Credit insurance

In Europe, the first techniques pertaining to credit insurance were set up between the two wars. But they really took off just by the end of the 1970s. The development of credit insurance goes hand in hand with the growth of international trade.

Introduction

In the OECD countries, 70% of companies are said to be confronted with outstanding payments. Credit sale exposes sellers to risks of non recovery of debts. For non-financial companies, outstanding sums are in average established at 35% of all assets. Delays and non payments account for 25% of bankruptcies. This rate is even higher for the companies with less than two years of existence. Credit insurance is then a particularly useful tool against payment failures. In average, 1.38% of the annual turnover of a given company may be preserved by underwriting credit insurance.

In the OECD countries, 70% of companies are said to be confronted with outstanding payments. Credit sale exposes sellers to risks of non recovery of debts. For non-financial companies, outstanding sums are in average established at 35% of all assets. Delays and non payments account for 25% of bankruptcies. This rate is even higher for the companies with less than two years of existence. Credit insurance is then a particularly useful tool against payment failures. In average, 1.38% of the annual turnover of a given company may be preserved by underwriting credit insurance.

Due to political, economic, situations and to the different trade regulations, non-payment risks still remain even greater when it comes to international trade.

Credit insurance differs from surety insurance. The latter entitles the insured to obtain compensation in case the government or a national company fails to honor its payment. As regulatory baselines differ from country to country, surety insurance is, therefore, not the same in distinct markets. That is not the case of credit insurance.

Definition

Credit insurance enables the insured (vendor) to be covered against definitive loan losses due to the client's (purchaser) insolvency. The purchaser's default could result from commercial risks or even political ones due to the recourse to export credit.

Credit insurance enables the insured (vendor) to be covered against definitive loan losses due to the client's (purchaser) insolvency. The purchaser's default could result from commercial risks or even political ones due to the recourse to export credit.

The commercial risks for which the insurer provides guarantees are generally related to the purchaser's non-compliance with payment deadlines and insolvency.

Political risks result from non-settlement of contracts or of export projects following measures or situations which keep importers from receiving goods or which prevent exporters from receiving payment. Such failures may be accounted for by a conflict, a war, a withdrawal of license or a governmental decision. Private insurance companies in general protect the insured against short-term risks extending from two to four months. Quite often, these risks jeopardize the sale of consumer goods or raw material.

Long-term credit risks are often covered by state-owned insurers. These risks may last for a period up to five years. Financial assets are covered on medium-term bases. Yet these risks remain relatively scarce.

Advantages of credit insurance

Credit insurance allows the insured not only to benefit from advice of experts but also to:- avoid lack of liquidity resulting from purchasers' default

- diminish results volatility

- provide access to funding. Banks often link the granting of loans to the requirement of underwriting a credit insurance: 49% of companies having credit insurance obtain bank loans, versus 34% for the non-insured

- expand the client portfolio of the insured towards purchasers who pay only on credit

- transfer default payment from the insured to the insurer

The different types of policies

Policies based on the overall turnover

They are the most common. They cover all the insured's debts. In order to avoid anti-selection, the insured does not have the possibility to choose the risks that will be covered. That is why they are based on the total turnover. Unlike the insured, the insurer may choose to exclude the clients of the insured whom he regards to be insolvent, or to limit the cover for suspicious clients. Policies are often set for a one-year renewable period.

The premium rate varies according to the exposure of the insured to the insolvency of their potential clients. The premiums basis is made up of the provisional turnover declared by the insured.

Policies always include a deductible. For a proportional premium based on the total turnover, deductible is set between 10% and 20%. This deductible is a variable which depends on the solvency of the purchasers and of the credit cycle.

Policies based on a single account

This type of policies covers only exposure to a single given purchaser.

Policies based on specific accounts

This kind of policies covers only exposure to a group of defined purchasers.

Event or catastrophe policies

These policies have high deductibles and often take the shape of non-proportional covers. They cover the insured against default by a big number of purchasers which may jeopardize the balance of the company. Natural catastrophes are the risks which trigger the guarantee. This cover is mostly granted to big companies endowed with an internal system for credit monitoring.

Policies covering political risks

This risk occurs when governmental measures interrupt the execution of a contract or prevent the purchaser from honoring his payment obligations. Wars or periods of internal instability within a country may also trigger such risks.

Policies covering monetary risks

These risks include exchange risks and transfer risks. Exchange risk happens when on the day of encashment the rate of the foreign currency used for payment is below the rate used as a basis when the guarantee was granted. Transfer risk occurs when economic problems, political events or the legislation of the purchaser's country no longer allow or delay the transfer of due funds.

Covered risks

A noticed insolvency, that is, the acknowledged impossibility of the purchaser to pay his debt is always covered.

A noticed insolvency, that is, the acknowledged impossibility of the purchaser to pay his debt is always covered.

The presumed insolvency which is the purchaser's inability to settle his debt after a period of time (often 9 months following the deadline) is equally covered. However, it can apply only for low-amount credits whose administrative or legal expenses are insignificant.

Risks excluded

Are sometimes excluded:

- debt defaults: due to natural catastrophes, civil or foreign wars, terrorism, currency devaluation and exchange rate losses.

Are generally excluded:

- debt defaults resulting from atomic disintegration

- some kind of customers: legal or physical entities not acting as commercial companies, craftsmen or traders

- companies in which the insured is endowed with a supervisory power

- the insured's clients with difficult financial situation:

- bankrupt companies or firms in cessation of payment

- companies having difficulties to pay the insured

- companies having already been declared by the insurer to the insured as non-insurable

Risk management by the insurer

The profitability of the credit insurer depends on the quality of the evaluation of his exposure and to his control of the risk portfolio. It is essential that the insurer adjust his overall risk to his shareholders' equity.

The insurance policy

A good risk management starts with a good elaboration of insurance policies with:

a limitation of the policy period to a short time

a limitation of the policy period to a short time- fixed guarantee limits comprising yearly restrictions

- appropriate deductibles

- the use of a rating model based on sophisticated tools

Pricing

The modern quotation models allow reliable underwriting. They make it possible to price a wide range of risks. In addition to statistics, these models integrate indicators pertaining to rating, compensation of financial expenses and forecast of payment stoppage.

Limits per country, business line and client/purchaser

Credit insurers examine millions of companies throughout the world (45 million for Euler Hermes) and store this information in their data bases. The information gathered will allow insurers to rate each company. Most risks (80%) are concentrated in the OECD countries. Insurers will, then, diligently scatter the risks per business line and per country in order to reduce the volatility of their portfolio. Small and medium sized enterprises are the favorite for insurers. They have a more or less local activity and are less exposed to the risk of dishonoring their obligations.

Credit insurers examine millions of companies throughout the world (45 million for Euler Hermes) and store this information in their data bases. The information gathered will allow insurers to rate each company. Most risks (80%) are concentrated in the OECD countries. Insurers will, then, diligently scatter the risks per business line and per country in order to reduce the volatility of their portfolio. Small and medium sized enterprises are the favorite for insurers. They have a more or less local activity and are less exposed to the risk of dishonoring their obligations.

For the insurer, a good risk management also requires:

- The use of coinsurance: It makes it possible to scatter the exposure of a policy between several insurers.

- Recourse to reinsurance: Reinsurance is a good means of smoothing the frequency and/or the severity of claims. Part of the exposure is ceded to the reinsurer. By smoothing results, reinsurance stands as an optimal tool to contain the cost of capital. An insurer who abstains from having recourse to reinsurance will need to have more funds to be able to honor one's commitments.

The cession of reinsurance businesses for main insurers is comprised between 40% and 50%. - Risk transfer through securitization: These financial products are widely used. They enable companies to transfer undesirable risks to the financial markets and to relieve as such its assets. Moreover, companies receive liquidities which correspond to the assets transferred, which will improve their cash flow.

The financial crisis, whose by products are directly responsible, has triggered today some mistrust toward securitization. - The use of key performance indexes to measure the sector's trend: Throughout the years, insurers have developed indexes which reflect the health of the different businesses and economic sectors. This approach enables underwriters to accept business only in the areas where the index is good enough.

- A dynamic management of the limits offered to a client/purchaser: The insurer may limit the credit of a purchaser, the client of his insurer who is experiencing some difficulties.

The monitoring carried out by the insurer enables the insured to benefit from counseling which will shed light on their outstanding debts. The insurer is in a good position to detect risks affecting a client/purchaser, an industry or a State. It is, therefore, in the insurer's interest to make such knowledge available to his insured.

The main credit insurers

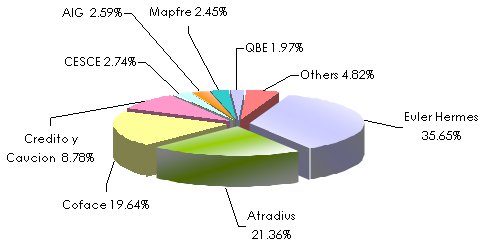

During the 1990s, a powerful concentration movement had gathered the bulk of business in the hands of three main insurers: Euler Hermes (born from the merger of two credit insurers belonging to Allianz), Atradius (whose main shareholders are Swiss Re and Credito y Caucion) as well as Coface. These three groups share about 75% of the market.

Market shares in 2008 (ICISA's members only)

* AIG is not member of ICISA (International Credit Insurance & Surety Association)

* AIG is not member of ICISA (International Credit Insurance & Surety Association)

The overall credit insurance market is estimated at approximately 5 billion EUR in 2008 (7 billion USD). Western Europe remains the cradle of credit insurance (75% of business worldwide). In 2015, the total premium volume is poised to reach 10 billion EUR (14 billion USD).

According to Swiss Re, the regions with growth potential are: Asia 10%, North America 9%, South America and East Europe 8% while West Europe's annual growth would not exceed 6%.

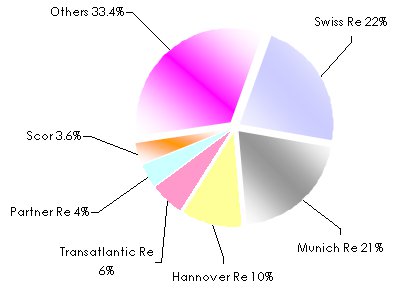

The main credit reinsurers

The main reinsurers' market shares

The main credit reinsurance brokers

Benfield is the biggest broker. The other players are: Guy Carpenter, Aon Re, Willis, Calomex.

According to the association of British insurers, the total loss ratio of the British market has leapt by 166% reaching 509.4 million USD in the first quarter of 2009 in comparison with the same period of 2008. Insurers are reporting that similar trends are noticed worldwide for short-term credit risks.