Innovation in the insurance sector

Are insurance companies hardly innovative?

The insurance industry looks conservative and hardly innovative to the public. This impression is enhanced by the limited number of investments allowed in the field of research and development.

The insurance industry looks conservative and hardly innovative to the public. This impression is enhanced by the limited number of investments allowed in the field of research and development.

Studies conducted in the 1990s on insurance products, management/organization and marketing principles showed that on the whole this sector is as innovative as that of the other service providers. These analyses gathered quantitative and qualitative data in order to obtain innovation indicators such as: research and development expenditure, the level of ingenuity, innovation ratio per country and per sector. The outcome is as follows:

- Innovation in insurance depends largely on the country under study. In Germany, four insurers out of five confirmed having marketed innovating covers.

- The turnover generated from the new financial products marketed are less substantial than in other activities. Here again, considerable variations are noticed among countries, especially in Europe. Small-size countries seem to be endowed with a higher degree of ingenuity when it comes to create new financial products. This trend may be accounted for by the fact that insurers operating in small States are seeking to increase their size and market shares by proposing products that are already marketed elsewhere.

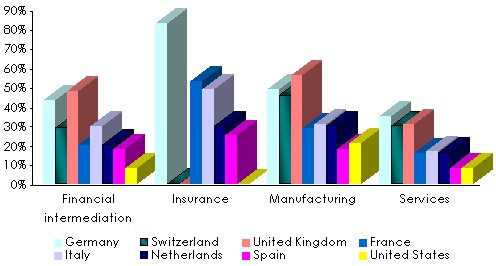

Product innovation rate per sector

Surveys carried out 2006 to 2008 highlight the turnover generated from newly developed or significantly improved products as a portion of the aggregate turnover in the corresponding sector.

Sources: Sigma, Eurostat, UK CIS 2009, US CIS 2008

Sources: Sigma, Eurostat, UK CIS 2009, US CIS 2008 In insurance, innovation rests on existing products or principles. Novelty is achieved more regularly through the transformation of a policy or the improvement of a process. Innovations are therefore mostly progressive in traditional insurance and usually consist in cover extensions, guarantee additions or evolutions. In comparison with the industrial or informatics sectors, it is rare for a product or a principle to be completely revolutionary.

Number of new product announcements in insurance

| New products | Amendments/ Enchancements | Ancillary services | Bundling/ Unbundling | Product marketing | Process changes | Total | |

|---|---|---|---|---|---|---|---|

Third party liability | 8 | 41 | 2 | 10 | 94 | 0 | 155 |

Workmen’s compensation | 0 | 1 | 3 | 3 | 10 | 1 | 18 |

Property | 6 | 9 | 1 | 6 | 17 | 0 | 39 |

Motor | 0 | 1 | 0 | 0 | 3 | 1 | 5 |

Composite* | 3 | 2 | 1 | 14 | 18 | 1 | 39 |

Other classes | 12 | 23 | 2 | 7 | 32 | 1 | 77 |

Total | 29 | 77 | 9 | 40 | 174 | 4 | 333 |

% of the total | 9% | 23% | 3% | 12% | 52% | 1% | 100% |

Some insurance companies are, nonetheless, trying to cover new kinds of risks:

- Insurance of environment-related risks

- Insurance against outages affecting sources of renewable energies

- Insurance of risks related to ineligibility to carbon loans

- Takaful insurance

- Microinsurance

- Insurance of nanotechnology risks

- E-reputation insurance

- Insurance against breach of computer data

- Outbuildings insurance

The three kinds of innovation called progressive in classical insurance

Innovations in the insurance sector are often progressive and be categorized according to three criteria: policy modification, guarantee merging or splitting, the guarantee-triggering parameters. Some regard such evolutions as the intrinsic flexibility of insurance products.

1. Policy modification

Competition pushes insurers to modify their policies, especially the benefits provided by widening the scope, modifying the deductibles, the limits and other factors or by amending the general conditions of the policy. These transformations account for 25% of the new products according to the table hereafter. They allow to adapt to the demands of the customers whose basic needs have evolved gradually. On the other hand, such modifications make risk perception more complex which may raise rating problems. It is, therefore, common for transformations to be aimed at simplifying policies.

2. Guarantee merging or splitting

Commonly noticed in non-life insurance, guarantee merging is designed to maximize customer coverage by gathering various covers under a single policy. This can be the case for instance of a life insurance policy associated to disability or unemployment policy.

Commonly noticed in non-life insurance, guarantee merging is designed to maximize customer coverage by gathering various covers under a single policy. This can be the case for instance of a life insurance policy associated to disability or unemployment policy.

The insured, mainly SME, may find it beneficial to join different risks under a same policy, thus benefiting from more advantageous tariffs and reduced costs. On the insurer’s side, when risks are separate, this strategy allows to decrease the probability of an event since the probability of sums is below the sum of probabilities.

On the contrary, splitting risks allows the insurer to better control his exposure.

3. Insurance whose guarantee is triggered by a parameter

This kind of policy is found often times in the coverage of agricultural risks but also in some insurance plans: sun/snow guarantee, ... policies are based on one/several indexes which make up the triggering element according to the physical measurement of the risk (quantity of rain, snow, ...). when the index is reached, the insured will be compensated for the damage incurred (loss of crop, holiday cancellation for torrential rain, ...).

Fundamental changes made by innovation

Alongside the common gradual changes in traditional insurance, development in finance has paved the way for the most radical mutations. Breakthroughs towards new insurance solutions have been made possible by alternative risk transfer techniques. That is the case of securitization on the one hand and alternative structures on the other. These covers, whose period may exceed one year, often meet financing needs (in capital for example) or risks transfer.

Securitization

This technique allows the transfer of an insured risk towards financial markets by back-up to financial securities (see Atlas magazine n° 52, June 2008). These covers are mainly utilized for the protection against natural catastrophes (CAT bonds). The investor receives a risk premium in return for liability. The value of securities depends on the occurrence or absence of loss. As losses diminish or become inexistent, the rate of return gets more substantial. Contrarily, when the rate of return goes down, the nominal value of the security may be reduced to nothing / none during the occurrence of loss.

Securitization has often been used as an alternative to traditional reinsurance.

Alternative structures

They include pools, captives and self insurance.

Innovation-stimulating factors

External causes have fundamental impact on innovation emanating from insurers. It is mainly about tariff cycles, regulatory framework, the demand level as well as technological breakthroughs.

Tariff cycles

In period of insurance tariff peaks, insurers are not motivated by the search of alternative income sources. Traditional solutions, alone, generally allow to meet their premium objectives. On the contrary, during seasonal downwards, insurers’ ingenuity is stimulated by wider margins. New products would then allow to take some additional market shares.

Fierce competition, nonetheless, provides the insured with more space for negotiations which pertain to the modifications of traditional insurance policies (extending the coverage,...). This phenomenon can be characterized as gradual innovations.

The regulatory framework

The impact of legislation on insurance is primordial. The important role entrusted to insurance in the economy and society means that insurers are submitted to a strict monitoring of their activities by the supervisory authorities. Oftentimes, legislations evolve compelling insurance companies to ensure that these developments result in transformation of insurance contracts.

The most common cases pertain to motor third party liability (especially in the European Union following the adoption of the directives imposing the minimum indemnification limits or to natural catastrophes (some countries instituting compulsory covers for some classes of risks).

For the first case, evolution is gradual as changes pertain solely to the amendments of current policies while the second case insurance obligation may lead to the creation of new products.

Demand

In insurance, demand partly depends on the economic, political and social environment and on the perception of risks that ensue. External factors, therefore, strongly impact corporate and individual need for cover. Climate change and their impact in terms of droughts, floods or storms, civil commotion, the advent of clean energies, ... are common risks which highlight the use of being covered. Such trends are likely to trigger the creation of new products in order to meet the entirely new needs.

Basically, the birth of new covers is getting scarcer and scarcer. The most radical innovations were reported in Germany and United Kingdom a long time ago. The table hereafter refers to the dates at which new products emerged for non-life insurance.

Introduction of production innovations in some non life markets

| Germany | United Kingdom | France | United States | |

|---|---|---|---|---|

Hail | 1719 | 1840 | 1802 | 1870 |

Accident | 1853 | 1848 | - | 1864 |

Fire | 1676 | 1680 | - | - |

Glass breakage | 1862 | 1852 | 1829 | 1874 |

Personal liability | 1874 | 1875 | 1829 | - |

Water damage | 1886 | 1854 | - | - |

Theft | 1895 | 1846 | - | 1878 |

Credit | 1898 | 1820 | - | 1876 |

Motor | 1899 | 1896 | - | - |

Machinery breakdown | 1900 | 1872 | - | - |

Technological breakthroughs

Technological advances largely promote innovations in the field of distribution or marketing. It is possible sometimes for new products to emerge following technological evolutions. That is the case applying to the protection of data against intrusion, bugs (the year 2000 bug), …

Technological advances largely promote innovations in the field of distribution or marketing. It is possible sometimes for new products to emerge following technological evolutions. That is the case applying to the protection of data against intrusion, bugs (the year 2000 bug), …

Some products have also been improved thanks to new techniques, especially with the advent of positioning technologies which some insurers utilize for the management of motor policies based on mileage. A series of data is therefore measured then made available for analysis.

Internet has also allowed to adapt covers to the specifics of online sales of insurance-related services or products: travel insurance consecutive to the purchase of a plane ticket, …

Why are insurers required to innovate?

Insurance, like any other business on the market, witnesses competition which in some cases may turn out to be fierce. Innovating in a progressive fashion may make it possible to maintain margins. The product specifics justify the price which may be higher because of a modification of this product increasing its added value. This effect may attract or maintain a customer portfolio while boosting the company’s image. It is therefore a competitive advantage.

By proceeding with gradual innovation, insurers are able to better contain certain needs and issues, which in the long run may result in the evolution of more radical products. Therefore, fundamental innovations are less commonplace.

Eventually, by improving covers gradually, the insurer allows some risks which otherwise would have become uninsurable to remain insurable by mere modification of the policy. The insurer also saves costs in the process related to insurer change or to multiple insurance contracts.

What are the obstacles to innovation?

Insurers evolve in an environment with frontiers defined by the legislative framework on the one hand and by risks insurability limits on the other hand. Therefore, there is little space for creation from the market’s players with certain factors and behaviors straining innovation.

The sector’s life cycle, the market maturity

Fundamental innovations have been carried over a period of time as old as insurance itself which dates back to several centuries. It is then legitimate that the majority of the recent innovations come within the framework of slight policy transformations. Most innovative products have been created at the beginning of the cycle enabling gradual innovation to take over when the market becomes mature.

Demand weaknesses

A poor insurance demand is not likely to stimulate the supply of new products. Poor demand may be accounted for by:

- High tariffs for the new products does not justify their purchase, exposing them to competition with less onerous classical insurance products.

- Inadequate perception of the need to underwrite a new product compounded by the suspicion around its use.

The shortage of available data and risk assessment by the insurer

Insurance rests on experience and on the mass of data collected which it uses to analyze and evaluate risks. Actuarial calculation determines price, market knowledge and related conditions. Such approach is so indispensible that no insurer would market a new product if the data required for its study were insufficient.

Insurance rests on experience and on the mass of data collected which it uses to analyze and evaluate risks. Actuarial calculation determines price, market knowledge and related conditions. Such approach is so indispensible that no insurer would market a new product if the data required for its study were insufficient.

As insurance companies proceed to data analysis, they always remember that the insured are in possession of better data than the ones gathered by their departments. That is when anti-selection sets in exposing the insurer to losses related to the attractiveness of bad risks.

Moreover, insurers would abstain from new risks disrupting the homogeneity of their portfolio and compromising them in the event of a total loss. Likewise for extreme risks whose consequences are of large scale nature: for instance nuclear, pandemics, electromagnetic risks, …

Insurance companies exhibit aversion to risks, which is not likely to facilitate decision making in favor of non-mastered new initiatives.

Reinsurers’ conservatism

Outside traditional reinsurance, insurers have few solutions of risk sharing. The advent of new insurance solutions cannot be achieved without the support of reinsurers who absorb a large part of liabilities. But the latter can only have a partial image of the risk, which makes them very cautious about innovation, be it radical or progressive.

Innovations and intellectual property

Very seldom does innovation benefit from provisions guaranteeing intellectual property. Clauses pertaining to non-disclosure, exclusivity or confidentiality can hardly be deemed to be solid defense. Passive companies may just copy the innovation of more active or ingenious companies to benefit from new solutions.

Conclusion

Insurance is a highly regulated business providing a little margin of maneuver to the players. The nature of the insurer’s profession requires prudence. Such conditions do not however compromise the possibilities of innovation even though the latter tend to be more progressive than radical.

Insurance is a highly regulated business providing a little margin of maneuver to the players. The nature of the insurer’s profession requires prudence. Such conditions do not however compromise the possibilities of innovation even though the latter tend to be more progressive than radical.

Insurance companies are large companies entrusted with a key role in the economy. Their financial weight enables them to innovate but their size may reduce them to actors lacking flexibility and responsiveness in the process of innovation. Yet opportunities do exist thanks to the mutation of society. Today’s issues mainly pertain to population ageing, sustainable development, social evolutions and the securisation of the financial system.

The aid provided by the new technologies in marketing and distribution is crucial to insurers. The world of insurance is now fully aware of the tasks awaiting him.