AIG: The giant's downfall

Set up in 1919 by Cornelius Vander Starr in Shanghai, the company AIG extends to Asia, Europe, Latin America and to the Middle East where it has deployed its network throughout 130 countries.

Set up in 1919 by Cornelius Vander Starr in Shanghai, the company AIG extends to Asia, Europe, Latin America and to the Middle East where it has deployed its network throughout 130 countries.

Its headquarter is located in New York. In the United States, AIG is the largest underwriter of commercial and industrial risks. It employs 116 000 staff members and has 74 million clients worldwide. The group is listed in the New York, Zurich, Paris and Tokyo stock markets.

Ranking as the world's number one insurer for a long time, AIG has posted a turnover of 110 billion USD in 2007.

The downfall

Maurice R. Greenberg who ran AIG until 2005 was compelled to resign for his implication in fraudulent accounting practices. He was replaced by Martin J. Sullivan who, on his part, had to relinquish his post on June 15, 2008 following the financial losses and the crash of the company's stocks. It was Robert B. Willumstad who took over on September 17, 2008 when the federal government made use of its right of intervention to nominate Edward Liddy instead.

The stages of the downfall

- September 14, 2008:The large rating agencies downgrade the company's rating.

- September 15, 2008:AIG title reaches a record minimum. In total, the company amassed losses worth 57.8 billion USD.

- September 16, 2008:The United States Federal Reserve, (FED), grants a loan of 85 billion USD with an interest rate of 8.5%. This bridging loan is repayable over a two year period and provides for the government's shareholding up to 79.9% of the capital. In collateral, AIG provides the totality of its assets and subsidiaries. In return for the loan, the American federal government has obtained the right to carry out a reshuffle within AIG's management as well as the right to veto payment of dividends to shareholders.

- October 9, 2008:FED grants an additional amount of 38 billion USD to keep AIG's current operations running.

- November 10 , 2008 :FED grants a new aid of 40 billion USD

More than an insurance group, AIG is a financial conglomerate whose London subsidiary of virtual investments, AIG Financial Products, established in 1987, seems to have been the cause of the group's ordeal for the set up of financially complex and risky products.

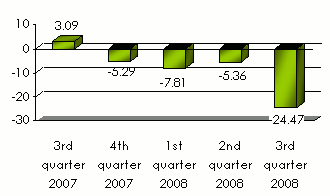

Evolution of AIG's net result during the last quarters

in billions USD Source: AIG

Source: AIGThe way out

In response to its new situation under governmental trusteeship, AIG has announced its decision to focus on property insurance and to open the capital of its life insurance companies located abroad, namely in Asia and even In United States to European and Asian insurance and reinsurance firms (CIC, China Life, Munich Re).

In response to its new situation under governmental trusteeship, AIG has announced its decision to focus on property insurance and to open the capital of its life insurance companies located abroad, namely in Asia and even In United States to European and Asian insurance and reinsurance firms (CIC, China Life, Munich Re).

Numerous releases and rumors report that the group is about to undergo dismantlement. AIG commits to a cost and staff-reducing plan. Having already ceded some operations (stakes in the British airport, the London City Airport), the company plans on giving up several other leasing, motor insurance and reinsurance units in the USA and later its 59% stakes in Transatlantic Holdings.

The latest news point to the imminent cession of AIG Hawai as well as three life insurance companies in Japan: Alico Japan, AIG Edison Life Insurance Co. and AIG Star Life Insurance Co.