to issue additional accounting counterparts with a view to balance its positions vis-à-vis its debtors, that is, 13 billion USD of capital that must be raised, which then was impossible.

Read also:

AIG’s bailout plan

On September 16, 2008, the American State decided to come to the rescue of the group. The New York’s branch of the American Federal Reserve provided AIG with a loan of 85 billion USD with a rate of 8.5% above the LIBOR (the London Inter-Bank Offered Rate). It was a loan over two years requiring a State shareholding of up to 79.9% in the company’s capital. This move appeased international financial markets which were under the threat of collapse because of AIG links with all of the international financial markets and players. The top management was discarded and the State appointed Edward Liddy as head of the group. AIG had to be dismantled in order to refund the loan provided by tax payers.

Several weeks later, the group had to face a new crisis of liquidity resulting from the failure of its financial securities loan program (shares, bonds, asset-backed bonds) for which new accounting counterparts had to be found. The Federal Reserve extends its loan by adding 37.8 billion USD of financial assets rated at BBB minimum.

Main financial institutions exposure to derivative on asset backed receivables by AIG

| Financial institutions | Sums in millions USD |

|---|---|

Société Générale (France) | 4100 |

Goldman Sachs (United States) | 2500 |

Calyon (France) | 1 100 |

UBS (Switzerland) | 800 |

Wachovia (United States) | 700 |

KFW (Germany) | 500 |

Banco Santander (Spain) | 300 |

Reconstruction Finance Corp (United States) | 200 |

Morgan Stanley (United States) | 200 |

Bank of Montreal (Canada) | 200 |

Deutsche Bank (Germany) | 2600 |

Merrill Lynch (United States) | 1800 |

Barclays (United Kingdom) | 900 |

DZ Bank (Germany) | 700 |

Rabobank (The Netherlands) | 500 |

JPMorgan (United States) | 400 |

Danske Bank (Denmark) | 200 |

HSBC Bank (United Kingdom) | 200 |

Bank of America (United States) | 200 |

Royal Bank of Scotland (United Kingdom) | 200 |

Others (non specified) | 4100 |

The third phase of the bailout plan consisted in selling all of the group’s toxic assets and restructured loans. This stage enabled AIG to raise a total of 152.2 billion USD since the first loan.

The sale of the group’s different units to repay the American State and refocus the company upon the insurance activity led to the cession of numerous companies belonging to the nebulous AIG.

These deals were nonetheless difficult because of the financial crisis which triggered the decline of the value of the assets detained. So far, the company has ceded approximately 40 of its subsidiaries worldwide. The business is currently focused on the marketing of insurance products pertaining to natural catastrophes, accident and life plans in the United States along with SunAmerica pension products.

AIG: The group’s main cessions in 2010 and 2011

| Cession date | Amount of the transaction | Purchaser | |

|---|---|---|---|

American Life Insurance Company (ALICO) | November 2010 | 16.2 billion USD | MetLife |

AIG Star Life & AIG Edison Life | February 2011 | 4.8 billion USD | Prudential Financial |

Nan Shan Life Insurance Company | July 2011 | 2.16 billion USD | Ruen Chen Investment |

American General Finance (AGF) | November 2010 | - | Fortress |

Since the group’s restructuring plan was announced, the number of AIG staff has fallen by almost 40%. Its securities portfolio has dwindled from 44 000 positions down to less than 16 000 while the notional amount* of financial by-products has shrunk from 2 billion USD to less than 1 billion USD.

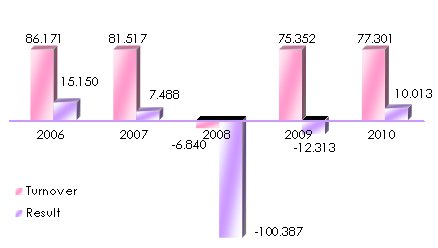

* Notional amount: The amount, often fictitious, to which is added the difference between the guaranteed rate and the variable rate for the contracts dealing with the management of interest rate risks.AIG: Main technical highlights 2006-2010

in billions USD| 2006 | 2007 | 2008 | 2009 | 2010 | |

|---|---|---|---|---|---|

The group’s total revenues | 86.171 | 81.517 | -6.840 | 75.352 | 77.301 |

-Premiums | 57.861 | 61.581 | 63.137 | 51.239 | 48.029 |

-Net investment income | 22.303 | 23.933 | 10.453 | 18.987 | 20.930 |

-Net realized capital losses | -0.324 | -3.248 | -46.794 | -5.210 | -0.279 |

-Unrealized market valuation gains (losses) | - | -11.472 | -28.602 | 1.418 | 0.598 |

-Other income | 6.331 | 10.723 | -5.034 | 8.918 | 8.023 |

Chartis turnover | - | - | 34.531 | 30.653 | 31.612 |

The group’s net profit/loss | 15.150 | 7.488 | -100.387 | -12.313 | 10.013 |

Shareholder’s equity | 101.677 | 95.801 | 52.710 | 69.824 | 85.319 |

Combined ratio | 91.3% | 85.9% | 102.2% | 108% | 116.8% |

AIG: The establishment of Chartis

In July 2009, AIG separated its non-life insurance from the rest of the financial activities and announced the establishment of a new entity dedicated to marketing only non-life policies. Named Chartis, this entity is designed as an umbrella covering all non life operations in North America and worldwide. Kristian Moor, a former AIG vice-president in charge of the property-casualty division, was nominated CEO. He was replaced in April 2011 by Peter Hancock.

In July 2009, AIG separated its non-life insurance from the rest of the financial activities and announced the establishment of a new entity dedicated to marketing only non-life policies. Named Chartis, this entity is designed as an umbrella covering all non life operations in North America and worldwide. Kristian Moor, a former AIG vice-president in charge of the property-casualty division, was nominated CEO. He was replaced in April 2011 by Peter Hancock.

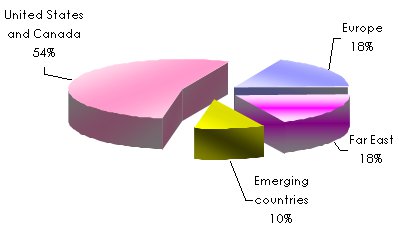

Taking advantage of the long experience of the parent company, Chartis has quickly become a world leader in non-life insurance. This company, which controls nine entities worldwide, has 40 000 staff members and 45 million customers scattered around 130 countries. In 2010, Chartis reported 17.2 billion USD in net premiums in the United States and Canada and 14.4 billion USD internationally.

Chartis has announced the loss of 463 million USD in the second quarter of 2011 against a profit of 879 million USD in the first quarter.

Evolution of AIG group’s global turnover and result: 2006-2010

in billions USD

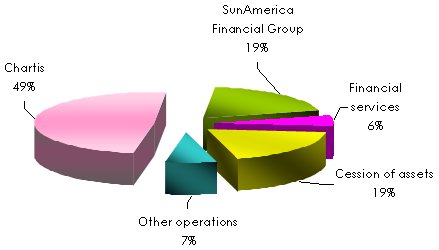

Breakdown of AIG group’s turnover per activity in 2010

Breakdown in % of Chartis 2010 net written premiums per geographic zone

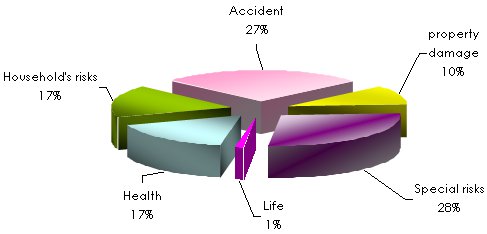

Breakdown in % of Chartis 2010 net written premiums per class of business

AIG group’s major companies after its restructuring

- Chartis: the entity in charge of the management and marketing of non-life insurance in the United States and worldwide. Chartis has nine entities throughout the world.

- SunAmerica: the entity which gathers six entities, offering non-life insurance services along with pension products.

- Financial Services: the entity in charge of financial services through three companies: International Lease Corporation, AIG Financial Products and AIG Trading Group.

- Other activities: cessions and asset management operations.