Insurance in the BRICS (Part one)

The first part, published in this issue, is dedicated to the Chinese and Brazilian markets. The second, to be posted online in early January, will discuss Russia and India.

The general context

View of Hong Kong© Diliff, CC BY 3.0 Brazil, Russia, India and China (BRIC*)are considered to be the four emerging powers. As rising forces, their economies ranked among the top 11 in the world in terms of GDP. According to the IMF, these countries will be the ones pulling global growth by 2025. In 2012, GDP reached almost 14 200 billion for about 3 billion people, that is about 42% of the world population. GDP per capita is steadily increasing even if it is expected to remain well below that of most developed countries until 2050. According to the World Bank estimates, China and India are still the dominant economic powers. They would come ahead of the United States as of 2025 for the first country, and as of 2050 for the second, a dynamism that is likely to create a strong development of the insurance business.

View of Hong Kong© Diliff, CC BY 3.0 Brazil, Russia, India and China (BRIC*)are considered to be the four emerging powers. As rising forces, their economies ranked among the top 11 in the world in terms of GDP. According to the IMF, these countries will be the ones pulling global growth by 2025. In 2012, GDP reached almost 14 200 billion for about 3 billion people, that is about 42% of the world population. GDP per capita is steadily increasing even if it is expected to remain well below that of most developed countries until 2050. According to the World Bank estimates, China and India are still the dominant economic powers. They would come ahead of the United States as of 2025 for the first country, and as of 2050 for the second, a dynamism that is likely to create a strong development of the insurance business.

It is the insurance activity in the four countries mentioned above that we are going to review.

* We named by BRIC, Brazil, Russia, India and China and by BRICS, these four countries in addition to South AfricaEnabling factors for insurance

Several factors have contributed to the growth of the insurance business in the BRICs. The size of the population combined with economic dynamism has led to the emergence of a large middle class endowed with substantial purchasing power. We can also mention other factors:

- a healthy economic environment allowing control of inflation.

- competent insurance supervisory authorities.

- the promulgation of laws favorable to the development of insurance.

- a progressive market deregulation designed to increase productivity and competitiveness.

- the innovation undertaken by certain insurers in high-potential segments such as islamic insurance, microinsurance or weather-indexed agricultural risks.

- the use of multiple marketing vehicles, ranging from traditional networks to bancassurance. Internet and mobile phones remain marginal.

- introduction of major international insurance groups in these markets. Sometimes the mere affiliation to these groups helps stimulate the sector, increase innovation and establish expertise.

This dynamism stands as real attraction for foreign investors in search of vectors of development.

Constraints to the development of insurance

Despite their attraction the BRICs face many constraints including:

- complexity of regulation and slow governance.

- difficulty for rural areas to have access to insurance which is confined to urban populations.

- poor perception of insurance by the populations which could not see its usefulness.

- low level of contracts’ pricing, often very far away from international standards.

China

World Financial Center and Jin Mao Tower, Shanghai © Jakub Hałun, CC BY-SA 3.0 World Financial Center and Jin Mao Tower, Shanghai © Jakub Hałun, CC BY-SA 3.0 |

Insurance was first introduced in China by the British in the early 19 th century. In the decades that followed, the market remained embryonic, if not almost non-existent. The State monopoly established later by the national company PICC has not enabled the development of this industry deemed unnecessary. Very few Chinese owned property and most of the non-governmental companies were not ensured.

The first reforms introduced in 1978 had gradually liberalized the market. It was not until 1988 and the establishment of the insurer Ping An, that this sector of the economy started growing. The accession of the country to the World Trade Organization (WTO) in late 2011 paved the way for foreign insurers who were then authorized to invest in the country. During the past decade, the turnover of the Chinese market have gone fivefold, with an average annual growth of 20%. For the government, insurance is today a strategic sector.

Despite its strong growth, the insurance activity was hardly breaking into the market. The non-life class of business accounted for just 1.26% of GDP versus 1.7% for life insurance. Although the Chinese market is recent, it remains quite appealing for foreign companies that are attracted by its enormous potential. However, foreign insurers find it difficult to get established in China and start underwriting: many regulations complicating license applications , product-based authorizations, etc.

Although foreign companies bring expertise, local insurers remain active and innovative, standing as formidable competitors for the new comers.

By the end of 2011, the country had 129 insurers, the most important of which were state-run. This is the case of PICC and also of many others in which the State holds substantial stakes. The top five insurers in 2012 detained over 80% of the market share. They are: PICC Property & Casualty, Ping An Property & Casualty, CPIC Property, China United and China Life Property & Casualty.

Written premiums of the first five Chinese insurers

in millionsRank | Companies | 2012 written premiums | 2011 written premiums in CNY | 2011/12 growth | Shares | |

|---|---|---|---|---|---|---|

| CNY | USD | |||||

1 | PICC Propery & Casualty | 193 486 | 94 522 | 173 962 | 11.22% | 38.5% |

2 | Ping An Property & Casualty | 98 816 | 48 274 | 83 435 | 18.43% | 19.6% |

3 | CPIC Property | 69 696 | 34 048 | 61 687 | 12.98% | 13.8% |

4 | China United | 24 555 | 11 996 | 20 954 | 17.19% | 4.8% |

5 | China Life Property & Casualty | 23 549 | 11 504 | 16 404 | 43.56% | 4.7% |

Total of the first five companies | 410 102 | 200 344 | 356 442 | 15.05% | 81.4% | |

State of the Chinese market

In 2011, the Chinese market underwrote nearly 222 billion USD of premiums, 61% of which in life insurance, 32% in non-life and 7% in health and personal accident. In 2012, the premiums volume totalled 245.5 billion USD.

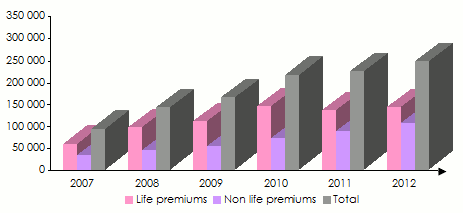

Evolution of life and non life premiums: 2007-2012

The Chinese market is overwhelmingly life-based as this class of business accounts for 57.5% of the market, after having peaked at 67 and 68% in the years 2008, 2009 and 2010.

in millions USD| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|

Life premiums | 58 673 | 95 828 | 109 175 | 142 999 | 134 539 | 141 208 |

Non life premiums | 33 810 | 44 987 | 53 872 | 71 628 | 87 319 | 104 302 |

Total | 92 483 | 140 815 | 163 047 | 214 627 | 221 858 | 245 510 |

Evolution of premiums, GDP and inflation rate: 2007-2012

During the 2007-2012 period, the development of the insurance sector outpaced that of GDP.

In 2012, the growth rate of the market was in sharp decline which was mainly accounted for by the slowdown in the sales of new vehicles and the suppression of the State subsidies to the insurance industry initiated in 2008. This decline has triggered a sharp reduction of investments in infrastructure.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|

Evolution of premiums (%) | +30.6 | +52.3 | +15.8 | +31.6 | +33.7 | +10.7 |

Evolution of GDP (%) | +13 | +9.7 | +8.5 | +10.4 | +9.3 | +7.8 |

Inflation rate (%) | +4.8 | +5.9 | -0.7 | +3.3 | +5.4 | +2.6 |

Source: Swiss Re

Evolution of the market: 2007-2012

in millions USD  Source: Swiss Re

Source: Swiss Re

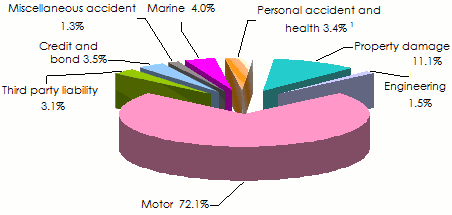

Breakdown of non life premiums in 2011

China's non-life market is mainly dominated by motor insurance. Sales of private cars, which has been growing at an annual rate of 20% since 2003, contributed largely to the growth of the insurance demand.

In 2011, motor insurance accounted for over 72% of premiums. The property damage class of business, which ranks second, represents only 11% of the total premiums.

1 Premiums underwritten by non life companies Source: Association of insurance companies and market regulatory authority

1 Premiums underwritten by non life companies Source: Association of insurance companies and market regulatory authority

Distribution networks

Insurance agents are the primary distribution network. Their number reached more than 420 000 in 2010. The law governing insurance brokers was only instituted in 2000, which makes this channel of distribution relatively recent. The emergence of small brokers lacking technical skills has generated a strong distrust toward such intermediation.

In an effort to make up for the lack of professionalism of their networks, companies are increasingly relying on new technologies, especially on the internet. The Chinese are topping the list of internet users in the world with nearly 500 million people having access to the web. Insurers have therefore developed modern platforms for the online sale of policies. The use of telemarketing has become common.

Bancassurance is also booming as all insurers have entered into agreements with banks to distribute their products through this channel.

Brazil

Statue of Christ the Redeemer, Brazil© Klaus with K, CC BY-SA 3.0 Statue of Christ the Redeemer, Brazil© Klaus with K, CC BY-SA 3.0 |

The Brazilian insurance business dates back to 1908 when the first two companies, Companhia de Seguros Boa Fé and Companhia de Seguros Conceito Público were established.

The sector has grown sharply from the early 90s. In 1994, almost all of the market, that is 95%, was controlled by Brazilian groups. This rate has ever since fallen down drastically to roughly 55% after the liberalization of the sector in 2007. American insurers are the most present, detaining about 20% of market share. Today the country counts 116 insurers, all private. The Brazilian State does not detain any insurance company.

The interest of foreign companies in Brazil is not only motivated by the stability of the economy but also by its size and the potential it represents. The country has the highest population of the continent and a substantial middle class, which contributes greatly to the development of the sector. Nearly 40% of the premiums of the South American market are reported in Brazil.

Before 1994, insurers had been counting on inflation to make profits. Today, the strategies of insurance companies are based on risk selection, cost reduction and good investment management.

The insurance penetration rate in the country is 3.65% in 2012 compared to 1% in 1993. This growth has been made possible thanks to State and insurers’ dynamism. However, the penetration rate remains one of the lowest on the continent.

Unlike Europe or the American market, there is no mandatory separation of life and non-life insurance as most insurers are active in both classes. This is especially true for insurance companies associated with the banks.

Written premiums of the first five Brazilian insurers

In 2012, the five largest insurers accounted for nearly 28% of the market share. They are: Bradesco Vida E Previdência S.A., Itau Vida E Previdência S/A, Brasilprev Seguros E Previdência S/A, Santander Seguros S/A, Itau Seguros S/A.

in billions USD

| Rank | Companies | 2012 written premiums | Market share |

|---|---|---|---|

| 1 | Bradesco Vida E Previdência S.A. | 8.38 | 10.18% |

| 2 | Itau Vida E Previdência S/A | 4.42 | 5.37% |

| 3 | Brasilprev Seguros E Previdência S/A | 4.29 | 5.21% |

| 4 | Santander Seguros S/A | 3.37 | 4.09% |

| 5 | Itau Seguros S/A | 2.54 | 3.08% |

Total of the first five companies | 23 | 27.93% | |

Source: Federacion Interamericana de Empresas de Seguros (FIDES)

The market has experienced a period of great consolidation among local insurers and especially among those affiliated with banks. Foreign insurers, increasingly interested in Brazil, have made significant market entries through acquisitions or joint ventures.

In 2012, the Brazilian market is dominated by life insurance which accounts for 54.5% of premiums compared to 45.5% for non-life which include personal accident and health classes of business.

Breakdown of 2012 premiums per life and non life insurance

As for China, the life class of business is dominating the Brazilian insurance market, a primacy that was established only in 2009.

in millions

| Life | Non life | Total | |

|---|---|---|---|

Premiums in Reals (BRL) | 87 535 | 73 263 | 160 798 |

Premiums in USD | 44 784 | 37 483 | 82 267 |

Market shares | 54.5% | 45.5% | 100% |

Source: Swiss Re

Evolution of premiums, GDP and inflation rate: 2007-2012

Despite a certain slowdown in 2012, the development of insurance is significantly faster than the economy as a whole. Up to the year 2011, insurance premiums’ growth could be more than five times the one of GDP.

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|

Evolution of premiums (%) | +28.7 | +21.3 | +2.8 | +31.4 | +22.7 | +4.6 |

Evolution of GDP (%) | +5.7 | +5.2 | -0.2 | +7.6 | +2.8 | +0.9 |

Inflation rate (%) | +3.6 | +5.7 | +4.9 | +5 | +6.6 | +5.4 |

Source: Swiss Re

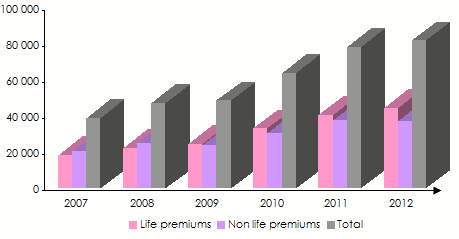

Evolution of life and non life premiums: 2007-2012

The growth reported by the main classes of business has been sustainable, with life and non-life insurance doubling the premiums volume since 2007. However there is a slight slowdown for the non-life business in 2012 compared to 2011.

in millions USD

| 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | |

|---|---|---|---|---|---|---|

Life premiums | 18 533 | 22 471 | 24781 | 33 246 | 40793 | 44 784 |

Non life premiums | 20 508 | 24 972 | 23 979 | 30 847 | 37 863 | 37 483 |

Total | 39 113 | 47 443 | 48 760 | 64 093 | 78 656 | 82 267 |

in millions USD  Source: Swiss Re

Source: Swiss Re

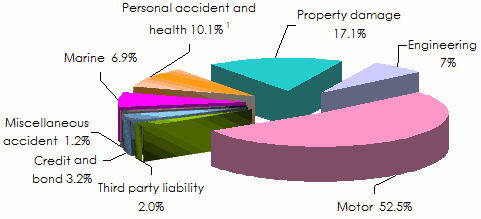

Breakdown of 2011 non-life premiums per class of business

The Brazilian non-life market accounts for 1.88% of the global market in 2012.

In 2011, non-life insurance was dominated by the motor class which accounts for more than half of the turnover. Property damage and marine risks come in second and third position.

1 Premiums underwritten by non life companies Source: Association of insurance companies and market regulatory authority

1 Premiums underwritten by non life companies Source: Association of insurance companies and market regulatory authority

Distribution networks

View of the capital, Brasilia © Jorge Andrade, CC BY 2.0 View of the capital, Brasilia © Jorge Andrade, CC BY 2.0 |

The non-life insurance is marketed at almost 70% by brokers. An insurer who sells a policy without the intermediation of a broker is required to pay a commission. Significant efforts are being made to ensure that insurance is accessible to a wide audience: sales of contracts in pharmacies, in gas stations, in supermarkets, etc.