Egypt 2005

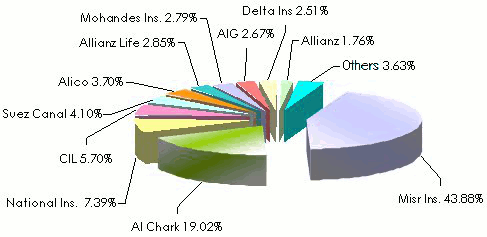

Distribution of premiums by company in 2005

in thousands USD| Life premiums | Non life premiums | Total | Shares | |

|---|---|---|---|---|

Misr Ins. | 69 507 | 255 706 | 325 213 | 43.88% |

Al Chark Ins. | 61 612 | 79 388 | 141 000 | 19.02% |

National Ins. | 20 334 | 34 434 | 54 768 | 7.39% |

CIL | 42 241 | - | 42 241 | 5.70% |

Suez Canal. | 3 926 | 26 470 | 30 396 | 4.10% |

Alico | 27 431 | - | 27 431 | 3.70% |

Allianz Life | 21112 | - | 21 112 | 2.85% |

Mohandes Ins. | 8 543 | 12 153 | 20 696 | 2.79% |

AIG | - | 19 817 | 19 817 | 2.67% |

Delta Ins. | 5 670 | 12 920 | 18 590 | 2.51% |

Allianz | - | 13 079 | 13 079 | 1.76% |

AMIG | - | 7 794 | 7 794 | 1.05% |

Ace CIIC | - | 5 552 | 5 552 | 0.75% |

Cooperative Ins. Society | - | 4 991 | 4 991 | 0.67% |

Royal & Sun Alliance | - | 3 653 | 3 653 | 0.49% |

Egyptian Saudi Ins. Co | - | 2 487 | 2 487 | 0.34% |

NSGB Life | 1990 | - | 1 990 | 0.27% |

Egyptian Export Credit Ins. Co. | - | 287 | 287 | 0.04% |

Ace Life | 130 | - | 130 | 0.02% |

Total | 262 496 | 478 730 | 741 226 | 100.00% |

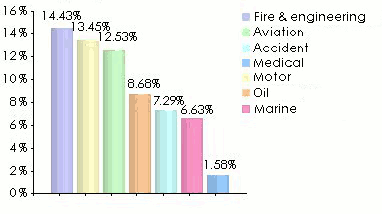

Distribution of premiums by classes of business in 2005

in thousands USD| Premiums | Shares | |

|---|---|---|

| Non life | ||

Property | 106 937 | 14.43% |

Motor | 99 734 | 13.45% |

Aviation | 92 879 | 12.53% |

Oil | 64 314 | 8.68% |

Accident | 54 018 | 7.29% |

Marine | 49 163 | 6.63% |

Health | 11 685 | 1.58% |

Non life total | 478 730 | 64.59% |

| Life | ||

Life | 262 496 | 35.41% |

Grand total | 741 226 | 100.00% |

Distribution of non-life premiums by classes of business in 2005

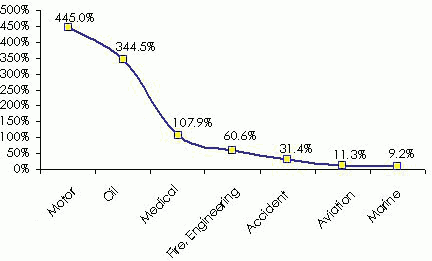

Loss of the non-life market in 2005

Exchange rate EGP/USD as at 31/12/2005: 1EGP= 5.78 USD Source: Insure Egypt: Egyptian Insurance Market 2005

Exchange rate EGP/USD as at 31/12/2005: 1EGP= 5.78 USD Source: Insure Egypt: Egyptian Insurance Market 2005

0

Your rating: None

Tue, 14/05/2013 - 16:28

The online magazine

Live coverage

07/26

07/26

07/26

07/26

07/24

Latest news